ned wants us to think about real expectations

which ratex has neutered in the cause of a higher invisible ordering

much as the red of tooth and claw competition out there

was turned into the court eunick in arrow-debreu

"In the expectations-based framework that I put forward around 1968, we didn't pretend we had a correct and complete understanding of how firms or employees formed expectations about prices or wages elsewhere. We turned to what we thought was a plausible and convenient hypothesis. For example, if the prices of a company’s competitors were last reported to be higher than in the past, it might be supposed that the company will expect their prices to be higher this time, too, but not that much. This is called "adaptive expectations:" You adapt your expectations to new observations but don't throw out the past. If inflation went up last month, it might be supposed that inflation will again be high but not that high. "

"

" The "scientists" from Chicago and MIT came along to say, we have a well-established theory of how prices and wages work."

" Before, we used a rule of thumb to explain or predict expectations: Such a rule is picked out of the air."

" They said, let's be scientific. In their mind, the scientific way is to suppose price and wage setters form their expectations with every bit as much understanding of markets as the expert economist seeking to model, or predict, their behavior. "

"The

rational expectations approach is to suppose that the people in the market form their expectations in the very same way that the economist studying their behavior forms her expectations: on the basis of her theoretical model."

" And what's the consequence of this putsch?... Craziness for one thing."

" You’re not supposed to ask what to do if one economist has one model of the market and another economist a different model."

" The people in the market cannot follow both economists at the same time. "

"One, if not both, of the economists must be wrong."

" Another thing: It’s an important feature of capitalist economies that they permit speculation by people who have idiosyncratic views and an important feature of a modern capitalist economy that innovators conceive their new products and methods with little knowledge of whether the new things will be adopted -- thus innovations."

" Speculators and innovators have to roll their own expectations. They can’t ring up the local professor to learn how."

" The professors should be ringing up the speculators and aspiring innovators."

" In short, expectations are causal variables in the sense that they are the drivers. They are not effects to be explained in terms of some trumped-up causes. "

" So rather than live with variability, write a formula in stone! "

" What led to rational expectations was a fear of the uncertainty and, worse, the lack of understanding of how modern economies work."

" The rational expectationists wanted to bottle all that up and replace it with deterministic models of prices, wages, even share prices, so that the math looked like the math in rocket science."

" The rocket’s course can be modeled while a living modern economy’s course cannot be modeled to such an extreme."

" It yields up a formula for expectations that looks scientific because it has all our incomplete and not altogether correct understanding of how economies work inside of it, but it cannot have the incorrect and incomplete understanding of economies that the speculators and would-be innovators have. "

"people are

grossly uninformed, which is a far cry from what the rational expectations models suppose. "

"Why are they misinformed? I think they don’t pay much attention to the vast information out there because they wouldn’t know what to do what to do with it if they had it."

" The fundamental fallacy on which rational expectations models are based is that everyone knows how to process the information they receive according to the one and only right theory of the world. "

"The problem is that we don't have a "right" model that could be certified as such by the National Academy of Sciences. And as long as we operate in a modern economy, there can never be such a model. "

" I am far from being the only economist who has critiqued the premise of rational expectations."

" I’m just the main victim, since that approach drove people away from my approach -– from my emphasis that expectations are a driver of what happens in modern economies."

" Several economists saw that the emperor has no clothes. Oskar Morgenstern explained that rational expectations would be untenable in the modern world, and Friedrich Hayek got the point."

" A Danish economist complained about it in the 1940s. Axel Leijonhufvud attacked it. Roman Frydman has made his career uncovering the impossibility of rational expectations in several contexts. He explained that if the data are always bouncing around because expectations are bouncing around, we can’t use the data to calculate the right expectations"

". I have an image in my mind of a dog chasing its tail."

" When I was getting into economics in the 1950s, we understood there could be times when a craze would drive stock prices very high. Or the reverse: An economy in the grip of weak business confidence, weak investment, would lead to loss of jobs in the capital-goods sector. But now that way of thinking is regarded by the rational expectations advocates as unscientific."

"By the early 2000s, Chicago and MIT were saying we've licked inflation and put an end to unhealthy fluctuations –- only the healthy “vibrations” in rational expectations models remained. Prices are scientifically determined, they said. Expectations are right and therefore can't cause any mischief. "

"At a celebration in Boston for Paul Samuelson in 2004 or so, I had to listen to Ben Bernanke and Oliver Blanchard, now chief economist at the IMF, crowing that they had conquered the business cycle of old by introducing predictability in monetary policy making, which made it possible for the public to stop generating baseless swings in their expectations and adopt rational expectations."

"

My work on how wage expectations could depress employment and how asset price expectations could cause an asset boom and bust had been disqualified and had to be cleansed for use in the rational expectations models. "

" The rational expectations treatment of inflation did not perform well in predicting inflation.

In the 1990s, we had a boom with none of the inflation that was predicted.

In 2004-2006 there was another boom without much inflation."

"The bond market would be right to have very little confidence that the Fed has the right model."

" It's only a small exaggeration to say the Fed doesn't have any important structural forces in its model. It's just guessing about the new normal (for the unemployment rate). It seems to me that they don’t even want to think about it. "

" I would tell them not to assume they have hit upon a model that captures expectations so they don't need to think about expectations anymore"

". Expectations are a living thing and flighty; beliefs are flimsy, as Keynes said."

" The Fed is banking that expectations will behave according to the model the Fed wants people to adopt"

" But no central bank or anyone else should bank heavily on the correctness of its model. "

"Expectations will almost certainly surprise the Fed and surprise Wall Street, too"

". Furthermore, the Fed model doesn't allow for animal spirits in Silicon Valley or evil spirits on Wall Street.'

" It can't know about those things."

" Washington is banking on a best-case scenario to bail it out of the entitlements mess in the 2020s."

" The world is still in a crisis. Not a hospitable place for models based on rational expectations."

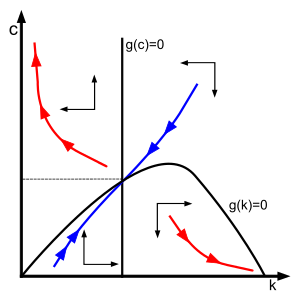

is change in

is change in  is the

is the

and

and  equal to zero we can find the steady"

equal to zero we can find the steady"