Tuesday, May 31, 2011

Monday, May 30, 2011

the man !!!!!

" capitalists may decide to consume and to invest more in a given period than in the preceding one, but they cannot decide to earn more

: investment and consumption decisions determine profits, and not vice versa"

then again

its all about mark up.....(k)

i've read in fact the apian hive at any time is 3/4's idle

and yet manny writes in fabula dicta :

the bulk of the human hive can be vexed by want

to higher mobilization :

"The economic well-being of the nation depends on the presence of a large number of men who are content to labor hard all day long. Because men are naturally lazy they will not work unless forced by necessity to do so. The education of the poor threatens to rob the nation of their productivity... "

but there more truth pay attention to0 this ..let's call it manny's lemma :

"Every hour those poor people spend at their books is so much time lost to society. Going to school in comparison to working is idleness."

but there more truth pay attention to0 this ..let's call it manny's lemma :

"Every hour those poor people spend at their books is so much time lost to society. Going to school in comparison to working is idleness."

tennyson locksley hall

For I dipt into the future, far as human eye could see,

Saw the Vision of the world, and all the wonder that would be;

Saw the heavens fill with commerce, argosies of magic sails,

Pilots of the purple twilight dropping down with costly bales;

Heard the heavens fill with shouting, and there rain'd a ghastly dew

From the nations' airy navies grappling in the central blue;

Far along the world-wide whisper of the south-wind rushing warm,

With the standards of the peoples plunging thro' the thunder-storm;

Till the war-drum throbb'd no longer, and the battle-flags were furl'd

In the Parliament of man, the Federation of the world.

There the common sense of most shall hold a fretful realm in awe,

And the kindly earth shall slumber, lapt in universal law.

60 years on ...

60 years on ...

Gone the cry of 'Forward, Forward,' lost within a growing gloom;

Lost, or only heard in silence from the silence of a tomb.

Half the marvels of my morning, triumphs over time and space,

Staled by frequence, shrunk by usage into commonest commonplace!

'Forward' rang the voices then, and of the many mine was one.

Let us hush this cry of 'Forward' till ten thousand years have gone.

Sunday, May 29, 2011

paradigm ecoc con at work

menzie chinn does it right..... with numbers

http://www.econbrowser.com/archives/2011/05/economic_underp.html

the blow up of gop congo agit-pap

is just detailed and linkified enough

to turn Cap-Hill size moose turds

into breeze removeable 100 angstrom diameter

dust particles

Mr Chinn has gotta be

the hardest working

accuracy obsessed

wonkonomics guy

now operating

a white hat con shop on the blogosphere

graphs

note domestic production

call it annualized 1.8 billion barrels

do the calc

$ 50 per b rise ...adds $90 billion

in wind fall profits to domestic producers

-- assuming that long interval of similar production

at lower prices indicates marginal cost prices

on these wells are prolly still around 50 bucks per b --

second graph :

paul k

correctly notes :

we could go to 4% core inflation for tten years

ie revisit the reagan bright new morning in amerika rates

whilst

considerably shrinking the real debt of all of us

from mr and mrs little me

to uncle hizzseff

call it annualized 1.8 billion barrels

do the calc

$ 50 per b rise ...adds $90 billion

in wind fall profits to domestic producers

-- assuming that long interval of similar production

at lower prices indicates marginal cost prices

on these wells are prolly still around 50 bucks per b --

second graph :

paul k

correctly notes :

we could go to 4% core inflation for tten years

ie revisit the reagan bright new morning in amerika rates

whilst

considerably shrinking the real debt of all of us

from mr and mrs little me

to uncle hizzseff

Sunday, May 22, 2011

Friday, May 20, 2011

at bottom

at contraction's end at touch down 09

we employed the same number of folks in the manusec

as in ..........................1941

http://www.bls.gov/opub/mlr/2011/04/art5full.pdf

we employed the same number of folks in the manusec

as in ..........................1941

http://www.bls.gov/opub/mlr/2011/04/art5full.pdf

oh ya

the better ratio is manu gap top manu sector

say uncle's manu-sec is 20% of NVA

at -2% gdp

its running 10% below balance now

10% more manu jobs ??? at 12 mill now maybe what ???

a million added jobs ???

peanuts

manusec contracted by 15% in jobs after the credit crunch

the dropping dollars manged to more or less stabilize the manu job force

for about 4 years b4 the crunch

then plop

my guess the implicit " 2 % target gap"

will put manusec in job stag mode for the time being

say uncle's manu-sec is 20% of NVA

at -2% gdp

its running 10% below balance now

10% more manu jobs ??? at 12 mill now maybe what ???

a million added jobs ???

peanuts

manusec contracted by 15% in jobs after the credit crunch

the dropping dollars manged to more or less stabilize the manu job force

for about 4 years b4 the crunch

then plop

my guess the implicit " 2 % target gap"

will put manusec in job stag mode for the time being

how many jobs in a persistent 2% manubalance gap

the decade range almost as good as 1.5 to as bad as 4 plus

but suggesting we could keep it close to two even if we zoomed up to full employment corporate style

ie 4-5% UE

that is the seeewwwious poser's question for pk et al

but suggesting we could keep it close to two even if we zoomed up to full employment corporate style

ie 4-5% UE

that is the seeewwwious poser's question for pk et al

manubalance

estimate US full employment balance

so much for pure absorption rate adjustments etween north h and south h

break balances into regions

north vv south

and more finely

east asia

south asia

europe east west

latin america sub s africa arab world etc

trends may not be uniform once the regional forex adjustments are targeted

and the trade results isolated

so much for pure absorption rate adjustments etween north h and south h

break balances into regions

north vv south

and more finely

east asia

south asia

europe east west

latin america sub s africa arab world etc

trends may not be uniform once the regional forex adjustments are targeted

and the trade results isolated

Thursday, May 19, 2011

Wednesday, May 18, 2011

broader picture

lucas on '08 repo run

"The repo market

As deposits moved out of commercial banks, investment banks and money market funds increasingly provided close substitutes for the services commercial banks provide. Like the banks they replaced, they accepted cash in return for promises to repay with interest, leaving the option of when and how much to withdraw up to the lender. The exact form of the contracts involved came in enormous variety. In order to support these activities, financial institutions created new securities and new arrangements for trading them, arrangements that enabled them collectively to clear ever larger trading volumes with smaller and smaller holdings of actual cash. In August of 2008, the entire banking system held about $50 billion in actual cash reserves while clearing trades of $2,996 trillion per day.2 Yet every one of these trades involved an uncontingent promise to pay someone hard cash whenever he asked for it. If ever a system was “runnable,” this was it. Where did the run occur?...There were two runs on investment banks... The run on Bear Stearns in March ended with its purchase by JPMorgan Chase, and the run on Lehman Brothers in September ended with its bankruptcy. In addition, there was an incipient run on money market mutual funds following the collapse of Lehman, halted only when the Treasury stepped in to provide deposit insurance for those institutions.

Of course,... these events also heightened the fear of contagion for all financial institutions, altering their willingness to engage in various transactions. "

"In economic terms a repurchase agreement (repo) is a securitized loan.3 The lender brings cash to the transaction, while the borrower supplies a T-bill or some other security to be used as collateral. The loans are short term, often one day.

Large lenders in the repo market include money market mutual funds and hedge funds. The repo market performs for these large institutions the same function that commercial banks perform for smaller depositors. In effect, it allows them to pool their cash, collectively economizing on their stocks of non-interest-bearing assets. For lenders, the repo market is attractive because the loans are very short term, so it is a way to earn a return—albeit modest—on cash reserves that would otherwise be idle. In normal times, any lender can withdraw cash by declining to roll over earlier loans. Firms that do not want liquidity do not lend in the repo market, since higher returns are available elsewhere."

" Consider a shock that heightens uncertainty about the soundness of financial institutions. Potential lenders will choose to hold more of their cash in reserve, anticipating possible withdrawals by their own clients. As a result, potential borrowers will find it difficult to obtain funds. Actual defaults are rare in this market, but borrowers who hoped to roll over old agreements may have to sell securities on short notice, perhaps at fire sale prices, to obtain cash elsewhere."

The Repo Market and other Monetary Aggregates January 2008 to January 2009 | |||

|---|---|---|---|

Jan. 2008 (billions) | Jan. 2009 (billions) | Change | |

Cash Held Outside of Banks* | $773.9 | $832.2 | +7.5% |

Private, Domestic Demand Deposits* | $510.7 | $658.0 | +28.8% |

Money Market Mutual Funds* | $3,033.1 | $3,757.3 | +23.9% |

Repos held by Primary Dealers**

| $3,699.4 $2,543.6 | $2,585.9 $2,005.6 | -30.1% -21.2% |

.

Lessons from the panic of 2008

We began by asking what theory and evidence tell us about liquidity crises and about policies to avoid them or to mitigate their severity. The arguments above do not provide a complete answer, but they do point to some broad principles.

(a) Bank regulation can reduce the likelihood of liquidity crises, but it cannot eliminate them entirely.Banks will fail, and these failures will make failure more likely for others. There is language in Dodd-Frank suggesting that the Fed should take responsibility for predicting and precluding crises, but this task seems to us to be an impossible one, at least for the foreseeable future.4

(b) During a liquidity crisis, the Fed should act as a lender of last resort.

In the event of a bank run or a run on the repo market, the Fed can always add liquidity to the system, and there will be occasions—as in 1930 and in the fall of 2008—when it would be irresponsible not to do so.

(c) The Fed should announce its policy for liquidity crises, explaining how and under what circumstances it will come into play.The events of 2008 illustrate the importance of an announced and well-understood policy. Over the years prior to 2008, investors came to understand that the Fed was operating under an implicit too-big-to-fail policy, in the sense that the depositors/creditors of large banks would be protected. No other policy was ever discussed, and the Fed’s assistance in engineering the orderly exit of Bear Stearns in March 2008 was surely interpreted as evidence that this policy was still in place. The abrupt end of Lehman in September was then all the more shocking.

There is no gain from allowing uncertainty about how the Fed will behave. The beliefs of depositors/lenders are critical in determining the contagion effects of runs that do occur. By announcing a credible policy, the Fed can affect those beliefs, and the Fed needs to use this tool.

There is no gain from allowing uncertainty about how the Fed will behave. The beliefs of depositors/lenders are critical in determining the contagion effects of runs that do occur. By announcing a credible policy, the Fed can affect those beliefs, and the Fed needs to use this tool.

(d) Deposit insurance is part of the answer.

When introduced in the Banking Act of 1933, deposit insurance was limited to small deposits, and its role was viewed as consumer protection, not run prevention. Deposit insurance performed this function well during the 2008 crisis: There were no runs on FDIC-insured commercial banks, although many failed or were absorbed by stronger institutions.

Deposit insurance should be retained, although for the reasons described by Kareken and Wallace, the assets held against insured deposits should be carefully regulated.

(e) Deposit insurance has a limited role.

Investment banks, money market funds and the repo market are outside the protection of the insured system, and the liquidity crisis of 2008 involved these other institutions. Could they be brought into the fold, with the relevant portion of their investment portfolio regulated in the same way that commercial banks are?

Higher returns in the uninsured sector will always be attractive for large depositors, and new institutions or arrangements would surely arise, offering liquidity provision on the old, risky terms. Clients will want it, markets will have a strong incentive to provide it and regulators will probably not be able to contain their efforts. Providers will be able to innovate around regulations or move offshore to avoid them. This dilemma leads us to our next point.

(f) The Fed’s lending in a crisis should be targeted toward preserving market liquidity, not particular institutions.

There are two goals here: to have a credible policy for how liquidity will be injected in a crisis and to provide proper incentives for banks during ordinary times. Both goals are met by the Bagehot rule: In a crisis, the central bank should lend on good collateral at a penalty rate. To implement this rule, we need to know how much the Fed should lend and what assets will be regarded as good collateral.

Time consistency requires that no upper bound be placed on crisis lending. The guidelines we have for monetary policy, whether stated in terms of monetary aggregates or interest rates, are directed at long-term objectives and are no help in a liquidity crisis. After the Lehman failure in the fall of 2008, the Fed expanded bank reserves from $40 billion to $800 billion in three months, surely exceeding by far any limit that would have been imposed in August. Even with this decisive response, spending declined sharply over next two quarters.

Because crises occur too rarely for the ex ante formulation of useful quantitative rules, the Fed should have considerable discretion in times of crisis. Nevertheless, because policies should be predictable, the Fed should describe the indicators it will use to decide when lending has reached a sufficient level.

Defining good collateral is more complicated. The quality of collateral is in the eye of the lender, and it can change dramatically from week to week. In this application, though, the lender is the Fed, and it is the responsibility of the Fed to define what it will treat as good collateral. To this end, the Fed should announce an ordering of assets by their quality. The list should be long enough to cover all contingencies, and it would need to be revised from time to time.

In such a regime, banks outside the FDIC would be free to choose their portfolios, with clients, bondholders and equity holders bearing the risk that those choices entail. The lower return on lower-risk assets would be offset, at least in part, by their superior status as collateral in the event of a crisis.

Avoiding liquidity crises altogether is probably more than we can hope for. What we can do is put in place mechanisms to make such crises infrequent and to make their effects manageable

Monday, May 16, 2011

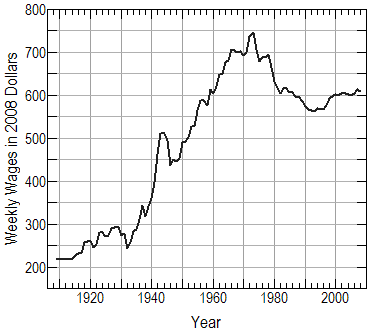

us manu flat

Real shipments down 22% from peak fourth quarter 07 to second quarter 09

as of first quarter 11

15% below peak

that shows the old trend is not reversed eh ???

no surprise Over the past year, aggregate hours in the private sectorup 2.3%,

aggregate hours in manufacturing up 2.9%.

feel the .6% difference ?????

on the other hand

this is the era of de industrialization and looking back over the ea's cycles --after the big pop

of the early 80's

ie

the rebound of reagan morning in america

Saturday, May 14, 2011

when cash out is not doable

if you gotta stay in an institutions paper

other then fed cash

say cause your talking billions or even tens of millions

why of course is you think demand accounts are uncertain at least liquidity wise

then if you have to to get your value into safe issues

you buy t notes above face value

ie negative rate of nominal return

just saying ....

other then fed cash

say cause your talking billions or even tens of millions

why of course is you think demand accounts are uncertain at least liquidity wise

then if you have to to get your value into safe issues

you buy t notes above face value

ie negative rate of nominal return

just saying ....

why representative firm level thinking is so dangerous a generalization

interfu-idiot randy w

set me off

with his league of magic trick assumptions

set me off

with his league of magic trick assumptions

“firms under monopolistic competition with increasing marginal costs”

assume increasing marginal costs ??

is this the magic trick here?

what if its almost never the case particularly in a demand squeeze

what if demand constrained firms always face declining or at least level variable costs and thus

your operating at capacity needs to go poof

and this ??

” Holding symmetrical and constant the shape of the distribution of sales conditional on price, adjusting prices downward increases the mass of the profit distribution inside the bankruptcy regime. It is unrealistic to hold the shape of that distribution constant, but even allowing for plausible variation (the distribution of sales narrows around a mean of zero as price increases), at the margin the effect of leverage is to reduce price adjustment, prevent the price from reaching the price an unlevered firm would set.”

strikes me as a very intense tap dance

unpack it dear sir

in particular

“adjusting prices downward increases the mass of the profit distribution inside the bankruptcy regime”

not for sure if sales increase

ie violate ..and why not..your stricture :

“Holding symmetrical and constant the shape of the distribution of sales conditional on price”

and with unit sales flex capacity

we get both q and p movements at the firm level

and alas ambiguity as to firm level revenue change eh ??

first off the line price cut marketers often gain share here …no ??

--------------------

“the effect of leverage is to reduce price adjustment, prevent the price from reaching the price an unlevered firm would set.”

this key insight and by itseelf worth a post

runs aground for equally keen reasons you nicely sight

the competitive advantage of maximal leverage

sunk cost are to be fogotten in operation eh

and fixed costs have this added sunk like dynamic aspect you can’t liquidate em

especial in market contraction conditions

best practice utilize all fixed factors

but the incubus of debt used to buy and build these fixed factors

cripples the marginal pricing option

ie dramatic price cuts

by spoiling the market for other participants

as well as unsettling your creditors and holders of your trade receivables

that have other firms in their payment stream that will face dramatic unit sales drops if they don’t respond

the flabalanche of weak participants into payment problems quickly insues

btw

assume increasing marginal costs ??

is this the magic trick here?

what if its almost never the case particularly in a demand squeeze

what if demand constrained firms always face declining or at least level variable costs and thus

your operating at capacity needs to go poof

and this ??

” Holding symmetrical and constant the shape of the distribution of sales conditional on price, adjusting prices downward increases the mass of the profit distribution inside the bankruptcy regime. It is unrealistic to hold the shape of that distribution constant, but even allowing for plausible variation (the distribution of sales narrows around a mean of zero as price increases), at the margin the effect of leverage is to reduce price adjustment, prevent the price from reaching the price an unlevered firm would set.”

strikes me as a very intense tap dance

unpack it dear sir

in particular

“adjusting prices downward increases the mass of the profit distribution inside the bankruptcy regime”

not for sure if sales increase

ie violate ..and why not..your stricture :

“Holding symmetrical and constant the shape of the distribution of sales conditional on price”

and with unit sales flex capacity

we get both q and p movements at the firm level

and alas ambiguity as to firm level revenue change eh ??

first off the line price cut marketers often gain share here …no ??

--------------------

“the effect of leverage is to reduce price adjustment, prevent the price from reaching the price an unlevered firm would set.”

this key insight and by itseelf worth a post

runs aground for equally keen reasons you nicely sight

the competitive advantage of maximal leverage

sunk cost are to be fogotten in operation eh

and fixed costs have this added sunk like dynamic aspect you can’t liquidate em

especial in market contraction conditions

best practice utilize all fixed factors

but the incubus of debt used to buy and build these fixed factors

cripples the marginal pricing option

ie dramatic price cuts

by spoiling the market for other participants

as well as unsettling your creditors and holders of your trade receivables

that have other firms in their payment stream that will face dramatic unit sales drops if they don’t respond

the flabalanche of weak participants into payment problems quickly insues

btw

the burden of more and more arbitrary assumptions

build as you thicken your one firm decider scenario towards

market like complexity

btw have you ever run a firm thru these sorts of tempest ??

build as you thicken your one firm decider scenario towards

market like complexity

btw have you ever run a firm thru these sorts of tempest ??

why so much job kill and payment default ??

why can't we sublate some of this waste ??

example

the payments grid

the system just needs more insurance eh ??

a payments grid with full insurance mandated

participate or not

uncle makes it an option you can’t refuse by a subsidy thru premium payment participation

ultimately all risk should be held at maximal spread

ie the level of the whole society

ie uncle as reinsurer of all policies

moral hazard ??

what lesser creditor has uncle’s ability and capacity for generosity ???

justice has its maximal chance if uncle is the final creditor

of course this isn’t cor[porate capitalism

so

forget about it

——————

happy fewest job force

is indeed corporate optimal

the secular increase in the reserve army

is an artifact of social marketeering

corporate style

example

no wage insurance which would solve the wage cut or hour cut alternative

to the job axe

but if corporate operations can extract higher margins with bigger reserve armies …..

take th apparently benign german job time account

despite the recent job kill free swoon in output there

that indeed the system might have contributed to

like the rest of the hartz reforms

this strikes me as fishy if not over the full cycle then secularly

these job time accounts remove the over time premium and back load it as an exit tax paid directly to the exiter

to avoid the exit tax at time of job hack corporates are incentivized to reduce hours or wage rates

usually hours

this seems systemically to pin hours higher and participation lower over the long haul

as does company pay ins toward job attached benefit plans

so long as the company pay ins are not pro rated by hours worked

the over time premium oughta be higher if anything

and jobs oughta pay wages with no benefits

–uncle could scoop this bene stream up

and set up an earned income credit system to provision the stream in part

and of course wage theft thru recorded hours games enters here double force

ahh so much to do so little corporate incentive to do it

we need an october

example

the payments grid

the system just needs more insurance eh ??

a payments grid with full insurance mandated

participate or not

uncle makes it an option you can’t refuse by a subsidy thru premium payment participation

ultimately all risk should be held at maximal spread

ie the level of the whole society

ie uncle as reinsurer of all policies

moral hazard ??

what lesser creditor has uncle’s ability and capacity for generosity ???

justice has its maximal chance if uncle is the final creditor

of course this isn’t cor[porate capitalism

so

forget about it

——————

happy fewest job force

is indeed corporate optimal

the secular increase in the reserve army

is an artifact of social marketeering

corporate style

example

no wage insurance which would solve the wage cut or hour cut alternative

to the job axe

but if corporate operations can extract higher margins with bigger reserve armies …..

take th apparently benign german job time account

despite the recent job kill free swoon in output there

that indeed the system might have contributed to

like the rest of the hartz reforms

this strikes me as fishy if not over the full cycle then secularly

these job time accounts remove the over time premium and back load it as an exit tax paid directly to the exiter

to avoid the exit tax at time of job hack corporates are incentivized to reduce hours or wage rates

usually hours

this seems systemically to pin hours higher and participation lower over the long haul

as does company pay ins toward job attached benefit plans

so long as the company pay ins are not pro rated by hours worked

the over time premium oughta be higher if anything

and jobs oughta pay wages with no benefits

–uncle could scoop this bene stream up

and set up an earned income credit system to provision the stream in part

and of course wage theft thru recorded hours games enters here double force

ahh so much to do so little corporate incentive to do it

we need an october

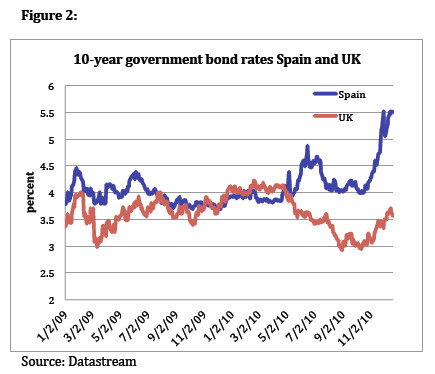

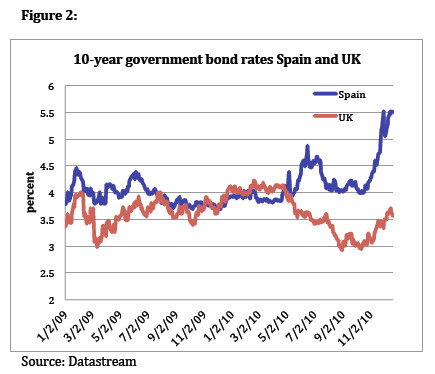

euro strain as expansion stuck in wicked unbalance mode

in 05 germany and france contributed 50% of zone growth

now

the big two contribute over 70%

note the horrors of piigdom

Friday, May 13, 2011

cyber pricing and the commmmmmmanding heights

automated price algorithms as part of a complete corporate pricing pacification

the seller as price taker has only buying and output to consider ie how much q at p

if the system is fully interconnected financially

ie full court financialization within the unitary credit/insurance dome of course

the seller as price taker has only buying and output to consider ie how much q at p

if the system is fully interconnected financially

ie full court financialization within the unitary credit/insurance dome of course

Thursday, May 12, 2011

trade and uncle's gap

Wednesday, May 11, 2011

dani dani oh oh dani

CAMBRIDGE – I have been presenting my new book The Globalization Paradox to different groups of late. By now I am used to all types of comments from the audience. But at a recent book-launch event, the economist assigned to discuss the book surprised me with an unexpected criticism. “Rodrik wants to make the world safe for politicians,” he huffed.

Lest the message be lost, he then illustrated his point by reminding the audience of “the former Japanese minister of agriculture who argued that Japan could not import beef because human intestines are longer in Japan than in other countries.”

The comment drew a few chuckles. Who doesn’t enjoy a joke at the expense of politicians?

But the remark had a more serious purpose and was evidently intended to expose a fundamental flaw in my argument. My discussant found it self-evident that allowing politicians greater room for maneuver was a cockamamie idea – and he assumed that the audience would concur. Remove constraints on what politicians can do, he implied, and all you will get are silly interventions that throttle markets and stall the engine of economic growth.

This criticism reflects a serious misunderstanding of how markets really function. Raised on textbooks that obscure the role of institutions, economists often imagine that markets arise on their own, with no help from purposeful, collective action. Adam Smith may have been right that “the propensity to truck, barter, and exchange” is innate to humans, but a panoply of non-market institutions is needed to realize this propensity.

Consider all that is required. Modern markets need an infrastructure of transport, logistics, and communication, much of it the result of public investments. They need systems of contract enforcement and property-rights protection. They need regulations to ensure that consumers make informed decisions, externalities are internalized, and market power is not abused. They need central banks and fiscal institutions to avert financial panics and moderate business cycles. They need social protections and safety nets to legitimize distributional outcomes.

Well-functioning markets are always embedded within broader mechanisms of collective governance. That is why the world’s wealthier economies, those with the most productive market systems, also have large public sectors.

Once we recognize that markets require rules, we must next ask who writes those rules. Economists who denigrate the value of democracy sometimes talk as if the alternative to democratic governance is decision-making by high-minded Platonic philosopher-kings – ideally economists!

But this scenario is neither relevant nor desirable. For one thing, the lower the political system’s transparency, representativeness, and accountability, the more likely it is that special interests will hijack the rules. Of course, democracies can be captured too. But they are still our best safeguard against arbitrary rule.

Moreover, rule-making is rarely about efficiency alone; it may entail trading off competing social objectives – stability versus innovation, for example – or making distributional choices. These are not tasks that we would want to entrust to economists, who might know the price of a lot of things, but not necessarily their value.

True, the quality of democratic governance can sometimes be augmented by reducing the discretion of elected representatives. Well-functioning democracies often delegate rule-making power to quasi-independent bodies when the issues at hand are technical and do not raise distributional concerns; when log-rolling would otherwise result in sub-optimal outcomes for all; or when policies are subject to myopia, with heavy discounting of future costs.

Independent central banks provide an important illustration of this. It may be up to elected politicians to determine the inflation target, but the means deployed to achieve that target are left to the technocrats at the central bank. Even then, central banks typically remain accountable to politicians and must provide an accounting when they miss the targets.

Similarly, there can be useful instances of democratic delegation to international organizations. Global agreements to cap tariff rates or reduce toxic emissions are indeed valuable. But economists have a tendency to idolize such constraints without sufficiently scrutinizing the politics that produce them.

It is one thing to advocate external restraints that enhance the quality of democratic deliberation – by preventing short-termism or demanding transparency, for example. It is another matter altogether to subvert democracy by privileging particular interests over others.

For instance, we know that the global capital-adequacy requirements produced by the Basel Committee reflect overwhelmingly the influence of large banks. If the regulations were to be written by economists and finance experts, they would be far more stringent. Alternatively, if the rules were left to domestic political processes, there could be more countervailing pressure from opposing stakeholders (even though financial interests are powerful at home, too).

Similarly, despite the rhetoric, many World Trade Organization agreements are the result not of the pursuit of global economic well-being, but the lobbying power of multinationals seeking profit-making opportunities. International rules on patents and copyright reflect the ability of pharmaceutical companies and Hollywood – to take just two examples – to get their way. These rules are widely derided by economists for having imposed inappropriate constraints on developing economies’ ability to access cheap pharmaceuticals or technological opportunities.

So the choice between democratic discretion at home and external restraint is not always a choice between good and bad policies. Even when the domestic political process works poorly, there is no guarantee that global institutions will work any better. Often, the choice is between yielding to domestic rent-seekers or to foreign ones. In the former case, at least the rents stay at home!

Ultimately, the question concerns whom we empower to make the rules that markets require. The unavoidable reality of our global economy is that the principal locus of legitimate democratic accountability still resides within the nation state. So I readily plead guilty to my economist critic’s charge. I do want to make the world safe for democratic politicians. And, frankly, I wonder about those who do not.

Lest the message be lost, he then illustrated his point by reminding the audience of “the former Japanese minister of agriculture who argued that Japan could not import beef because human intestines are longer in Japan than in other countries.”

The comment drew a few chuckles. Who doesn’t enjoy a joke at the expense of politicians?

But the remark had a more serious purpose and was evidently intended to expose a fundamental flaw in my argument. My discussant found it self-evident that allowing politicians greater room for maneuver was a cockamamie idea – and he assumed that the audience would concur. Remove constraints on what politicians can do, he implied, and all you will get are silly interventions that throttle markets and stall the engine of economic growth.

This criticism reflects a serious misunderstanding of how markets really function. Raised on textbooks that obscure the role of institutions, economists often imagine that markets arise on their own, with no help from purposeful, collective action. Adam Smith may have been right that “the propensity to truck, barter, and exchange” is innate to humans, but a panoply of non-market institutions is needed to realize this propensity.

Consider all that is required. Modern markets need an infrastructure of transport, logistics, and communication, much of it the result of public investments. They need systems of contract enforcement and property-rights protection. They need regulations to ensure that consumers make informed decisions, externalities are internalized, and market power is not abused. They need central banks and fiscal institutions to avert financial panics and moderate business cycles. They need social protections and safety nets to legitimize distributional outcomes.

Well-functioning markets are always embedded within broader mechanisms of collective governance. That is why the world’s wealthier economies, those with the most productive market systems, also have large public sectors.

Once we recognize that markets require rules, we must next ask who writes those rules. Economists who denigrate the value of democracy sometimes talk as if the alternative to democratic governance is decision-making by high-minded Platonic philosopher-kings – ideally economists!

But this scenario is neither relevant nor desirable. For one thing, the lower the political system’s transparency, representativeness, and accountability, the more likely it is that special interests will hijack the rules. Of course, democracies can be captured too. But they are still our best safeguard against arbitrary rule.

Moreover, rule-making is rarely about efficiency alone; it may entail trading off competing social objectives – stability versus innovation, for example – or making distributional choices. These are not tasks that we would want to entrust to economists, who might know the price of a lot of things, but not necessarily their value.

True, the quality of democratic governance can sometimes be augmented by reducing the discretion of elected representatives. Well-functioning democracies often delegate rule-making power to quasi-independent bodies when the issues at hand are technical and do not raise distributional concerns; when log-rolling would otherwise result in sub-optimal outcomes for all; or when policies are subject to myopia, with heavy discounting of future costs.

Independent central banks provide an important illustration of this. It may be up to elected politicians to determine the inflation target, but the means deployed to achieve that target are left to the technocrats at the central bank. Even then, central banks typically remain accountable to politicians and must provide an accounting when they miss the targets.

Similarly, there can be useful instances of democratic delegation to international organizations. Global agreements to cap tariff rates or reduce toxic emissions are indeed valuable. But economists have a tendency to idolize such constraints without sufficiently scrutinizing the politics that produce them.

It is one thing to advocate external restraints that enhance the quality of democratic deliberation – by preventing short-termism or demanding transparency, for example. It is another matter altogether to subvert democracy by privileging particular interests over others.

For instance, we know that the global capital-adequacy requirements produced by the Basel Committee reflect overwhelmingly the influence of large banks. If the regulations were to be written by economists and finance experts, they would be far more stringent. Alternatively, if the rules were left to domestic political processes, there could be more countervailing pressure from opposing stakeholders (even though financial interests are powerful at home, too).

Similarly, despite the rhetoric, many World Trade Organization agreements are the result not of the pursuit of global economic well-being, but the lobbying power of multinationals seeking profit-making opportunities. International rules on patents and copyright reflect the ability of pharmaceutical companies and Hollywood – to take just two examples – to get their way. These rules are widely derided by economists for having imposed inappropriate constraints on developing economies’ ability to access cheap pharmaceuticals or technological opportunities.

So the choice between democratic discretion at home and external restraint is not always a choice between good and bad policies. Even when the domestic political process works poorly, there is no guarantee that global institutions will work any better. Often, the choice is between yielding to domestic rent-seekers or to foreign ones. In the former case, at least the rents stay at home!

Ultimately, the question concerns whom we empower to make the rules that markets require. The unavoidable reality of our global economy is that the principal locus of legitimate democratic accountability still resides within the nation state. So I readily plead guilty to my economist critic’s charge. I do want to make the world safe for democratic politicians. And, frankly, I wonder about those who do not.

---------------------------------

notes :

.

"Of course, democracies can be captured too. But they are still our best safeguard against arbitrary rule."

i love dani

but this is a wooden duck

its up shot

hugo chavez gets tumbled about in the well meaning liberal press

for cutting due process corners

danny ortega gets tossed out because a majority finally has had enough yankee torment

worship of formalisms are the real platonic vices

not dreaming of a guardian class

the best of all possible forms

and of universalist application

open multi party elections

sez who ??

i contend the color revolutions marked an advance only for MNC global penetration

we will see how the arab street benefits

from the recent uprising

not if its hi jacked by compradore interests like say....

the military in egypt

i love dani

but this is a wooden duck

its up shot

hugo chavez gets tumbled about in the well meaning liberal press

for cutting due process corners

danny ortega gets tossed out because a majority finally has had enough yankee torment

worship of formalisms are the real platonic vices

not dreaming of a guardian class

the best of all possible forms

and of universalist application

open multi party elections

sez who ??

i contend the color revolutions marked an advance only for MNC global penetration

we will see how the arab street benefits

from the recent uprising

not if its hi jacked by compradore interests like say....

the military in egypt

paine said in reply to paine ...

"subvert democracy by privileging particular interests over others."

and how is this prevented

thru more open elections ??

look if you can fool enough of the people enough of the time

the media the school system and the riot police can go the rest

and how is this prevented

thru more open elections ??

look if you can fool enough of the people enough of the time

the media the school system and the riot police can go the rest

paine said...

"Independent central banks "

oh my god !!!!

dani shame on you

oh my god !!!!

dani shame on you

paine said...

"economists have a tendency to idolize such constraints without sufficiently scrutinizing the politics that produce them."

now you're cookin dani !!!!

"Often, the choice is between yielding to domestic rent-seekers or to foreign ones. In the former case, at least the rents stay at home!"

exactly !!!! err that is till they send their gleens off shore and thru a forex processor

problem if this piece by the wonderous rodrik

were a carpet it would fall apart its got so many mutually contradictory patches

unless like me dani is a hegelian

that oughta give him pause

but no

dani is a gleeful eclectic like most good progressive econ cons these days

up shot

eat him up only after careful carving out

now you're cookin dani !!!!

"Often, the choice is between yielding to domestic rent-seekers or to foreign ones. In the former case, at least the rents stay at home!"

exactly !!!! err that is till they send their gleens off shore and thru a forex processor

problem if this piece by the wonderous rodrik

were a carpet it would fall apart its got so many mutually contradictory patches

unless like me dani is a hegelian

that oughta give him pause

but no

dani is a gleeful eclectic like most good progressive econ cons these days

up shot

eat him up only after careful carving out

Tuesday, May 10, 2011

forex moves versus price level moves

big difference ???

existing legacy parts of the nominally fixed forward payments grid

with forex adjustment

the values of that grid's locally denominated parts

remain uneffected

( at least prior to future knock on price movements

thru the import export channels )

on the other hand

the value of foreign denominated parts are of course immediately altered

in a direct product price level move

the adjustment immediately changes

the local exchange value of these obligationns

but if forex remains stable not the foreign obligations value

existing legacy parts of the nominally fixed forward payments grid

with forex adjustment

the values of that grid's locally denominated parts

remain uneffected

( at least prior to future knock on price movements

thru the import export channels )

on the other hand

the value of foreign denominated parts are of course immediately altered

in a direct product price level move

the adjustment immediately changes

the local exchange value of these obligationns

but if forex remains stable not the foreign obligations value

stig and the new academic scpeticism

on the 300 th anniversary of david hume's birth

it dawned on me

why the new micronomics of stgilitz et akerlof spence et al

is in the great hume's tradition of chastening anti dogmatics

anti zealotry and anti superstition

and consequent open minded policy eclecticism

stig's credit rationing job rationing non clearing market world

where

incalculable uncertainty are rife and pareto difficient externalities pandemic

surely makes a nice anti world to paul samuelson's

sum up

of two generations

encompassable by just two boys from gary

akerlof tells the story of this great transformation

"At the beginning of the 1960s, standard microeconomic theory was overwhelmingly based upon the perfectly competitive general equilibrium model.

By the 1990s the study of this model was just one branch of economic theory.

Then, standard papers in economic theory were in a very different style from now,

where economic models are tailored to specific markets and specific situations.

In this new style, economic theory is not just the exploration of deviations

from the single model of perfect competition.

Instead, in this new style, the economic model is customized

to describe the salient features of reality that describe the special problem under consideration."

it dawned on me

why the new micronomics of stgilitz et akerlof spence et al

is in the great hume's tradition of chastening anti dogmatics

anti zealotry and anti superstition

and consequent open minded policy eclecticism

stig's credit rationing job rationing non clearing market world

where

incalculable uncertainty are rife and pareto difficient externalities pandemic

surely makes a nice anti world to paul samuelson's

sum up

of two generations

encompassable by just two boys from gary

akerlof tells the story of this great transformation

"At the beginning of the 1960s, standard microeconomic theory was overwhelmingly based upon the perfectly competitive general equilibrium model.

By the 1990s the study of this model was just one branch of economic theory.

Then, standard papers in economic theory were in a very different style from now,

where economic models are tailored to specific markets and specific situations.

In this new style, economic theory is not just the exploration of deviations

from the single model of perfect competition.

Instead, in this new style, the economic model is customized

to describe the salient features of reality that describe the special problem under consideration."

the bordered sub markets of the world market

a model must not only be corporate agent based but also recognize the barriers to one world price for traded goods and services

two academic streams collide here

optimal tariff theory and optimal price discrimination theory

the state firm inter action is left unmodeled of course

ie

to what extent the state captures gains from cross border trade

etc

two academic streams collide here

optimal tariff theory and optimal price discrimination theory

the state firm inter action is left unmodeled of course

ie

to what extent the state captures gains from cross border trade

etc

Monday, May 9, 2011

pov bridge of an MNC

what does the global economy look like from the executive suite of a true multinational corporation

an outfit with plant in many bordered markets

in many currency zones

and shares in many or most siginifigant bordered markets

both north and south

an outfit with plant in many bordered markets

in many currency zones

and shares in many or most siginifigant bordered markets

both north and south

mundell's trilemma

" the Mundellian impossible trinity, aka the trilemma,

can’t simultaneously have free movement of capital, a stable exchange rate,

and independent monetary policy. :"

can’t simultaneously have free movement of capital, a stable exchange rate,

and independent monetary policy. :"

Sunday, May 8, 2011

the real target of macronautics corporate style

wizard of mass ave

greg mankiw :

"This paper assumes that a central bank commits itself to maintaining an inflation target and then asks what measure of the inflation rate the central bank should use if it wants to maximize economic stability. The paper first formalizes this problem and examines its microeconomic foundations. It then shows how the weight of a sector in the stability price index depends on the sector’s characteristics, including size, cyclical sensitivity, sluggishness of price adjustment, and magnitude of sectoral shocks. When a numerical illustration of the problem is calibrated to U.S. data,

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

greg mankiw :

"This paper assumes that a central bank commits itself to maintaining an inflation target and then asks what measure of the inflation rate the central bank should use if it wants to maximize economic stability. The paper first formalizes this problem and examines its microeconomic foundations. It then shows how the weight of a sector in the stability price index depends on the sector’s characteristics, including size, cyclical sensitivity, sluggishness of price adjustment, and magnitude of sectoral shocks. When a numerical illustration of the problem is calibrated to U.S. data,

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages

on the other hand productivity wise

"in 2010 China’s total manufacturing output was US$2 trillion ... overtaking the US’s US$1.95 trillion.

China employed over 100 million manufacturing workers...to the US’s 11.5 million."

and MNCs look in ??

"China’s manufacturing productivity per worker is one ninth that of the US. The gap in other sectors, for example non-financial services, is bigger.

This creates a ‘win-win’ situation for ... foreign companies that will exist for decades. ....

the majority of China’s companies will not reach the level of productivity of foreign firms for decades, creating huge openings for co-operation as well as competition.

It is this combination of China soon becoming the world’s largest economy, but one in which foreign companies in some sectors can possess comparative advantage for decades, that makes China the world’s most important market."

China employed over 100 million manufacturing workers...to the US’s 11.5 million."

and MNCs look in ??

"China’s manufacturing productivity per worker is one ninth that of the US. The gap in other sectors, for example non-financial services, is bigger.

This creates a ‘win-win’ situation for ... foreign companies that will exist for decades. ....

the majority of China’s companies will not reach the level of productivity of foreign firms for decades, creating huge openings for co-operation as well as competition.

It is this combination of China soon becoming the world’s largest economy, but one in which foreign companies in some sectors can possess comparative advantage for decades, that makes China the world’s most important market."

MNCs know where the growth center is marketwise

" In 2010 the US economy grew by US$540 billion. China’s increase was US$890 billion

– over 60 percent higher.

Annual dollar expansion of China’s market overtook the US in 2007 "

– over 60 percent higher.

Annual dollar expansion of China’s market overtook the US in 2007 "

could china use its trade surplus ???

China is in the historically unusual position of being an immature

creditor: its own currency, the renminbi, is hardly used at

all in financing its huge trade (saving) surplus. Instead, the

world—particularly the Asian part of it—is still on a dollar

standard. The dollar is the invoice currency of choice for most

Chinese exports and imports and for open-market, that is,

nongovernment, controlled financial flows. So we have the

anomaly that the world’s largest creditor country cannot use

its own currency to finance foreign investments.

The lag in the international use of the renminbi is partly

because China’s domestic financial markets are not fully

developed. Interest rate restrictions as well as residual capital

controls on foreign exchange flows remain. But a more

fundamental constraint is that the U.S. dollar has the firstmover

advantage of being ensconced as “international

money.” World financial markets shun the use of more than

one or two national currencies for clearing international payments—

with the euro now in second place. But the euro’s

use in payments clearing is still pretty well confined to

Europe’s own backyard (Eastern Europe and former

European colonies). Thus, dollar dominance makes the internationalization

of the renminbi very difficult—although the

People’s Bank of China is trying hard to encourage the renminbi’s

use in international transacting on China’s immediate

borders.

The upshot is that China’s own currency is still not used

much in lending to foreigners. Foreigners won’t borrow from

Chinese banks in renminbi or issue renminbi- denominated

bonds in Shanghai. But, apart from direct investments abroad

by Chinese corporations, private finance for China’s trade

surplus would have to take the form of Chinese banks, insurance

companies, pension funds, and so on, acquiring liquid

foreign exchange assets—largely in dollars. But their domestic liabilities—bank deposits, annuity or pension liabilities—

are all denominated in renminbi. Because of this currency

mismatch, the exchange rate risks for China’s private

banks and other financial institutions are simply too great

for them to be international financial intermediaries, that is,

to lend to foreigners on a large scale.

China’s current large trade (saving) surpluses, which

run at about $200 billion to $300 billion per year, would

quickly cumulate to become much greater than the combined

net worth of all of China’s private financial institutions.

Because these private (nonstate) institutions would

refuse to accept the exchange risk (possible dollar depreciation)

of holding dollar assets on a significant scale, the

international intermediation of China’s saving surplus is

left to the central government. The problem is worsened by

American “China bashing” to appreciate the renminbi, theexpectation of which makes foreigners even

more loathe to borrow in renminbi—while stimulating

perverse inflows of hot money to China.

The upshot is that China’s central government

steps in to intermediate and control the

country’s saving surplus in several different

ways.

First, huge liquid official reserves of foreign

exchange, currently about $2.5 trillion, are

accumulated in the State Administration of

Foreign Exchange. Next, sovereign wealth funds

are created, like the China Investment

Corporation, which invests overseas in bonds,

equities, or real estate. Third, China’s large stateowned

enterprises such as SINOPEC are

encouraged to invest in, or partner with, foreign

oil companies in exploration and production.

And finally, quasi-barter aid programs in developing

countries generate a return flow of industrial

materials.

Regarding this last, China does not give

“aid” to African or Latin American countries in

the conventional form of liquid dollar deposits.

Instead, China’s overseas investments are combined

with aid under the fairly strict government

control of China’s Export-Import Bank or

the Department of Commerce. In return for

using state-owned construction companies to

build large-scale infrastructure for ports, railways,

power plants, and so on, the recipient

country agrees to repay China by giving it a

claim on a future stream of copper or iron ore or

oil or whatever mineral that the infrastructure

investments make possible, whence the “quasibarter”

nature of the deal. Because these foreign

aid/investment projects are under the

control of state-owned financial intermediaries, they

become effectively illiquid. They will not be suddenly

sold off and become part of hot money flows back into

China.

tracking the differential productivty growth of national systems

imagine a forex set at time t at time t plus n

the va per hourly unit of one side of this forex is triple and the other double

imagine both have had zero change in price level

what ought to be the change in forex rate ???

the va per hourly unit of one side of this forex is triple and the other double

imagine both have had zero change in price level

what ought to be the change in forex rate ???

moral hazard prevents full socialization ???

if we were all fully insured would we loaf and disipate ??

the legacy incubus in the forward payment grid

models with only money lack the meat of the incubus

nominally fixed future payment obligations

bonds etc

the forward payment grid effects weigh on the variously and privately partitioned holdings of other outfits

payment obligations

removing the nominal rigities with index adjustments etc

does this increase or decrease the secular breadth and depth of the payment grid ???

obviously risk uncertainty has squoozening impacts

nominally fixed future payment obligations

bonds etc

the forward payment grid effects weigh on the variously and privately partitioned holdings of other outfits

payment obligations

removing the nominal rigities with index adjustments etc

does this increase or decrease the secular breadth and depth of the payment grid ???

obviously risk uncertainty has squoozening impacts

forex moves versus price level moves

similarities

trade surplus country:

forex appreciation lowers import prices

lifting the relative general price level lowers import prices

trade deficit country :

forex devaluation raises import prices

lowering relative price level raises import prices

differences :

the general price level changes obviously effect non trade good prices

no substitution effect toward non trade goods

export pricing ???

the relative price level change effects impell export price changes for surplus traders

forex moves impell too both changes mean the export can buy less domestic inputs from foreign earnings

but more foreign imports for processing into exports

off shoring impetus

switching to off shore sources might allow no price change on exports

imagine if global trade goods prices are unique ???

not unique ????

the big problem is the irreducable historically given limited product flex

ie production structure granularity and the grain ain't fine

pebbular rocky maybe even boldicular at any rate

far far from coloidal

the lack of a infinitessimalizable production base with dough like reshape ability

makes the presumption of qualitatively different short and mid term outcomes

with the use of one or the other policy instrument look sound

to be continued

trade surplus country:

forex appreciation lowers import prices

lifting the relative general price level lowers import prices

trade deficit country :

forex devaluation raises import prices

lowering relative price level raises import prices

differences :

the general price level changes obviously effect non trade good prices

no substitution effect toward non trade goods

export pricing ???

the relative price level change effects impell export price changes for surplus traders

forex moves impell too both changes mean the export can buy less domestic inputs from foreign earnings

but more foreign imports for processing into exports

off shoring impetus

switching to off shore sources might allow no price change on exports

imagine if global trade goods prices are unique ???

not unique ????

the big problem is the irreducable historically given limited product flex

ie production structure granularity and the grain ain't fine

pebbular rocky maybe even boldicular at any rate

far far from coloidal

the lack of a infinitessimalizable production base with dough like reshape ability

makes the presumption of qualitatively different short and mid term outcomes

with the use of one or the other policy instrument look sound

to be continued

usury rate management

the fed really has no impact on corporate investment

in as much as it jiggers with policy rates

the impact is on car loans and house morgages

card use etc

usury plain and simple

uncle shylock time

in as much as it jiggers with policy rates

the impact is on car loans and house morgages

card use etc

usury plain and simple

uncle shylock time

Saturday, May 7, 2011

the glorious imfonomics revolution 1970-1990

this site will review some of the papers joe stig contributed to this " paradigm upheavel "

Friday, May 6, 2011

stig waddles past the far post of corporate international capital operations

"The annual spring meeting of the International Monetary Fund was notable in marking the Fund’s effort to distance itself from its own long-standing tenets on capital controls and labor-market flexibility.

Slightly more than 13 years earlier, at the IMF’s Hong Kong meeting in 1997, the Fund had attempted to amend its charter in order to gain more leeway to push countries towards capital-market liberalization. The timing could not have been worse: the East Asia crisis was just brewing – a crisis that was largely the result of capital-market liberalization in a region that, given its high savings rate, had no need for it.

That push had been advocated by Western financial markets – and the Western finance ministries that serve them so loyally."

yup

" Financial deregulation in the United States was a prime cause of the global crisis that erupted in 2008, and financial and capital-market liberalization elsewhere helped spread that “made in the USA” trauma around the world."

can't fault a word of that

"The crisis showed that free and unfettered markets are neither efficient nor stable. They also did not necessarily do a good job at setting prices (witness the real-estate bubble), including exchange rates (which are merely the price of one currency in terms of another)."

again on target

capital controls for emerger nations and midgets too ??

because

"in unfettered markets...money goes to where markets think returns are highest."

and that can lead to forex mayhem

example today:

" With emerging markets booming, and America and Europe in the doldrums, its clear that much of the new liquidity being created would find its way to emerging markets. ....The resulting surge of money into emerging markets has meant that even finance ministers and central-bank governors who are ideologically opposed to intervening believe that they have no choice but to do so. Indeed, country after country has now chosen to intervene in one way or another to prevent their currencies from skyrocketing in value."

stig goes on to draw the correct job class conclusions as well as antyi metropole perphery conclusion

but might there not be another point here

note well:

in 97 emerging currencies colapsed in value

here and now they're fixin to" sky rocket "

ie threatening to wreck the GREAT TILT ( the north south profit slurry ... eh ??)

a nice coincidence of goo goo pro emerger national sovereignty and MNC best practices .

often the MNC playing the whole board for profit max sees realizations better behind barriers and with rapidly rising emerger asset markets and land lot markets and commodity prices and ...

perhaps joe is carried away with this change of policy

perhaps as the prevailing winds shift again and they must

then this benign policy like the nasty washington consensus of the 90's

will pass into a new negation's new position

.

.

"Now the IMF has blessed such interventions –" but maybe this needs undeerlining not hand wringing unease

"... as a sop to those who are still not convinced, it suggests that they should be used only as a last resort."

get the drift mates ???

tack right tack left profits can befound on either side

open border doors close border doors

just like strengthen the state weaken the state

policy follows profits not principles

but i'll let joe dream in public

" On the contrary, we should have learned from the crisis that financial markets need regulation, and that cross-border capital flows are particularly dangerous. Such regulations should be a key part of any system to ensure financial stability; resorting to them only as a last resort is a recipe for continued instability."

"There is a wide range of available capital-account management tools, and it is best if countries use a portfolio of them. Even if they are not fully effective, they are typically far better than nothing."

what about wage policy :

"The crisis has also put to the test long-standing dogmas that blame labor-market rigidity for unemployment, because countries with more flexible wages, like the US, have fared worse than northern European economies, including Germany. "

germany joe ??

the german industrial job force has faced steady stag since the germans began to eat the flesh of their euro pinned piig partners in THE ZONE

maintaining their intra zone surplus and sapping the piigs trade position

as piig price levels rose against german price levels

a nasty game that clever german social marketeering social transfering systems pulled off

while we yankees simply blew out the industrial jobs themselves

Slightly more than 13 years earlier, at the IMF’s Hong Kong meeting in 1997, the Fund had attempted to amend its charter in order to gain more leeway to push countries towards capital-market liberalization. The timing could not have been worse: the East Asia crisis was just brewing – a crisis that was largely the result of capital-market liberalization in a region that, given its high savings rate, had no need for it.

That push had been advocated by Western financial markets – and the Western finance ministries that serve them so loyally."

yup

" Financial deregulation in the United States was a prime cause of the global crisis that erupted in 2008, and financial and capital-market liberalization elsewhere helped spread that “made in the USA” trauma around the world."

can't fault a word of that

"The crisis showed that free and unfettered markets are neither efficient nor stable. They also did not necessarily do a good job at setting prices (witness the real-estate bubble), including exchange rates (which are merely the price of one currency in terms of another)."

again on target

capital controls for emerger nations and midgets too ??

because

"in unfettered markets...money goes to where markets think returns are highest."

and that can lead to forex mayhem

example today:

" With emerging markets booming, and America and Europe in the doldrums, its clear that much of the new liquidity being created would find its way to emerging markets. ....The resulting surge of money into emerging markets has meant that even finance ministers and central-bank governors who are ideologically opposed to intervening believe that they have no choice but to do so. Indeed, country after country has now chosen to intervene in one way or another to prevent their currencies from skyrocketing in value."

stig goes on to draw the correct job class conclusions as well as antyi metropole perphery conclusion

but might there not be another point here

note well:

in 97 emerging currencies colapsed in value

here and now they're fixin to" sky rocket "

ie threatening to wreck the GREAT TILT ( the north south profit slurry ... eh ??)

a nice coincidence of goo goo pro emerger national sovereignty and MNC best practices .

often the MNC playing the whole board for profit max sees realizations better behind barriers and with rapidly rising emerger asset markets and land lot markets and commodity prices and ...

perhaps joe is carried away with this change of policy

perhaps as the prevailing winds shift again and they must

then this benign policy like the nasty washington consensus of the 90's

will pass into a new negation's new position

.

.

"Now the IMF has blessed such interventions –" but maybe this needs undeerlining not hand wringing unease

"... as a sop to those who are still not convinced, it suggests that they should be used only as a last resort."

get the drift mates ???

tack right tack left profits can befound on either side

open border doors close border doors

just like strengthen the state weaken the state

policy follows profits not principles

but i'll let joe dream in public

" On the contrary, we should have learned from the crisis that financial markets need regulation, and that cross-border capital flows are particularly dangerous. Such regulations should be a key part of any system to ensure financial stability; resorting to them only as a last resort is a recipe for continued instability."

"There is a wide range of available capital-account management tools, and it is best if countries use a portfolio of them. Even if they are not fully effective, they are typically far better than nothing."

what about wage policy :

"The crisis has also put to the test long-standing dogmas that blame labor-market rigidity for unemployment, because countries with more flexible wages, like the US, have fared worse than northern European economies, including Germany. "

germany joe ??

the german industrial job force has faced steady stag since the germans began to eat the flesh of their euro pinned piig partners in THE ZONE

maintaining their intra zone surplus and sapping the piigs trade position

as piig price levels rose against german price levels

a nasty game that clever german social marketeering social transfering systems pulled off

while we yankees simply blew out the industrial jobs themselves

to tell a story

saw some econ con big foot ...no medium foot ...somewhere

talking about making stories type poli econ con

versus empirically driven econ con

we here need stories

as far as i can see

the raison d'etre behind the stag north boom south

remains the greatest story never told

even if only in parable toy model form

lets do it eh ??

talking about making stories type poli econ con

versus empirically driven econ con

we here need stories

as far as i can see

the raison d'etre behind the stag north boom south

remains the greatest story never told

even if only in parable toy model form

lets do it eh ??

we need a toy model ...

why do MNCs prefer a de facto tilted and semi fixed north/south forex structure

we need these model;s and until we build them and plant them right here at market earth

for all to link to

this site will be merely a hoot hoot site

we need these model;s and until we build them and plant them right here at market earth

for all to link to

this site will be merely a hoot hoot site

a rediscovered gem

http://www.stanford.edu/~mckinnon/papers/TransferProblem.pdf

this soft paper talks of increased taxing of wages here and lowering wage taxes in trading surplus asia

rather then adjusting forex rates

the back ground is bretton woods policy science papers

the point

present stag policy here and reboom there

accomplishes this absorption rate only adjustment

just as well and without the extra burden

of a full employment job market

yup even better !!!

another paper by the same hand and corporate shadowed mind

http://www.stanford.edu/~mckinnon/papers/OptimumMundellN.pdf

key here national forex fixity in the standard currency ie

de facto large currency zoning

is good for mnc asset holders

implication:

the tilt plus fixity ie dollar locked regimes

is MNC field of clover

this soft paper talks of increased taxing of wages here and lowering wage taxes in trading surplus asia

rather then adjusting forex rates

the back ground is bretton woods policy science papers

the point

present stag policy here and reboom there

accomplishes this absorption rate only adjustment

just as well and without the extra burden

of a full employment job market

yup even better !!!

another paper by the same hand and corporate shadowed mind

http://www.stanford.edu/~mckinnon/papers/OptimumMundellN.pdf

key here national forex fixity in the standard currency ie

de facto large currency zoning

is good for mnc asset holders

implication:

the tilt plus fixity ie dollar locked regimes

is MNC field of clover

Thursday, May 5, 2011