Monday, December 31, 2012

do quasi rents dissolve optimally in a unregulated market system ?

lets doubt that eh ?

so what task comes into view ?

gos plan 2.0

incorporating this reality

into the design and construction of the hover craft full of tax and subsidy algorithms

so what task comes into view ?

gos plan 2.0

incorporating this reality

into the design and construction of the hover craft full of tax and subsidy algorithms

interest as a time and contract variable tax on capital

in part real in part notional

not necessarily < then operating profit

a tax

notionally different from its real extraction by actual creditors

the implicit equally notional

non price and quantity governing

point of systemic steady state

has a general rate of interest

that zeros out all operating profits

this is the goal

of any gosplan 2.0

a " general system wide tax " on "capital"

implemented thru the total credit funding system

like this general rate of interest

not necessarily < then operating profit

a tax

notionally different from its real extraction by actual creditors

the implicit equally notional

non price and quantity governing

point of systemic steady state

has a general rate of interest

that zeros out all operating profits

this is the goal

of any gosplan 2.0

a " general system wide tax " on "capital"

implemented thru the total credit funding system

like this general rate of interest

Sunday, December 30, 2012

most published findings are trash...

Let’s start with Ioannidis. As the title suggests, the paper claims that many published results are false. This is not surprising to most statisticians and epidemiologists. Nevertheless, the paper has received much attention. Let’s suppose, as Ioannidis does, that “publishing a finding” is synonymous with “doing a test and finding that it is significant.” There are many reasons why published papers might have false findings. Among them are:

Let me be clear about this: I am not suggesting we should treat every scientific problem as if it is a hypothesis testing problem. And if you have reason to include prior information into an analysis then by all means do so. But unless you have magic powers, simply doing a Bayesian analysis isn’t going to solve the problems above.

Let’s compute the probability of a false finding given that a paper is published. To do so, we will make numerous simplifying assumptions. Imagine we have a stream of studies. In each study, there are only two hypotheses, the null and the alternative

and the alternative  . In some fraction

. In some fraction  of the studies,

of the studies,  is true. Let

is true. Let  be the event that a study gets published. We do hypothesis testing and we publish just when we reject

be the event that a study gets published. We do hypothesis testing and we publish just when we reject  at level

at level  . Assume further that every test has the same power

. Assume further that every test has the same power  . Then the fraction of published studies with false findings is

. Then the fraction of published studies with false findings is

It’s clear that

It’s clear that  can be quite different from

can be quite different from  . We could recover

. We could recover  if we knew

if we knew  ; but we don’t know

; but we don’t know  and just inserting your own subjective guess isn’t much help. And once we remove all the simplifying assumptions, it becomes much more complicated. But this is beside the point because the bigger issue is bias.

and just inserting your own subjective guess isn’t much help. And once we remove all the simplifying assumptions, it becomes much more complicated. But this is beside the point because the bigger issue is bias.

The bias problem is indeed serious. It infects any analysis you might do: tests, confidence intervals, Bayesian inference, or whatever your favorite method is. Bias transcends arguments about the choice of statistical methods.

Which brings me to Madigan. David Madigan and his co-workers have spent years doing sensitivity analyses on observational studies. This has been a huge effort involving many people and a lot of work.

They considered numerous studies and asked: what happens if we tweak the database, the study design, etc.? The results, although not surprising, are disturbing. The estimates of the effects vary wildly. And this only accounts for a small amount of the biases that can enter a study.

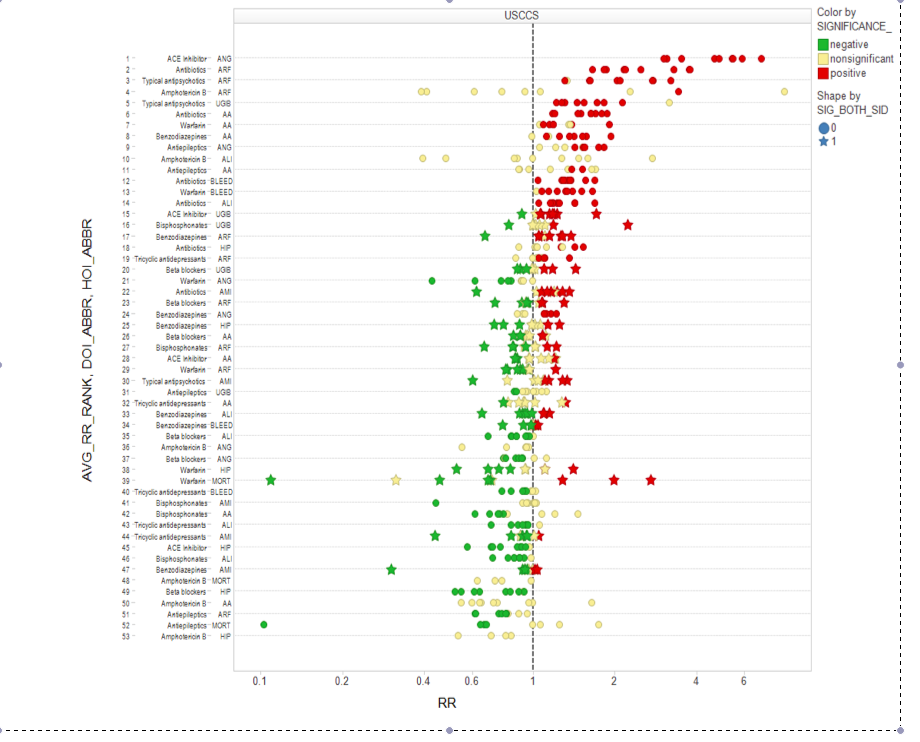

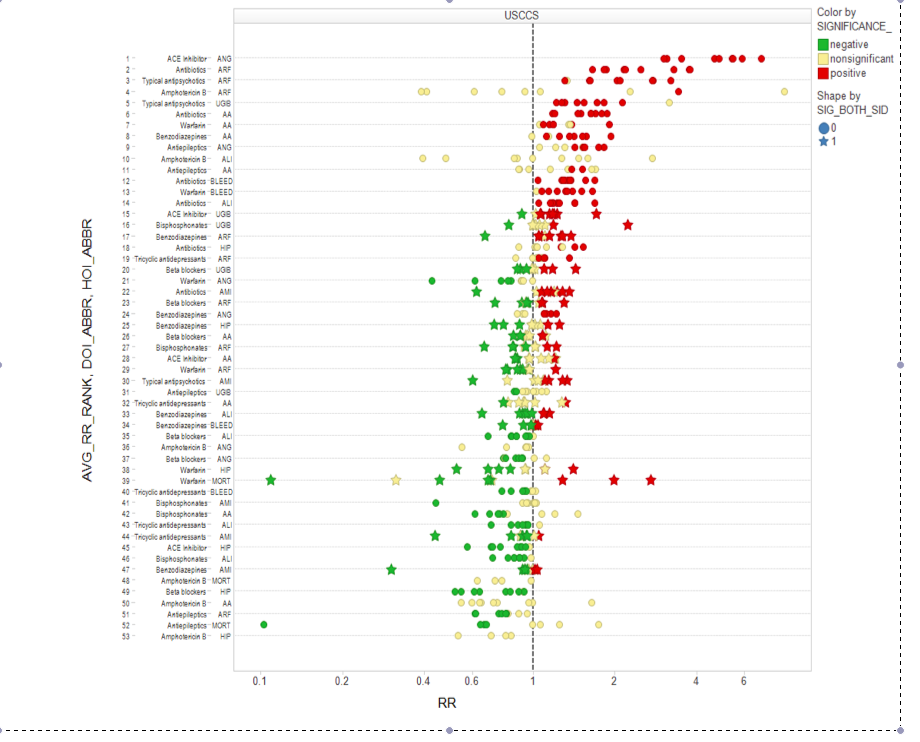

I do not have links to David’s papers (most are still in review) so I can’t show you all the pictures but here is one screenshot:

Each horizontal line is one study; the dots show how the estimates change as one design variable is tweaked. This picture is just the tip of the iceberg. (It would be interesting to see if the type of sensitivity analysis proposed by Paul Rosenbaum is able to reveal the sensitivity of studies but it’s not clear if that will do the job.)

To summarize: many published findings are indeed false. But don’t blame this on significance testing, frequentist inference or incompetent epidemiologists. If anything, it is bias. But really, it is simply a fact. The cure is to educate people (and especially the press) that just because a finding is published doesn’t mean it’s true. And I think that the sensitivity analysis being developed by David Madigan and his colleagues will turn out to be essential.

- From elementary probabilityIn fact, the left hand side can be much larger than the right hand side but it is the quantity on the right hand side that we control with hypothesis testing.

- Bias. There are many biases in studies so even if the null hypothesis is true, the p-value will not have a Uniform (0,1) distribution. This leads to extra false rejections. There are too many sources of potential bias to list but common ones include: unobserved confounding variables and the tendency to only report studies with small p-values.

Let me be clear about this: I am not suggesting we should treat every scientific problem as if it is a hypothesis testing problem. And if you have reason to include prior information into an analysis then by all means do so. But unless you have magic powers, simply doing a Bayesian analysis isn’t going to solve the problems above.

Let’s compute the probability of a false finding given that a paper is published. To do so, we will make numerous simplifying assumptions. Imagine we have a stream of studies. In each study, there are only two hypotheses, the null

The bias problem is indeed serious. It infects any analysis you might do: tests, confidence intervals, Bayesian inference, or whatever your favorite method is. Bias transcends arguments about the choice of statistical methods.

Which brings me to Madigan. David Madigan and his co-workers have spent years doing sensitivity analyses on observational studies. This has been a huge effort involving many people and a lot of work.

They considered numerous studies and asked: what happens if we tweak the database, the study design, etc.? The results, although not surprising, are disturbing. The estimates of the effects vary wildly. And this only accounts for a small amount of the biases that can enter a study.

I do not have links to David’s papers (most are still in review) so I can’t show you all the pictures but here is one screenshot:

Each horizontal line is one study; the dots show how the estimates change as one design variable is tweaked. This picture is just the tip of the iceberg. (It would be interesting to see if the type of sensitivity analysis proposed by Paul Rosenbaum is able to reveal the sensitivity of studies but it’s not clear if that will do the job.)

To summarize: many published findings are indeed false. But don’t blame this on significance testing, frequentist inference or incompetent epidemiologists. If anything, it is bias. But really, it is simply a fact. The cure is to educate people (and especially the press) that just because a finding is published doesn’t mean it’s true. And I think that the sensitivity analysis being developed by David Madigan and his colleagues will turn out to be essential.

Saturday, December 29, 2012

Friday, December 28, 2012

"Why do we have business cycles? Why do asset prices move around so much? At this stage, macroeconomics has little to offer by way of answer to these questions…. The sources of disturbances in macroeconomic models are (to my taste) patently unrealistic. Perhaps most famously, most models in macroeconomics rely on some form of large quarterly movements in the technological frontier… collective shocks to the marginal utility of leisure… large quarterly shocks to the depreciation rate in the capital stock…. None of these disturbances seem compelling, to put it mildly…."

kon kon lakota

"An especially pretentious conceit of the modern macroeconomics of the last 40 years is that the extreme assumptions on which it rests are the essential microfoundations without which macroeconomics lacks any scientific standing. That’s preposterous. Perfect foresight and rational expectations are assumptions required for finding the solution to a system of equations describing a general equilibrium. They are not essential properties of a system consistent with the basic rationality propositions of microeconomics"

d g

( federal

econ con bureaucrat staffer )

( federal

econ con bureaucrat staffer )

Wednesday, December 26, 2012

Shii Kazuo on global trans nat inc's" trade pact power play"

"The JCP chair demanded that the government give up participating in negotiations

for the Trans-Pacific Partnership (TPP) agreement, stating that an entry into

the free-trade pact would deal a devastating blow to Japan's agriculture and

sell out the nation's sovereignty over medical care, employment, and food safety

to the United States.

He criticized Prime Minister Noda Yoshihiko's pledge in his policy speech to "promote the TPP while protecting what should be protected." Stressing that "removal of tariffs without exceptions" and "elimination of non-tariff barriers" are the fundamental principles of the TPP, Shii asked what Noda considers as "items that should be protected."

In response to Shii, the prime minister only stated that he is determined to protect "Japan's medical system, Japanese traditions and culture, and beautiful farm villages.""

" "The Japan-U.S. Security Treaty is the root cause of Japan's subordination to the U.S. The government should abrogate the treaty and conclude a treaty of friendship with the U.S.""

He criticized Prime Minister Noda Yoshihiko's pledge in his policy speech to "promote the TPP while protecting what should be protected." Stressing that "removal of tariffs without exceptions" and "elimination of non-tariff barriers" are the fundamental principles of the TPP, Shii asked what Noda considers as "items that should be protected."

In response to Shii, the prime minister only stated that he is determined to protect "Japan's medical system, Japanese traditions and culture, and beautiful farm villages.""

" "The Japan-U.S. Security Treaty is the root cause of Japan's subordination to the U.S. The government should abrogate the treaty and conclude a treaty of friendship with the U.S.""

Sunday, December 23, 2012

brad self ex culpation

see back in 92 we were right to

"...aggressively move to reduce the budget deficit in 1993 even thought the recovery was weak"

ya break a huge party redefining campaign pledge

to cut working family federal taxes ,,...

why brekl that pledge p ass NAFTA and lose the house in 94 ?

" to eliminate any market expectations

that high deficits would lead to higher inflation"

okay nonsense but okay ...

excpt brad doesn't really believe the market is the prime mover here

attendez vour to the nut cutter line

..."--more importantly--"

meaning in reality

"to eliminate any belief

on the part of the Federal Reserve

that it need to raise rates rapidly and far "

i repeat

that " more importantly"

is brad telling us

the FED is decisive in such a context

and the FED must be appeased

or the FED

by strangling the recovery in a credit crunch

would create

"... a low-investment jobless recovery "

and why would the FED dosuch a nasty thing ?

"in order to guard against any possibility

of a renewed inflationary spiral."

but brad

was there any basis for such a concern ?

an inflationary spiral ? ...come now

isn't that just what a weak recovery won't create ?

in particular

an inflationary spiral

so fierce it required over the horizon

pre emption ?

of course not

now check out this pusilanimous crap

"That was not an attack"

(of bond vigilantes)

but it was

" a horizon-sighting of bond-market vigilantes--"

or was it ?

if he had the cubes to stop there its one thing

but here he goes covering his crotch

".. perhaps only the market thinking the Federal Reserve thought it was about to get a horizon-sighting of bond market vigilantes."

no you guysin the white house basement

thinking the market might be thinking the federal reserve might be thinking..blah blah blah

enough ?

nope

now don't he ned to double down

"I think we were right then to fear and take steps to ward off the bond-market vigilantes"

really ?

eerrrr

" or perhaps"

" only right

to fear and take steps to ward off

any Federal Reserve decision

that it needed to fear and take steps

to deal with bond-market vigilantes."

amazing !

brad alibis bondage bob rubin crap

by fingering a trigger happy greenspan FED

beautiful

what a fudge fest

"First, what was going on in 1994--and what those of us working in the Treasury and watching the Federal Reserve and the financial markets thought was going on--was not an attack of bond-market vigilantes terrified of rising debt and the prospect of explicit default or implicit default through rapid inflation. The Federal Reserve had undertaken a long easing from 1990 through the mid-1992 unemployment rate peak. But then, as unemployment started to decline, the Federal Reserve held off on tightening: it was expecting the passage of the deficit-reducing Clinton 1993 Reconciliation Bill--OBRA 19930--and believed that the spending cuts and tax increases in that were sufficient. In early 1994, however, the Federal Reserve concluded that it was time for monetary tightening, and began to gradually raise short-term safe interest rates by selling off some of its bonds for cash.

We in the Treasury--and the staff at the Federal Reserve--had expected the reaction of the long-term bond market to this Fed tightening cycle to be modest. Between 1990 and 1994 the Federal Reserve had reduced short-term interest rates by 5%, and as it had done so long-term rates had fallen by 3%. We attributed 1.75% of that long-term interest rate reduction to the reduced current and expected future federal deficits as a result of Clinton's OBRA 1993 and the earlier Foley-Mitchell-Bush OBRA 1990, leaving 1.25% to be the reaction of the long-term bond market to lower short-term interest rates. Thus as the Federal Reserve raised short-term safe interest rates from 3% to 6%, we expected a quarter of that to show up as a rise in long-term rates--we expected to see them go from 6% to 6.75%.

Instead, in 1994 long-term bond rates rose from 6% to 8%.

In the end we attributed the excess rise in long-term bond rates in 1994 to two factors:

- As interest rates rose, the duration of Mortgage Backed Securities lengthened--people weren't refinancing their houses any more. MBS thus became much longer duration securities--there was a much greater supply of long-term bonds in the market--and by supply and demand that pushed the prices of such bonds down until investment banks could figure out how to tap more risk-bearing capacity to hold those bonds.

- Nobody was sure that the Federal Reserve was going to stop raising short-term safe interest rates when they hit 6%. In the late 1980s, after all, they had not stopped until short-term interest rates hit 8%. Without effective forward guidance from the Federal Reserve, the bond market was pricing in a larger tightening than seemed likely to us.

We were, I think, completely correct. By mid-1995 it was clear that the Federal Reserve had reached the end of its tightening cycle and more money had flowed into the long-term bond market to hold attractively-priced MBS, and the long bond rate fell back into the trading range we had anticipated--and then fell some more.

So: 1994 was an interesting lesson on the importance of clear Federal Reserve forward guidance in avoiding excess bond-market volatility and on the consequences of endogenous duration for the short-term pricing of complex securities, but it was not an example of bond-market vigilantes fearing higher deficits and default or inflation riding over the horizon. The federal deficit was under control and rapidly shrinking in 1994 as the combination of the business-cycle recovery and Clinton's OBRA 1993 worked even better than we had anticipated.

Second, there had been an attack--or, rather, not an attack but rather bond-market vigilantes visible on the horizon and gunshots in the air--earlier.

Throughout 1992 there was a 4%-point gap between the 3-Month Treasury rate and the 10-Year Treasury rate. Those of us in the Clinton-administration-to-be read this as market expectations that the uncontrolled federal budget deficit would lead people to expect higher inflation and the Federal Reserve would then feel itself forced to raise short-term interest rates far and fast in order to hit the economy on the head with a brick and keep those expectations of higher inflation from coming true. The result would be a low-investment and perhaps a jobless recovery. The right policy, we thought--and I think the evidence is pretty clear that we were 100% right--was to aggressively move to reduce the budget deficit in 1993 even thought the recovery was weak in order to eliminate any market expectations that high deficits would lead to higher inflation, and--more importantly--to eliminate any belief on the part of the Federal Reserve that it need to raise rates rapidly and far to create a low-investment jobless recovery in order to guard against any possibility of a renewed inflationary spiral.

That was not an attack but a horizon-sighting of bond-market vigilantes--or perhaps only the market thinking the Federal Reserve thought it was about to get a horizon-sighting of bond market vigilantes.

I think we were right then to fear and take steps to ward off the bond-market vigilantes--or perhaps only right to fear and take steps to ward off any Federal Reserve decision that it needed to fear and take steps to deal with bond-market vigilantes. In any event, our policies were right.

But that was then, with a 4%-point gap between 10-Yr and 3-Mo Treasury yields

Today we only have a 1.6%-point gap between 10-Yr and 3-Mo Treasury yields.

1.6% < 4%"

Friday, December 21, 2012

lucas only calls it fiscal activism if the fed sits on its hands

crowding out if assumed to be very powerful ...

u get it

fiscal policy can be largely self nullifying

even if the borrowed funds get spent completely

if the credit markets off set any additional uncle borrowing

by reducing firm and or household borrowing by an equivalent amount

one way this gets turned into a nice trick

the impact of uncle on the credit markets raises rates

and by pre aexisting harmonics

the rate elasticity of firm and household borrowing is such as to exactly off set the increased borrow by uncle

with reduced borrowing by the F's and H's

but the broader point is to introduce doubt

doubt in the efficacy of the additional uncle spending

a doubt that arms itself

with visions of large countering contractions

in F and H spending out of net new borrowings

such it is hoped will pre emptively scuttled

any fiscal activism

uncle borrowings crowding out private borrowings

recipients

of net increased transfer payments

or new tax cuts

won't spend the additional funds

buying additional recent outputs of the production system

reactive firm pricing will render it all nominal

welcome to the stump list

all about stumping fiscal activism

would lucas call a counter cyclical "earned social didivend" system monetary policy ?

i guess if the program was explicitly monetized

maybe the fed directly bought the issued ear marked debt

it would look like just " a fairness just desserts regulated"

fed helicopter drop

but of course the FOMC

can off set or accomodated any net new issue by the treasury

simply by

a purchasing program or selling program

of any t issued paper

that the fed deems roughly equivalent

or ....you know ...whatever !

---------------------------------------------

the key is a fed hog tied to treasury actions by a clear response imperative

maybe the fed directly bought the issued ear marked debt

it would look like just " a fairness just desserts regulated"

fed helicopter drop

but of course the FOMC

can off set or accomodated any net new issue by the treasury

simply by

a purchasing program or selling program

of any t issued paper

that the fed deems roughly equivalent

or ....you know ...whatever !

---------------------------------------------

the key is a fed hog tied to treasury actions by a clear response imperative

PK on NK

"So, Noah Smith weighs in on the state of macro and argues that there really isn’t that much disagreement in the field, because both saltwater and freshwater macro use the same set of techniques."

"...New Keynesians .. still find Keynesian ideas useful and argues that monetary and fiscal policy can be effective;

real business cyclist ....business cycles are optimal responses to real shocks "

". Alchemists and chemists used similar equipment: retorts, beakers, and so on. ....

. New Keynesians and real business cycle theorists both do lots of intertemporal maximization

. Again, this doesn’t make them the same endeavor."

"The real test came when the financial crisis struck"

".. pretty much to a man freshwater economists not only argued against fiscal stimulus — which is a defensible position — but insisted that there was no possible way to justify stimulus,"

".. such ideas had been refuted and that “nobody” believed in them anymore."

"anyone who actually worked with an NK model would know that fiscal policy

can indeed have an effect in that framework."

"I’m not saying that the NK approach is necessarily right;.....there’s a lot of evidence for the price stickiness that is central to NK models;"

"... maybe that evidence doesn’t mean what the theorists think, but surely that evidence ought to be part of any discussion."

"So yes, the equations in one of Mike Woodford’s papers look a lot like the equations coming out of Chicago or Minneapolis."

" And a few years ago it was possible to delude oneself into believing that this represented a true convergence of thought. But recent events have proved that it just wasn’t true"

---------------------------------------------------

what caught my eagle eye :

"pretty much to a man freshwater economists ..... argued against fiscal stimulus

— which is a defensible position "

a defensible position eh ?

paul still clings to the monetary only macro school the morbid usury infested

cave of the cyclopian school

that reveled at the feats of the late great moderation

old beliefs die hard or at least remain ....as big chunks in the daily stool

--------------------------------------------------

okay the bit about sticky prices is pathetic

i know \

but that horse we must beat on a happier more triumphant day

--------------------------------------------

just to brighten up this measly macro post some

here's ....

"...New Keynesians .. still find Keynesian ideas useful and argues that monetary and fiscal policy can be effective;

real business cyclist ....business cycles are optimal responses to real shocks "

". Alchemists and chemists used similar equipment: retorts, beakers, and so on. ....

. New Keynesians and real business cycle theorists both do lots of intertemporal maximization

. Again, this doesn’t make them the same endeavor."

"The real test came when the financial crisis struck"

".. pretty much to a man freshwater economists not only argued against fiscal stimulus — which is a defensible position — but insisted that there was no possible way to justify stimulus,"

".. such ideas had been refuted and that “nobody” believed in them anymore."

"anyone who actually worked with an NK model would know that fiscal policy

can indeed have an effect in that framework."

"I’m not saying that the NK approach is necessarily right;.....there’s a lot of evidence for the price stickiness that is central to NK models;"

"... maybe that evidence doesn’t mean what the theorists think, but surely that evidence ought to be part of any discussion."

"So yes, the equations in one of Mike Woodford’s papers look a lot like the equations coming out of Chicago or Minneapolis."

" And a few years ago it was possible to delude oneself into believing that this represented a true convergence of thought. But recent events have proved that it just wasn’t true"

---------------------------------------------------

what caught my eagle eye :

"pretty much to a man freshwater economists ..... argued against fiscal stimulus

— which is a defensible position "

a defensible position eh ?

paul still clings to the monetary only macro school the morbid usury infested

cave of the cyclopian school

that reveled at the feats of the late great moderation

old beliefs die hard or at least remain ....as big chunks in the daily stool

--------------------------------------------------

okay the bit about sticky prices is pathetic

i know \

but that horse we must beat on a happier more triumphant day

--------------------------------------------

just to brighten up this measly macro post some

here's ....

how much leverage may effect durable and res structure spending

red is high leverage rareas

black dot low

.

.

Thursday, December 20, 2012

roman roman you've been thinking

imperfect knowledge

this is the pea of wisdom

produced by

this NYU "pocket" school --plus NED--

a generalization i suspect undisputed by anyone

not even the blind sheik of stump ville

bob lucas

okay so

some dare not call us irrational agents

as we enter the market place

where as

gain oriented sociopathic opportunists

that label

strikes me as an adequate agent mind set a priori

for at least the professional players

able to move markets into or around corners on occasion

and of course pick up dimes in front of the racing steam rolller

translation :

yes dotty

few leave dollar bills on the side walk

err dollar bills they notice down there that is

our man in sabra shirt

comes hucking his wares :

.".. To be sure, the upswing in house prices in many markets around the country in the 2000s did reach levels that history and the subsequent long downswings tell us were excessive. But, as we show in Part II, such excessive fluctuations should not be interpreted to mean that asset-price swings are unrelated to fundamental factors. In fact, even if an individual is interested only in short-term returns—a feature of much trading in many markets—the use of data on fundamental factors to forecast these returns is extremely valuable. And the evidence that news concerning a wide array of fundamentals plays a key role in driving asset-price swings is overwhelming.[16]

i read something like this

and i see a lot of pre fight smack talk

get in the ring and show us what you got

it ain't here

REH took three torpedos at least below the water line

and in reality sank

out there on the 7 seas now is a ghost ship

building models with plausible agent actions

is under way

but we hardly can expect a whole system simulating model yet

just suggestive pieces

that's the science

however we've known how to mobilize productive factors into greater market activity since the days of the arsenal of democracy

that we don't declare war on climate change

like we

declared war on fascism

or the japanese empire

---sandy as pearl harbor ---

but instead stag along

producing our own " welfare infamy" all by ourselves

well that's all about class politics not science

------------------

you prolly share my contempt for stevie wonder williamson

he de throwns calvo

by crying

" what about the arbitrage reachable

" side walk dollar bills "

any stuttering price makers must leave

all around themselves

the general assumption

men and gals of enterprise

if free to choose to pounce and scoop

will rapidly rationalize market outcomes

they are every where like guardian angels

of the marketsever ready and able

to reconfirm

those reassuring

ike era social welfare theorems

-------------------------------------

smart agents

that learn have clever hunches etc

roman is correct to suggest

agents are not irational apriori or a posteriori

only imperfect

get it

imperfect agents ...imperfect markets

lesson

we can do better then leave the markets to their spontaneous agents

again greenwald stiglitz etc etc

----------------

interestingly

there is a set of assumptions about agents actions

that implies a set of

a priori linear taxes and subsidies can correct all market failures

the full greenwald stiglitz

however generalizes to any set of agent actions

including ones that get nicely caught

by insurance models

agent actions that radically intensify the degree

and kind of optimal interventions

not pyrrhonism

but an awesome account of the complexity here

so its correct to suggest mechanical models will fail to capture not just the nuance but the substance of any required "instrumentalities"

and interventions

we might need

to pursue higher social welfare

------------------------

herd and rational bubble making

the drovers of the herd are not irrational

their task is to know when to break off

ie before the cliff edge

and of course

saet up a new camp at the bottom of the cliff

to collect the meat

yup

take em on the way up

and slaughter em after they fall

of course to operate with the limitless credit line of TBTF makes this all hollywood fine

this is the pea of wisdom

produced by

this NYU "pocket" school --plus NED--

a generalization i suspect undisputed by anyone

not even the blind sheik of stump ville

bob lucas

okay so

some dare not call us irrational agents

as we enter the market place

where as

gain oriented sociopathic opportunists

that label

strikes me as an adequate agent mind set a priori

for at least the professional players

able to move markets into or around corners on occasion

and of course pick up dimes in front of the racing steam rolller

translation :

yes dotty

few leave dollar bills on the side walk

err dollar bills they notice down there that is

our man in sabra shirt

comes hucking his wares :

.".. To be sure, the upswing in house prices in many markets around the country in the 2000s did reach levels that history and the subsequent long downswings tell us were excessive. But, as we show in Part II, such excessive fluctuations should not be interpreted to mean that asset-price swings are unrelated to fundamental factors. In fact, even if an individual is interested only in short-term returns—a feature of much trading in many markets—the use of data on fundamental factors to forecast these returns is extremely valuable. And the evidence that news concerning a wide array of fundamentals plays a key role in driving asset-price swings is overwhelming.[16]

Missing the Point in the Economists’ Debate

Economists concluded that fundamentals do not matter for asset-price movements because they could not find one overarching relationship that could account for long swings in asset prices. The constraint that economists should consider only fully predetermined accounts of outcomes has led many to presume that some or all participants are irrational, in the sense that they ignore fundamentals altogether. Their decisions are thought to be driven purely by psychological considerations.

The belief in the scientific stature of fully predetermined models, and in the adequacy of the Rational Expectations Hypothesis to portray how rational individuals think about the future, extends well beyond asset markets. Some economists go as far as to argue that the logical consistency that obtains when this hypothesis is imposed in fully predetermined models is a precondition of the ability of economic analysis to portray rationality and truth.

For example, in a well-known article published in The New York Times Magazinein September 2009, Paul Krugman (2009, p. 36) argued that Chicago-school free-market theorists “mistook beauty . . . for truth.” One of the leading Chicago economists, John Cochrane (2009, p. 4), responded that “logical consistency and plausible foundations are indeed ‘beautiful’ but to me they are also basic preconditions for ‘truth.’” Of course, what Cochrane meant by plausible foundations were fully predetermined Rational Expectations models. But, given the fundamental flaws of fully predetermined models, focusing on their logical consistency or inconsistency, let alone that of the Rational Expectations Hypothesis itself, can hardly be considered relevant to a discussion of the basic preconditions for truth in economic analysis, whatever “truth” might mean.

There is an irony in the debate between Krugman and Cochrane. Although the New Keynesian and behavioral models, which Krugman favors,[11] differ in terms of their specific assumptions, they are every bit as mechanical as those of the Chicago orthodoxy. Moreover, these approaches presume that the Rational Expectations Hypothesis provides the standard by which to define rationality and irrationality.[18]

Behavioral economics provides a case in point. After uncovering massive evidence that the contemporary economics’ standard of rationality fails to capture adequately how individuals actually make decisions, the only sensible conclusion to draw was that this standard was utterly wrong. Instead, behavioral economists, applying a variant of Brecht’s dictum, concluded that individuals are irrational.[19]

To justify that conclusion, behavioral economists and nonacademic commentators argued that the standard of rationality based on the Rational Expectations Hypothesis works—but only for truly intelligent investors. Most individuals lack the abilities needed to understand the future and correctly compute the consequences of their decisions.[20]

In fact, the Rational Expectations Hypothesis requires no assumptions about the intelligence of market participants whatsoever (for further discussion, see Chapters 3 and 4). Rather than imputing superhuman cognitive and computational abilities to individuals, the hypothesis presumes just the opposite: market participants forgo using whatever cognitive abilities they do have. The Rational Expectations Hypothesis supposes that individuals do not engage actively and creatively in revising the way they think about the future. Instead, they are presumed to adhere steadfastly to a single mechanical forecasting strategy at all times and in all circumstances. Thus, contrary to widespread belief, in the context of real-world markets, the Rational Expectations Hypothesis has no connection to how even minimally reasonable profit-seeking individuals forecast the future in real-world markets. When new relationships begin driving asset prices, they supposedly look the other way, and thus either abjure profit-seeking behavior altogether or forgo profit opportunities that are in plain sight.

The Distorted Language of Economic Discourse

It is often remarked that the problem with economics is its reliance on mathematical apparatus. But our criticism is not focused on economists’ use of mathematics. Instead, we criticize contemporary portrayal of the market economy as a mechanical system. Its scientific pretense and the claim that its conclusions follow as a matter of straightforward logic have made informed public discussion of various policy options almost impossible.

Doubters have often been made to seem as unreasonable as those who deny the theory of evolution or that the earth is round. Indeed, public debate is further distorted by the fact that economists formalize notions like “rationality” or “rational markets” in ways that have little or no connection to how non-economists understand these terms. When economists invoke rationality to present or legitimize their public-policy recommendations, non-economists interpret such statements as implying reasonable behavior by real people. In fact, as we discuss extensively in this book, economists’ formalization of rationality portrays obviously irrational behavior in the context of real-world markets.

Such inversions of meaning have had a profound impact on the development of economics itself. For example, having embraced the fully predetermined notion of rationality, behavioral economists proceeded to search for reasons, mostly in psychological research and brain studies, to explain why individual behavior is so grossly inconsistent with that notion—a notion that had no connection with reasonable real-world behavior in the first place.

Moreover, as we shall see, the idea that economists can provide an overarching account of markets, which has given rise to fully predetermined rationality, misses what markets really do. ...

Footnotes

16 See Chapters 7-9 for an extensive discussion of the role of fundamentals in driving price swings in asset markets and their interactions with psychological factors.

17 For example, in discussing the importance of the connection between the financial system and the wider economy for understanding the crisis and thinking about reform, Krugman endorses the approach taken by Bernanke and Gertler. (For an overview of these models, see Bernanke et al., 1999.) However, as pioneering as these models are in incorporating the financial sector into macroeconomics, they are fully predetermined and based on the Rational Expectations Hypothesis. As such, they suffer from the same fundamental flaws that plague other contemporary models. When used to analyze policy options, these models presume not only that the effects of contemplated policies can be fully pre-specified by a policymaker, but also that nothing else genuinely new will ever happen. Supposedly, market participants respond to policy changes according to the REH-based forecasting rules. See footnote 3 in the Introduction and Chapter 2 for further discussion.

18 The convergence in contemporary macroeconomics has become so striking that by now the leading advocates of both the “freshwater” New Classical approach and the “saltwater” New Keynesian approach, regardless of their other differences, extol the virtues of using the Rational Expectations Hypothesis in constructing contemporary models. See Prescott (2006) and Blanchard (2009). It is also widely believed that reliance on the Rational Expectations Hypothesis makes New Keynesian models particularly useful for policy analysis by central banks. See footnote 7 in this chapter and Sims (2010). For further discussion, see Frydman and Goldberg (2008).

19 Following the East German government’s brutal repression of a worker uprising in 1953, Bertolt Brecht famously remarked, “Wouldn’t it be easier to dissolve the people and elect another in their place?”

20 Even Simon (1971), a forceful early critic of economists’ notion of rationality, regarded it as an appropriate standard of decision-making, though he believed that it was unattainable for most people for various cognitive and other reasons. To underscore this view, he coined the term “bounded rationality” to refer to departures from the supposedly normative benchmark."

i read something like this

and i see a lot of pre fight smack talk

get in the ring and show us what you got

it ain't here

REH took three torpedos at least below the water line

and in reality sank

out there on the 7 seas now is a ghost ship

building models with plausible agent actions

is under way

but we hardly can expect a whole system simulating model yet

just suggestive pieces

that's the science

however we've known how to mobilize productive factors into greater market activity since the days of the arsenal of democracy

that we don't declare war on climate change

like we

declared war on fascism

or the japanese empire

---sandy as pearl harbor ---

but instead stag along

producing our own " welfare infamy" all by ourselves

well that's all about class politics not science

------------------

you prolly share my contempt for stevie wonder williamson

he de throwns calvo

by crying

" what about the arbitrage reachable

" side walk dollar bills "

any stuttering price makers must leave

all around themselves

the general assumption

men and gals of enterprise

if free to choose to pounce and scoop

will rapidly rationalize market outcomes

they are every where like guardian angels

of the marketsever ready and able

to reconfirm

those reassuring

ike era social welfare theorems

-------------------------------------

smart agents

that learn have clever hunches etc

roman is correct to suggest

agents are not irational apriori or a posteriori

only imperfect

get it

imperfect agents ...imperfect markets

lesson

we can do better then leave the markets to their spontaneous agents

again greenwald stiglitz etc etc

----------------

interestingly

there is a set of assumptions about agents actions

that implies a set of

a priori linear taxes and subsidies can correct all market failures

the full greenwald stiglitz

however generalizes to any set of agent actions

including ones that get nicely caught

by insurance models

agent actions that radically intensify the degree

and kind of optimal interventions

not pyrrhonism

but an awesome account of the complexity here

so its correct to suggest mechanical models will fail to capture not just the nuance but the substance of any required "instrumentalities"

and interventions

we might need

to pursue higher social welfare

------------------------

herd and rational bubble making

the drovers of the herd are not irrational

their task is to know when to break off

ie before the cliff edge

and of course

saet up a new camp at the bottom of the cliff

to collect the meat

yup

take em on the way up

and slaughter em after they fall

of course to operate with the limitless credit line of TBTF makes this all hollywood fine

the neo classical magic act: minds move faster then markets

hence the efficacy of REH to the neo-neo's

from equilibrium to REH

or how the neo classical boot lickers

restored the corporate free power hand above the policy altar

yet another brilliant paine paper not written !

beaver barro

master mind among

"stump the fiscalists "

----------------------------

it is nice to consider the task of these " don't tamper with the markets" school

to consider a social optimality condition

--- like any social optimality plan project might ---

and embed the results in the spontaneous workings of markets or actions of market agents themselves

a pre established harmony if there ever was one

the advance in agent minds located optimality ?

fast and without noticeable

real resource cost

brain computation time vanishes into angelic aprehension

just as the walras grope or the pre transaction edgeworth recontracting

costless

but that howling assumption in all such magic acts

is all that much else conspicuous

the bridge

perfect fore sight

arrived at by vast instantaneous ratioconations

done on a mass scale

as the agents act as if but one over soul

ah the graces bestowed on the minds of all marketeers

graces

forever unavailable to any gosplan mites

from equilibrium to REH

or how the neo classical boot lickers

restored the corporate free power hand above the policy altar

yet another brilliant paine paper not written !

beaver barro

master mind among

"stump the fiscalists "

----------------------------

it is nice to consider the task of these " don't tamper with the markets" school

to consider a social optimality condition

--- like any social optimality plan project might ---

and embed the results in the spontaneous workings of markets or actions of market agents themselves

a pre established harmony if there ever was one

the advance in agent minds located optimality ?

fast and without noticeable

real resource cost

brain computation time vanishes into angelic aprehension

just as the walras grope or the pre transaction edgeworth recontracting

costless

but that howling assumption in all such magic acts

is all that much else conspicuous

the bridge

perfect fore sight

arrived at by vast instantaneous ratioconations

done on a mass scale

as the agents act as if but one over soul

ah the graces bestowed on the minds of all marketeers

graces

forever unavailable to any gosplan mites

Wednesday, December 19, 2012

ace strikes the nordic's on the bean

"we develop a simple model of economic growth in a world in which all countries benefit and potentially contribute to advances in the world technology frontier. A greater gap of incomes between successful and unsuccessful entrepreneurs (thus greater inequality) increases entrepreneurial effort and hence a country’s contribution to the world technology frontier"

and get this

"We show that, under plausible assumptions, the world equilibrium is asymmetric: some countries will opt for a type of “cutthroat” capitalism that generates greater inequality and more innovation and will become the technology leaders, while others will free-ride on the cutthroat incentives of the leaders and choose a more cuddly form of capitalism. Paradoxically, those with cuddly reward structures, though poorer, may have higher welfare than cutthroat capitalists; but in the world equilibrium, it is not a best response for the cutthroat capitalists to switch to a more cuddly form of capitalism. We also show that domestic constraints from social democratic parties or unions may be beneficial for a country because they prevent cutthroat capitalism domestically, instead inducing other countries to play this role. "

and get this

"We show that, under plausible assumptions, the world equilibrium is asymmetric: some countries will opt for a type of “cutthroat” capitalism that generates greater inequality and more innovation and will become the technology leaders, while others will free-ride on the cutthroat incentives of the leaders and choose a more cuddly form of capitalism. Paradoxically, those with cuddly reward structures, though poorer, may have higher welfare than cutthroat capitalists; but in the world equilibrium, it is not a best response for the cutthroat capitalists to switch to a more cuddly form of capitalism. We also show that domestic constraints from social democratic parties or unions may be beneficial for a country because they prevent cutthroat capitalism domestically, instead inducing other countries to play this role. "

Tuesday, December 18, 2012

Subscribe to:

Posts (Atom)