Tuesday, January 31, 2017

A double bust finding : "By our measurement, the trough in both com- modity and capital flow cycle dates to 1999 and the peak came in 2011, followed by a severe bust. This boom episode was the second longest boom in real commodity prices since the late eighteenth century and one of the four longest capital flow booms since 1815"

Capture the DP power core but bring along some new economic thinkers

This capture of the DP commanding heights needs a new economic think tank

Drawn “broadly ” from the several currents of real progressive economists

Drawn “broadly ” from the several currents of real progressive economists

As a macro economist I see the necessity to re found macro policy

We have fore fathers

like Kalecki Lerner and Vickrey

And a wide range of contemporaneous eclectic allies

From the likes of theorist joe Stiglitz to policy Merlins like bobby Reich and Jamie Galbraith

like Kalecki Lerner and Vickrey

And a wide range of contemporaneous eclectic allies

From the likes of theorist joe Stiglitz to policy Merlins like bobby Reich and Jamie Galbraith

Obama built his policy team basically out of inherited Clinton cadre

They must be pushed out …completely

They must be pushed out …completely

Example

Senators Warren or Brown or Sanders

Despite rooted job class orientations

Lack

a real economics brain trust

steeped in potential progressive best practices

Senators Warren or Brown or Sanders

Despite rooted job class orientations

Lack

a real economics brain trust

steeped in potential progressive best practices

"Low taxes merely liberated income from taxation to pay for higher levels of debt service, "

Nice little card trick of our times

"Social democracy and market liberalism offered different solutions to the same problem: how to provide for life-cycle dependency. Social democracy makes lateral transfers from producers to dependents by means of progressive taxation. Market liberalism uses financial markets to transfer financial entitlement over time. Social democracy came up against the limits of public expenditure in the 1970s. The ‘market turn’ from social democracy to market liberalism was enabled by easy credit in the 1980s. Much of this was absorbed into homeownership, which attracted majorities of households (and voters) in the developed world. Early movers did well, but easy credit eventually drove house prices beyond the reach of younger cohorts. Debt service diminished effective demand, which instigated financial instability. Both social democracy and market liberalism are in crisis."

Oxbridge take on the past 40 years

Sunday, January 29, 2017

Capitalists dictate prosperity or misery

Rog farmer uses wealth to drive spending around not income

He relies on beliefs about the future !

Beliefs in a future prosperity are self fulfilling

Similarly beliefs in future dirth are self fulfilling

He grabs the easiest existing ready to hand lever to move this system

The stock market

Essentially he surrenders the system to the capitalists

Motivating their firm level spending

thru state manipulation

of the equity value

of public corporations !

He relies on beliefs about the future !

Beliefs in a future prosperity are self fulfilling

Similarly beliefs in future dirth are self fulfilling

He grabs the easiest existing ready to hand lever to move this system

The stock market

Essentially he surrenders the system to the capitalists

Motivating their firm level spending

thru state manipulation

of the equity value

of public corporations !

Friday, January 27, 2017

Flash back pause : Ken's hierarchy of systems

2. Clockworks. The solar system or simple machines such as the lever and the pulley, even quite complicated machines like steam engines and dynamos fall mostly under this category.

3. Thermostats. Control Mechanisms or Cybernetic Systems : the system will move to the maintenance of any given equilibrium, within limits.

4. Cells. Open systems or self-maintaining structures. This is the level at which life begins to differentiate itself from not life.

5. Plants. The outstanding characteristics of these systems (studied by the botanists) are first, a division of labor with differentiated and mutually dependent parts (roots, leaves, seeds, etc.), and second, a sharp differentiation between the genotype and the phenotype, associated with the phenomenon of equifinal or "blueprinted" growth.

6. Animals. Level characterized by increased mobility, teleological behavior and self-awareness, with the development of specialized 'information receptors (eyes, ears, etc.) leading to an enormous increase in the intake of information.

7. Human Beings. In, addition to all, or nearly all, of the characteristics of animal systems man possesses self consciousness, which is something different from mere awareness.

8. Social Organizations. The unit of such systems is not perhaps the person but the "role" - that part of the person which is concerned with the organization or situation in question. Social organizations might be defined as a set of roles tied together with channels of communication.

9. Trascendental Systems. The ultimates and absolutes and the inescapable unknowables, that also exhibit systematic structure and relationship.

Beware cloud 9 !!!

Ancient Ken Boulding "Conventions of generality and mathematical elegance may be just as much barriers to the attainment and diffusion of knowledge as may contentment with particularity and literary vagueness... It may well be that the slovenly and literary borderland between economics and sociology will be the most fruitful building ground during the years to come and that mathematical economics will remain too flawless in its perfection to be very fruitful."

I doubt the development of frigidly formal ( with or without fudge sauce )

single rep

rat ex macro models

from what ..

The mid 70's to the late or mid 80's......

....Add in of course

the concurrent and subsequent elite smothering of alternatives ......

......Until September 2008 finally popped this most cunning of brain zits....

Has many peers for clog effect

Surely this interval

Will challenge scholars to find a better fulfillment

of stammer' Ken's prophecy

single rep

rat ex macro models

from what ..

The mid 70's to the late or mid 80's......

....Add in of course

the concurrent and subsequent elite smothering of alternatives ......

......Until September 2008 finally popped this most cunning of brain zits....

Has many peers for clog effect

Surely this interval

Will challenge scholars to find a better fulfillment

of stammer' Ken's prophecy

Black "If Wall Street remains in charge of the DNC, the democratic wing of the Democratic Party should found a new party free from Wall Street and big corporate influence."

No

Just set up a "counter national committee " of " Real Democrats "

With a real Democrat manifesto

Declare " the bought DNC " anti Democrat anti democratic anti people power

Force Dembots in elective positions to choose between the two national committees

Never surrender the party to Wall Street !

Just set up a "counter national committee " of " Real Democrats "

With a real Democrat manifesto

Declare " the bought DNC " anti Democrat anti democratic anti people power

Force Dembots in elective positions to choose between the two national committees

Never surrender the party to Wall Street !

Thursday, January 26, 2017

Big racket opportunity buy up existing life insurance policies and inject drugs

The gaps in the life insurance market can be exploited more efficiently

If an effort is made to shorten life expectancies by increased drug use

If an effort is made to shorten life expectancies by increased drug use

The Dembot party needs a brand new economic brain trust

Forever at Full blast job markets

Perpetual high utilization production

A green Industrial policy

Fairly balanced trade

Tied to

Based on globally equalized PPP guided forex

Tax wealth not work

Etc

Perpetual high utilization production

A green Industrial policy

Fairly balanced trade

Tied to

Based on globally equalized PPP guided forex

Tax wealth not work

Etc

Smarket algorithms that max social welfare objectives will be child's play .....once the market system is socialized

The endless dialectic

of competition and cooperation

of autonomy and integration

Of bottom up and top down

Etc etc

Can be codified and re codified

instituted and mutated incessantly

of competition and cooperation

of autonomy and integration

Of bottom up and top down

Etc etc

Can be codified and re codified

instituted and mutated incessantly

Undervalued forex leads to import substitution obviously

As forex falls domestic production of inputs into exportable outputs should rise

Cross put : the value of cross border transactions

The sum total of all transactions back and forth

across any bordered region of the global marketplace

Cross put

The degree of open ness is not well measured by ratio to GDP

if we have lots of intermediate imports as inputs to exported outputs and visa versa

An estimate of total domestic product transactions makes a better denominator

Sounds like I'm still shaken here

But the present formula import vale plus export value over GDP is too sensitive to

The amount of intermediate ins and outs

Once trade was in mostly final products not products that once productively consumed

Are headed back out into inter border commerce

across any bordered region of the global marketplace

Cross put

The degree of open ness is not well measured by ratio to GDP

if we have lots of intermediate imports as inputs to exported outputs and visa versa

An estimate of total domestic product transactions makes a better denominator

Sounds like I'm still shaken here

But the present formula import vale plus export value over GDP is too sensitive to

The amount of intermediate ins and outs

Once trade was in mostly final products not products that once productively consumed

Are headed back out into inter border commerce

Wednesday, January 25, 2017

Wage rates accelerate in 2017?

"We haven't been hearing reports from firms where the typical worker's wage increase in 2017 is expected to be above 4 percent. However, we did get readings for the Wage Growth Tracker pretty close to 4 percent in October and November of last year. As the following chart shows, a sharp increase in women's median wage growth (hitting 4.3 percent in October 2016) drove the overall increase. In contrast, the median wage increase for men was 3.5 percent."

Higher innovation rates among New research teams at new firms

Assume the productivity of a research outfit

falls as the size of the outfit gets larger and the duration of the outfit gets longer

falls as the size of the outfit gets larger and the duration of the outfit gets longer

Producing new memes decreasing returns ? Why ?

Maybe it takes longer and longer for new minds to reach the frontier

Very unlikely

Thus looking at individual industries/lines will help us sort out what is happening. The first example is transistors, and the count of transistors per square inch on a chip. Famously, this appears to obey Moore’s Law, which is that the number of transistors per square inch doubles every 18 months. If we count the number of transistors per square inch as “ideas”, then this translates to a growth rate of 35% per year. At the same time, the effective number of researchers working at chip companies (Intel, AMD, etc..) has grown by a factor of about 80 since 1970. Plotting this together yields their next figure.

Thus looking at individual industries/lines will help us sort out what is happening. The first example is transistors, and the count of transistors per square inch on a chip. Famously, this appears to obey Moore’s Law, which is that the number of transistors per square inch doubles every 18 months. If we count the number of transistors per square inch as “ideas”, then this translates to a growth rate of 35% per year. At the same time, the effective number of researchers working at chip companies (Intel, AMD, etc..) has grown by a factor of about 80 since 1970. Plotting this together yields their next figure.

Maybe discovery is only partly connected to total effort All you get with more research mind hours Is redundancy and tight interval between rival teams in the same races

Maybe discovery is only partly connected to total effort All you get with more research mind hours Is redundancy and tight interval between rival teams in the same races

Maybe large teams slow the rate of discovery

Much to ponder

Even if global pop growthslows to zero Of course as available free labor ratios rise Thru increased productivity for necessary labor The research effort can increase

Very unlikely

"In green is the relative number of researchers compared to the number in 1930. This isn’t the number of researchers, its a measure of effective researchers, found by dividing total R and D spending by the nominal wage of high-skilled workers. Relative to 1930, we have almost 25 times as many (effective) researchers at work today. This leads to the author’s title question - “Are ideas getting harder to find?”. And the author’s answer is “Yes”."

Thus looking at individual industries/lines will help us sort out what is happening. The first example is transistors, and the count of transistors per square inch on a chip. Famously, this appears to obey Moore’s Law, which is that the number of transistors per square inch doubles every 18 months. If we count the number of transistors per square inch as “ideas”, then this translates to a growth rate of 35% per year. At the same time, the effective number of researchers working at chip companies (Intel, AMD, etc..) has grown by a factor of about 80 since 1970. Plotting this together yields their next figure.

Thus looking at individual industries/lines will help us sort out what is happening. The first example is transistors, and the count of transistors per square inch on a chip. Famously, this appears to obey Moore’s Law, which is that the number of transistors per square inch doubles every 18 months. If we count the number of transistors per square inch as “ideas”, then this translates to a growth rate of 35% per year. At the same time, the effective number of researchers working at chip companies (Intel, AMD, etc..) has grown by a factor of about 80 since 1970. Plotting this together yields their next figure. Maybe discovery is only partly connected to total effort All you get with more research mind hours Is redundancy and tight interval between rival teams in the same races

Maybe discovery is only partly connected to total effort All you get with more research mind hours Is redundancy and tight interval between rival teams in the same races Maybe large teams slow the rate of discovery

Much to ponder

Even if global pop growthslows to zero Of course as available free labor ratios rise Thru increased productivity for necessary labor The research effort can increase

A senate chosen by lot

Sortition jury by lot is our everlasting version

Methods are under explored by institutional designers

Methods are under explored by institutional designers

Tuesday, January 24, 2017

"irreducible, emergent, non-ergodic, radically uncertain economy"

Irreducibility is a fact

Perfect foresight impossible ...so what ?

We can get better simply by acting on our simple models recommendations and using feed back

No need for ABMs to impact Kalecki macro

Emergent fine but once emerged and adequately observed we can model its features

And again if the unanticipated emerges we modify policy

Non- ergodic ?

Than God we finite beings are not endowed with infinite patience

Contemplating the management of The spontaneous motions of the seas is one thing

Managing the spontaneous motions of a market based national production system quite another

Radically uncertain ?

Yup but rarely overly surprising

Yes the September panic on non regulated over nite credit markets

Was such a surprise

But only because we failed to effectively up date

Our vintage " run " models to include

New markets for over nite credit

Perfect foresight impossible ...so what ?

We can get better simply by acting on our simple models recommendations and using feed back

No need for ABMs to impact Kalecki macro

Emergent fine but once emerged and adequately observed we can model its features

And again if the unanticipated emerges we modify policy

Non- ergodic ?

Than God we finite beings are not endowed with infinite patience

Contemplating the management of The spontaneous motions of the seas is one thing

Managing the spontaneous motions of a market based national production system quite another

Radically uncertain ?

Yup but rarely overly surprising

Yes the September panic on non regulated over nite credit markets

Was such a surprise

But only because we failed to effectively up date

Our vintage " run " models to include

New markets for over nite credit

No need to go over board Serious gains from ABMs exists once you posit three agents

The bust out from the one eyed rat rep agent models is complete

Let's get cooking !

The fact market economies are not just big complex beautiful machines is now

Well digested

The use of classical if largely rudimentary Mechanical engineering math

will be harder to strip out

It's like a sacred language for the priesthood

But we an see thru that easily enough with some awareness of the form confining the substance

Even if

Indeed transmuting autonomous minds into free moving molecules happens as we pass thru to the paradigms of yore !

But the formalisms congenial to that paradigm are not the road block

The paradigm itself is the road block

Yes even non linear systems are molecular not mindful

Translation alone is not transformation

Building in more complexity may not add to enlightenment

Generating Chaos is not discovery

Let's get cooking !

The fact market economies are not just big complex beautiful machines is now

Well digested

The use of classical if largely rudimentary Mechanical engineering math

will be harder to strip out

It's like a sacred language for the priesthood

But we an see thru that easily enough with some awareness of the form confining the substance

Even if

Indeed transmuting autonomous minds into free moving molecules happens as we pass thru to the paradigms of yore !

But the formalisms congenial to that paradigm are not the road block

The paradigm itself is the road block

Yes even non linear systems are molecular not mindful

Translation alone is not transformation

Building in more complexity may not add to enlightenment

Generating Chaos is not discovery

Over stating the now obvious

"Economics has not done a very good job of dealing with crises. I think this is because there are four characteristics of human experience that manifest themselves in crises and that cannot be addressed well by the methods of traditional economics.

The first of these is computational irreducibility. You may be able to reduce the behaviour of a simple system to a mathematical description that provides a shortcut to predicting its future behaviour, the way a map shows that following a road gets you to a town without having to physically travel the road first. Unfortunately, for many systems, as Stephen Wolfram argues, you only know what is going to happen by faithfully reproducing the path the system takes to its end point, through simulation and observation, with no chance of getting to the final state before the system itself. It’s a bit like the map Borges describes in On Rigor in Science, where “the Map of the Empire had the size of the Empire itself and coincided with it point by point”. Not being able to reduce the economy to a computation means you can’t predict it using analytical methods, but economics requires that you can.

The second characteristic property is emergence. Emergent phenomena occur when the overall effect of individuals’ actions is qualitatively different from what each of the individuals are doing. You cannot anticipate the outcome for the whole system on the basis of the actions of its individual members because the large system will show properties its individual members do not have. For example, some people pushing others in a crowd may lead to nothing or it may lead to a stampede with people getting crushed, despite nobody wanting this or acting intentionally to produce it. Likewise no one decides to precipitate a financial crisis, and indeed at the level of the individual firms, decisions generally are made to take prudent action to avoid the costly effects of a crisis. But what is locally stable can become globally unstable.

The name for the third characteristic, non-ergodicity, comes from the German physicist Ludwig Boltzmann who defined as “ergodic” a concept in statistical mechanics whereby a single trajectory, continued long enough at constant energy, would be representative of an isolated system as a whole, from the Greek ergon energy, and odos path. The mechanical processes that drive of our physical world are ergodic, as are many biological processes. We can predict how a ball will move when struck without knowing how it got into its present position – past doesn’t matter. But the past matters in social processes and you cannot simply extrapolate it to know the future. The dynamics of a financial crisis are not reflected in the pre-crisis period for instance because financial markets are constantly innovating, so the future may look nothing like the past.

Radical uncertainty completes our quartet. It describes surprises—outcomes or events that are unanticipated, that cannot be put into a probability distribution because they are outside our list of things that might occur. Electric power, the atomic bomb, or the internet are examples from the past, and of course by definition we don’t know what the future will be. As Keynes put it, “There is no scientific basis to form any calculable probability whatever. We simply do not know.” Economists also talk about “Knightian uncertainty”, after Frank Knight, who distinguished between risk, for example gambling in a casino where we don’t know the outcome but can calculate the odds; and what he called “true uncertainty” where we can’t know everything that would be needed to calculate the odds. This in fact is the human condition. We don’t know where we are going, and we don’t know who we will be when we get there. The reality of humanity means that a mechanistic approach to economics will fail.

So is there any hope of understanding what’s happening in our irreducible, emergent, non-ergodic, radically uncertain economy? Yes, if we use methods that are more robust, that are not embedded in the standard rational expectations, optimisation mode of economics. To deal with crises, we need methods that deal with computational irreducibility; recognise emergence; allow for the fact that not even the present is reflected in the past, never mind the future; and that can deal with radical uncertainty. Agent-based modelling could be a step in the right direction.

Hack down the dark cash markets ? Fine but inject replacement income for sustained spending

India. d- monetizes hordes of high denomination bills

A wealth hack that impacts market flow of dark cash payments and purchases

Macro contraction ?

No if the system is pumped full of new payments and loans and kept full till spontaneous adjustments

Restore high spending

Without the macro countering measures the protracted transition period

is needless misery for the innocent masses

See India today !

A wealth hack that impacts market flow of dark cash payments and purchases

Macro contraction ?

No if the system is pumped full of new payments and loans and kept full till spontaneous adjustments

Restore high spending

Without the macro countering measures the protracted transition period

is needless misery for the innocent masses

See India today !

Justice in the next existence ?

I die and instead of that being all She wrote on Owen paine event wise

OP ends up in a ...hell !

Well that would make me happy !

There's justice after all !

OP ends up in a ...hell !

Well that would make me happy !

There's justice after all !

Monday, January 23, 2017

Exquisitely assured dogma Delong"A government not beholden to those who have an interest in economic growth is likely to soon turn into nothing more than a redistribution-oriented protection racket, usually with a very short time horizon."

"Such a change of tone sells the book short, for there are many additional lessons that emerge from Landes's story of the wealth and poverty of nations. Here are five: (1) Try to make sure that your government is a government that enables innovation and production, rather than a government that maintains power by massive redistributions of wealth from its enemies to its friends. (2) Hang your priests from the nearest lamppost if they try to get in the way of assimiliating industrial technologies or forms of social and political organization. (3) Recognize that the task of a less-productive economy is to imitate rather than innovate, for there will be ample time for innovation after catching-up to the production standards of the industrial core. (4) Recognize that things change and that we need to change with them, so that the mere fact that a set of practices has been successful or comfortable in the past is not an argument for its maintenance into the future. (5) There is no reason to think that what is in the interest of today's elite--whether a political, religious, or economic elite--is in the public interest, or even in the interest of the elite's grandchildren."

Saturday, January 21, 2017

Larry simmers over sudden turn to "Trump pander " among the CEO elite

Why ?

What if trump hits some combo of luck and audacity that plows a path toward higher outcomes !

What if trump hits some combo of luck and audacity that plows a path toward higher outcomes !

M Moore "take over DNC "

The uprising this day

Encourages !

But the national Dembot party leadership

must be pushed aside !

Leadership must come from outside and act

Contrary to the thirty year legacy of its current elected majority

Like the at least momentary change in the Brit LP leadership

after their last debacle at the polls

Yes there are two movements here

The old establishments attempted bounce back

And a long aborning "new movement"

eager to break thru at last

Trump the horror

Can act to strengthen either current

False Unity trump helps the rebels

Jack boot trump the old guard

Encourages !

But the national Dembot party leadership

must be pushed aside !

Leadership must come from outside and act

Contrary to the thirty year legacy of its current elected majority

Like the at least momentary change in the Brit LP leadership

after their last debacle at the polls

Yes there are two movements here

The old establishments attempted bounce back

And a long aborning "new movement"

eager to break thru at last

Trump the horror

Can act to strengthen either current

False Unity trump helps the rebels

Jack boot trump the old guard

Forced individual savings vs taxation of income

Why not force a certain percent ..progressive on life time averaged income ....into individual

Federal savings accounts

Federal savings accounts

Tuesday, January 10, 2017

Crisis 2008 not about real toxic derivatives but rather spooked markets

"We examine the payoff performance, up to the end of 2013, of non-agency residential

mortgage-backed securities (RMBS), issued up to 2008. For our analysis, we have created

a new and detailed data set on the universe of non-agency residential mortgage backed

securities, per carefully assembling source data from Bloomberg and other sources. We

compare these payoffs to their ex-ante ratings as well as other characteristics. We establish

five facts. First, the bulk of these securities was rated AAA. Second, AAA securities did

ok: on average, their total cumulated losses up to 2013 are under six percent. Third, the

subprime AAA-rated RMBS did particularly well. Fourth, the bulk of the losses were

concentrated on a small share of all securities. Fifth, later vintages did worse than earlier

vintages. Together, these facts call into question the conventional narrative, that improper

ratings of RMBS were a major factor in the financial crisis of 2008."

Monday, January 9, 2017

maximum employment, stable prices and moderate long-term interest rates.

The CB troika

Maximum stable moderate

Each has one noun attached to it in the " law " governing the FED

However ...

Fed boards see to it

These modifiers are all in the wrong places

But we can re scramble the three around and get closer

Maximum employment ?

means employment rates consistent with moderate wage rate change

Stable prices ?

means moderate and stable product price inflation

Moderate long term interest rates ?

That's a stumper

Long rate goals are not moderate steady or maximum

They're instrumental

Maximum stable moderate

Each has one noun attached to it in the " law " governing the FED

However ...

Fed boards see to it

These modifiers are all in the wrong places

But we can re scramble the three around and get closer

Maximum employment ?

means employment rates consistent with moderate wage rate change

Stable prices ?

means moderate and stable product price inflation

Moderate long term interest rates ?

That's a stumper

Long rate goals are not moderate steady or maximum

They're instrumental

NBER quality punditation "In an interconnected world, national economic policies regularly lead to large international spillover effects, which frequently trigger calls for international policy cooperation. However, the premise of successful cooperation is that there is a Pareto inefficiency, i.e. if there is scope to make some nations better off without hurting others. This paper presents a first welfare theorem for open economies that defines an efficient benchmark and spells out the conditions that need to be violated to generate inefficiency and scope for cooperation. These are: (i) policymakers act competitively in the international market, (ii) policymakers have sufficient external policy instruments and (iii) international markets are free of imperfections. Our theorem holds even if each economy suffers from a wide range of domestic market imperfections and targeting problems. We provide examples of current account intervention, monetary policy, fiscal policy, macroprudential policy/capital controls, and exchange rate management and show that the resulting spillovers are consistent with Pareto efficiency, but only if the three conditions are satisfied. Furthermore, we develop general guidelines for how policy cooperation can improve welfare when the conditions are violated."

None of these conditions are met most of the time !

i) policymakers act competitively in the international market

(ii) policymakers have sufficient external policy instruments

(iii) international markets are free of imperfections.

Saturday, January 7, 2017

Hicks poison from PK

"Now, suppose you’re considering the effects of policies that will, other things equal, raise or lower aggregate demand — that is, shift the IS curve. In normal circumstances, where the IS curve intersects an upward-sloping LM, such shifts have limited effects on output and employment, because they’re offset by changes in interest rates: fiscal expansion leads to crowding out, austerity to crowding in, and multipliers are low."

Note austerity leads to ....crowding in !

Shades of early Billy C -benson - booby Rubin bilge

Vickrey fanatics must crush this absurd hicks interest rate school of normal wates macro navigation

We've known since Kalecki

interest rates are the bunk as aggregate demand managers

Note austerity leads to ....crowding in !

Shades of early Billy C -benson - booby Rubin bilge

Vickrey fanatics must crush this absurd hicks interest rate school of normal wates macro navigation

We've known since Kalecki

interest rates are the bunk as aggregate demand managers

The past 2 US dollar Forex surges hurt industrial Trade ..hurt low ed union wage workers

Money line

"workers with low education levels, but high wages, tend to do very badly during these periods of RER shocks."

"With the recent strength in the dollar, and the coming Trump fiscal stimulus and possible border tax adjustment, there is heightened interest in understanding what the consequences of RER movements will be for the manufacturing sectors and its workers (see here). In a past column, Campbell told the story of how, in the late 1990s, the rising value of the US dollar and the rise of China created a “perfect storm” of shocks to hit the US manufacturing sector. Sectors which were more exposed to these shocks suffered declines in output, employment, productivity, and investment. The magnitude of the shock was large enough to explain at least a large share of the “surprisingly sudden” collapse in US manufacturing employment in the early 2000s, in support of the Bernanke hypothesis on the origins of “secular stagnation”. In addition, the losses from a temporary overvaluation appear to be highly persistent, evidence for what economists call “hysteresis”.

"workers with low education levels, but high wages, tend to do very badly during these periods of RER shocks."

"With the recent strength in the dollar, and the coming Trump fiscal stimulus and possible border tax adjustment, there is heightened interest in understanding what the consequences of RER movements will be for the manufacturing sectors and its workers (see here). In a past column, Campbell told the story of how, in the late 1990s, the rising value of the US dollar and the rise of China created a “perfect storm” of shocks to hit the US manufacturing sector. Sectors which were more exposed to these shocks suffered declines in output, employment, productivity, and investment. The magnitude of the shock was large enough to explain at least a large share of the “surprisingly sudden” collapse in US manufacturing employment in the early 2000s, in support of the Bernanke hypothesis on the origins of “secular stagnation”. In addition, the losses from a temporary overvaluation appear to be highly persistent, evidence for what economists call “hysteresis”.

But, this analysis was conducted in terms of sector-level outcomes. What happens to individual workers in sectors more exposed to these trade shocks when the RER appreciates? Did the two large dollar appreciation periods (the mid-1980s and the late 1990s/early 2000s) have a differential impact on poor workers? To answer these questions, weconsidered evidence from the Current Population Survey’s (CPS) Merged Outgoing Rotation Group (MORG). The advantage of this data set is that workers are interviewed about their employment status and wages in consecutive years, so that the impact on individual workers can be measured. We use essentially the same identification strategy employed by Klein, Schuh, and Triest (2003), Campbell (2016b), and others by comparing workers in sectors initially more exposed to trade shocks vs. those in sectors less exposed when the RER appreciates. This identification strategy benefits from the fact that in the US from 1979 to 2010, there are two periods of large exchange rate appreciations, which were both associated with large structural trade deficits.

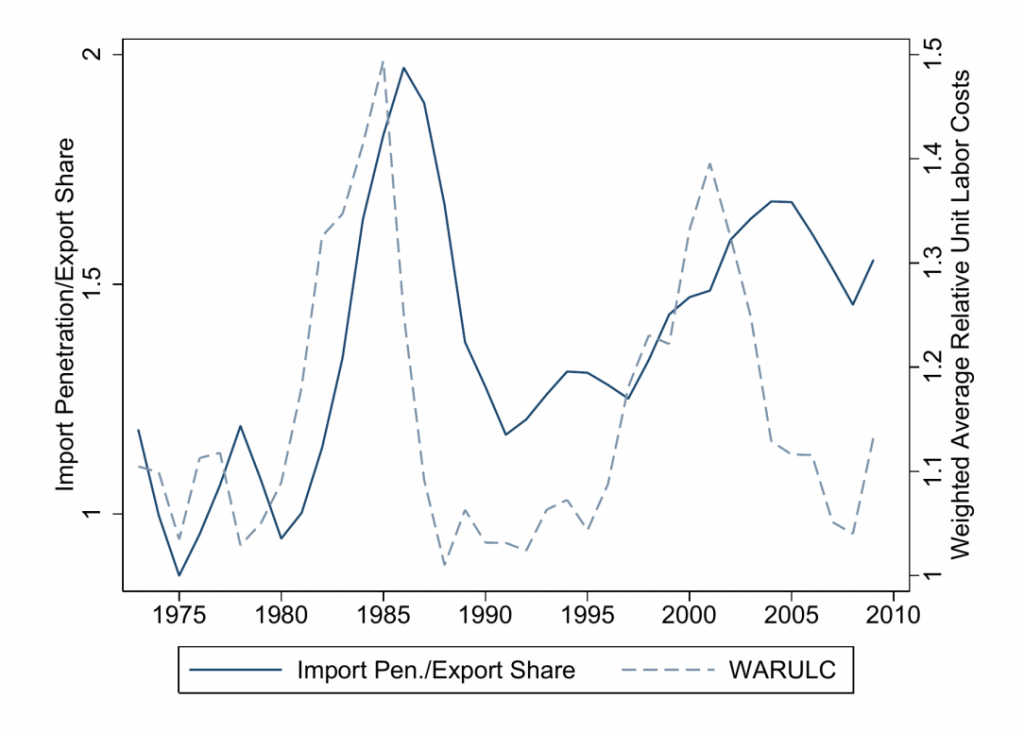

Figure 1: The Two Large RER/Trade Shocks

Notes: WARULC = Weighted Average Relative Unit Labor Costs, a measure of the real exchange rate. This measure was introduced by Campbell (2016a) to solve several problems in the IMF’s RULC index (which didn’t include China, among other flaws). Campbell found that WARULC has more out-of-sample predictive power than the IMF’s RULC index.

Notes: WARULC = Weighted Average Relative Unit Labor Costs, a measure of the real exchange rate. This measure was introduced by Campbell (2016a) to solve several problems in the IMF’s RULC index (which didn’t include China, among other flaws). Campbell found that WARULC has more out-of-sample predictive power than the IMF’s RULC index.

Figure 1 shows that, during the 1980s, US unit labor costs appreciated about 50% relative to RULCs in other countries, and in the 1996-2001 period, nearly 40%. This large change in relative prices should theoretically leave a mark on the economy, particularly in sectors more exposed to trade. The 1980s period is probably the cleanest experiment, as the cause of the appreciation was likely the election of Ronald Reagan and subsequent large fiscal stimulus, which led monetary policy in the US to be tight relative to trading partners. These events are all likely to be exogenous from the perspective of the subsequent decline in more open manufacturing sectors, particularly as more open sectors actually appear to be a bit less capital-intensive and also slightly less sensitive to interest rate movements than manufacturing sectors in general. (“Open sectors” here are defined as a weighted average of import penetration and the export share of shipments. Open sectors are defined in the paper at an average lag of 5 years.)

We find that workers in sectors more exposed to RER shocks are indeed less likely to be employed, and more likely to be either unemployed or to have exited the labor force altogether one year later. Over the period 1997 to 2004, a worker in a sector in the 90th percentile of openness would have been a cumulative 11% less more likely to be non-employed when surveyed relative to a worker from a sector in the 10th percentile of openness. Perhaps surprisingly, we do not find any impact on wages conditional on being employed. There is a differential negative impact on workers with less than a college education, who experience declines in wages. However, we also don’t find a negative differential impact for lower wage workers. We reconcile these seemingly conflicting results by showing that workers with low education levels, but high wages, tend to do very badly during these periods of RER shocks.

On the whole, our findings also support the thesis from the papers (such as Klein, Schuh, and Triest 2003, and Campbell 2016b) which argue that RER movements have relatively large impacts on more open sectors using data from the Annual Survey of Manufactures. (In our view, despite the paucity of replication and robustness studies published in journals, getting at the truth is actually very difficult, and so confirming results using datasets collected via different means is in fact helpful.) In addition, our results suggest that the two large trade shocks did not seem to have a large differential impact on low-wage workers.

Will these results hold out-of-sample in the period since 2014, as the dollar experiences a third period of overvaluation? Clearly, the trade policy environment is about to change dramatically, making it difficult to say. But if Trump’s policies continue to put upward pressure on the dollar, this will cause stress on the manufacturing sector and its workers. Whether this will result in a third manufacturing employment collapse (on a structural basis) is another question. In Germany, for example, corporate boards by law represent both workers and shareholders, and it is likely that the elasticity of employment with respect to the exchange rate is also lower (for example, see Moser et al. 2010). Thus it is not inevitable that RER/trade shocks must result in extreme hardship for manufacturing workers. Policies that limit hardship on workers and yet allow everyone to enjoy the benefits of free trade are probably a more stable political equilibrium than lurches from free trade to crude protectionism.

Trump fiscal thrust

Pk sings the downer blues "So, the probable outlook is for not too great growth and deindustrialization. Not quite what people expect."

Why?

"Trump deficits won’t actually do much to boost growth,

rates will rise and there will be lots of crowding out.

Also

a strong dollar and bigger trade deficit, like Reagan’s morning after Morning in America."

Crowding out ? De industrialization ?

Yikes !

Notice The fed plays ogre here by sadistically raising rates that lift forex and increase the trade gap

Even as the higher borrowing costs and forex smothers investment in additional domestic output capacity

But why assume a baleful Fed ?

Wage push inflation ..commodity bottle necks ....etc etc

Pk just loves that team of frauds among frauds with their sanctimonious

Phillips curve ish modeling toys

They worship

a devilish wage rate accelerator lurking beneath 5% ...or around 4 % UE

regardless of EPOPs

Ability to increase inflow of job seekers as prospect brighten

We just might hang in the mid 4's while employment grows rapidly

If the fed doesn't or can't squelch

the demand impact of a trump deficit surge

Given about 4 points of slack in the present EPOP

We got the latent output potential

Why?

"Trump deficits won’t actually do much to boost growth,

rates will rise and there will be lots of crowding out.

Also

a strong dollar and bigger trade deficit, like Reagan’s morning after Morning in America."

Crowding out ? De industrialization ?

Yikes !

Notice The fed plays ogre here by sadistically raising rates that lift forex and increase the trade gap

Even as the higher borrowing costs and forex smothers investment in additional domestic output capacity

But why assume a baleful Fed ?

Wage push inflation ..commodity bottle necks ....etc etc

Pk just loves that team of frauds among frauds with their sanctimonious

Phillips curve ish modeling toys

They worship

a devilish wage rate accelerator lurking beneath 5% ...or around 4 % UE

regardless of EPOPs

Ability to increase inflow of job seekers as prospect brighten

We just might hang in the mid 4's while employment grows rapidly

If the fed doesn't or can't squelch

the demand impact of a trump deficit surge

Given about 4 points of slack in the present EPOP

We got the latent output potential

Friday, January 6, 2017

At current discovery function parameters to sustain the present frontier per capita output growth R and D effort must double every 13 years to sustain a constant stream of new recipes

Or so find researchers of NBER calibre

Decreasing returns to R and D

In the limit if we reach peak effort in R and D

we will slowly run down and down till new ideas are exceeding rare ..again !

Decreasing returns to R and D

In the limit if we reach peak effort in R and D

we will slowly run down and down till new ideas are exceeding rare ..again !

Fed jargon maximum employment means the vicinity of 5% unemployment

Maximum is a curious term for this 5% zone

One wonders how this translates

Perhaps

Anything much lower then this zone leads to ever accelerating wage rate gains or the like

Ever accelerating

Recall above this zone leads to ever decelerating wage rate gains

Errr up to the zero gain barrier that is

Price stability of course is another curious fed term

Translates as

Stable and low price inflation

Do these off target terms have a conditioning effect

On expert thought processes ?

One wonders how this translates

Perhaps

Anything much lower then this zone leads to ever accelerating wage rate gains or the like

Ever accelerating

Recall above this zone leads to ever decelerating wage rate gains

Errr up to the zero gain barrier that is

Price stability of course is another curious fed term

Translates as

Stable and low price inflation

Do these off target terms have a conditioning effect

On expert thought processes ?

Wednesday, January 4, 2017

Forex neutralizing accounts . Forex .bomb shelters

If a currency starts to crumble in forex markets

State deposit accounts guaranteed to maintain domestic purchasing power

No matter the inflation...

Even if a new currency is issued

State deposit accounts guaranteed to maintain domestic purchasing power

No matter the inflation...

Even if a new currency is issued

Sunday, January 1, 2017

Co Cos equity from bond conversions ...and the general state dependent paper status

The features of asset paper can be metamorphic

One state of the system or other

One state equity another debt for example combined with derivativization

Could be nearly universal

The ability to automate leverage ratios at the unit level is crucial here

Rigidity is the enemy of stability continuity prosperity

Funding paper must learn to Flex not shatter

Diffusing the loss also diffuses the gain

Caveat

Moderating risk will never be a spontaneous outcome of profit max games

Assigning and enforcing accountability thru Responsibility must sharpen

Even as reformations innovations progress

The focus/ target become more accurate and inescapable

even as risk spreads

One state of the system or other

One state equity another debt for example combined with derivativization

Could be nearly universal

The ability to automate leverage ratios at the unit level is crucial here

Rigidity is the enemy of stability continuity prosperity

Funding paper must learn to Flex not shatter

Diffusing the loss also diffuses the gain

Caveat

Moderating risk will never be a spontaneous outcome of profit max games

Assigning and enforcing accountability thru Responsibility must sharpen

Even as reformations innovations progress

The focus/ target become more accurate and inescapable

even as risk spreads

Controlling ground rent bubbles ..

Schoar "Even before prices become very high, can we dynamically regulate banks so that loan-to-value ratios have to be lower when prices are high. So there's more buffer in the loans of each individual person.”

Exactly !

Exactly !

To off set devalue ...impose export tax off set

In the prior post turner worries about a sudden run out of the yuan

And a big deval

Leading to a huge trading partner revulsion retaliation

Actually the deval can be off set by an export tax if nothing else

The import side can be managed with temporary quotas ie export based import warrants

Then a new currency can be introduced if the old yuan looks ruined

None of this exceeds to capacity of a plan economy with sufficient central powers like the PRCs

Those in the run put will simply punish themselves if the old yuan is allowed to drop by the B of C

Of course the system should be pre announced and put on stand by immediately

Currency problems are comparatively simple if you are prepared to act

The underlying causes if really speculation turned to panic simply need

bold and adequate state action

Again an operating mark up warrant system makes all this merely a mode shift !

And a big deval

Leading to a huge trading partner revulsion retaliation

Actually the deval can be off set by an export tax if nothing else

The import side can be managed with temporary quotas ie export based import warrants

Then a new currency can be introduced if the old yuan looks ruined

None of this exceeds to capacity of a plan economy with sufficient central powers like the PRCs

Those in the run put will simply punish themselves if the old yuan is allowed to drop by the B of C

Of course the system should be pre announced and put on stand by immediately

Currency problems are comparatively simple if you are prepared to act

The underlying causes if really speculation turned to panic simply need

bold and adequate state action

Again an operating mark up warrant system makes all this merely a mode shift !

Subscribe to:

Posts (Atom)