Saturday, April 30, 2011

job rents versus talent or skill rents

job rents are position based

like a ceo that by implicit arrangement gets 10% of expected medium run corporate profits

like a ceo that by implicit arrangement gets 10% of expected medium run corporate profits

simple observation # 137899

when an elected official or officials

claim they're "taking effective action " to address society wide problem n

most folks lack the quantitative framework sense of scale etc

ie the informal loose model to figure out

whether this action has any chance at effectiveness

any chance to make a signifigant difference

this mass incapacity to evaluate a policy

can segment itself

and still exist

simply by operating with added octane at a number of higher levels of relative citizen sophistication

you get the ascending great chain of clown being

in the end

can we rely on the ballot box

to provide majoritarian self interets feed back to steer policy

in short

does our periodic duopoly choice mechanism work for ...the people ???

forget about it

doe it even curb anti majoritarian state action ???

if that anti majoritarian state action is deemed by policy circles

to be crucial to the sustemance of corporate hegemony

in a word

NYET !!!!!!

the biggest ignorance is of course about the global market structure

in products and funds

and the hegemonic role of trans nat free range corporations

why even academic macro nauts like pk

one's that know better

refuse to isolate the MNC policy pov

before speculating on the motives behind apparently

"anti majoritarian welfare " in say .. cyclical macro policy

or tax and transfer modification

---------------

tedious maxim :

forget the struggle of the ideologians

as a first cut

take on

why this policy path might benefit a powerful policy bending group or class

example trap and stag

paine patent pending thesis :

no forex moves

no fast recovery of job markets

no adequate transfer system pay outs

for the planet's major advanced national market systems

stag - boom contrasting absorption rates only

to adjustments chronic imbalances in cross N/S hemi trade and fund flows

boom south stag north

this is better

for the medium and long run as well as short run international corporate profits

and if we face a trade off

more international business is better then more inside advanced nation business

because

corporate profit margins are higher on cross border and overseas busimess

----------------

gedanken Rx... for enlightenment

find opr build an open macro model

with specified international firms IFs

with n bordered local market

give these IFs pricing power and border crossing ability

that allows them to capture

what in under specified models

pass thru as vague "national gains from trade "

or at best

"national factor gains from trade "

then starting with a stylized "present structure and condition " sim run

with each alternative policy path

then look for the IF profit maxer over the m periods

if you want to look at national factor effects of various policies kool

but must use a well defined economic class

like the IFs "stockholders"

or greater refinement

like the national skill or skill less gains

even a sim of income gains ..changes

to a simple unified labor factor has its virtues

despite submerged distributional complexity

so long as niche and positional job rent receivers

are removed first

crass mechanical most dollars for us determinism

is better then a review and evaluation

of class sponsored ideologians clashing by ....rights

claim they're "taking effective action " to address society wide problem n

most folks lack the quantitative framework sense of scale etc

ie the informal loose model to figure out

whether this action has any chance at effectiveness

any chance to make a signifigant difference

this mass incapacity to evaluate a policy

can segment itself

and still exist

simply by operating with added octane at a number of higher levels of relative citizen sophistication

you get the ascending great chain of clown being

in the end

can we rely on the ballot box

to provide majoritarian self interets feed back to steer policy

in short

does our periodic duopoly choice mechanism work for ...the people ???

forget about it

doe it even curb anti majoritarian state action ???

if that anti majoritarian state action is deemed by policy circles

to be crucial to the sustemance of corporate hegemony

in a word

NYET !!!!!!

the biggest ignorance is of course about the global market structure

in products and funds

and the hegemonic role of trans nat free range corporations

why even academic macro nauts like pk

one's that know better

refuse to isolate the MNC policy pov

before speculating on the motives behind apparently

"anti majoritarian welfare " in say .. cyclical macro policy

or tax and transfer modification

---------------

tedious maxim :

forget the struggle of the ideologians

as a first cut

take on

why this policy path might benefit a powerful policy bending group or class

example trap and stag

paine patent pending thesis :

no forex moves

no fast recovery of job markets

no adequate transfer system pay outs

for the planet's major advanced national market systems

stag - boom contrasting absorption rates only

to adjustments chronic imbalances in cross N/S hemi trade and fund flows

boom south stag north

this is better

for the medium and long run as well as short run international corporate profits

and if we face a trade off

more international business is better then more inside advanced nation business

because

corporate profit margins are higher on cross border and overseas busimess

----------------

gedanken Rx... for enlightenment

find opr build an open macro model

with specified international firms IFs

with n bordered local market

give these IFs pricing power and border crossing ability

that allows them to capture

what in under specified models

pass thru as vague "national gains from trade "

or at best

"national factor gains from trade "

then starting with a stylized "present structure and condition " sim run

with each alternative policy path

then look for the IF profit maxer over the m periods

if you want to look at national factor effects of various policies kool

but must use a well defined economic class

like the IFs "stockholders"

or greater refinement

like the national skill or skill less gains

even a sim of income gains ..changes

to a simple unified labor factor has its virtues

despite submerged distributional complexity

so long as niche and positional job rent receivers

are removed first

crass mechanical most dollars for us determinism

is better then a review and evaluation

of class sponsored ideologians clashing by ....rights

the trap is crap

the liquidity trap is really a credit ration contraction

if you talk like joe stig about a damaged set of credit channels

you are playing cover up

even if without intention

the existing private channels "could" loan to various applicants

they don't

because their narrow horizon own bottom profit calc cum default uncertainty

in a time like now of stagged effective demand

kills loans that in the event would create the very effective demand conditions to justify themselves

co ordination problem

really all these post crisis bs moves from a purely technical model maximizer agent pov

cry out for default protection from "above "

much like the implicit protection the big bail made flesh

the toxic bubble inside the big boys

was nasty in consequence

but that's not relevent eh ??

nothing prevents using same means to a higher not lower end

if you talk like joe stig about a damaged set of credit channels

you are playing cover up

even if without intention

the existing private channels "could" loan to various applicants

they don't

because their narrow horizon own bottom profit calc cum default uncertainty

in a time like now of stagged effective demand

kills loans that in the event would create the very effective demand conditions to justify themselves

co ordination problem

really all these post crisis bs moves from a purely technical model maximizer agent pov

cry out for default protection from "above "

much like the implicit protection the big bail made flesh

the toxic bubble inside the big boys

was nasty in consequence

but that's not relevent eh ??

nothing prevents using same means to a higher not lower end

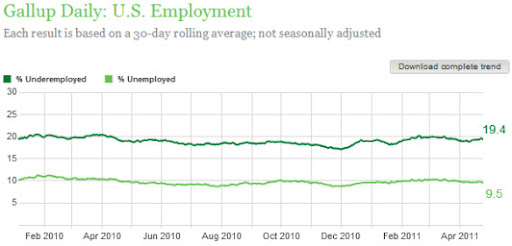

see the sedate red line

now unit labor costs are the real policy impacting " tracked data stream"

at least by the fed's number cruncher elves

of course they are

what is controled is a wage price spiral

avoid circularity here

whether indeed the first move is a price move or a wage move it perpetuates itself

in the absence of sufficient credit flow de - accommodation

interestingly

inquiring public eyes

and even deeper proding ---maybe even sceptical --

cross comparing causal fit operations

using credit policy and the various possible "governing " data streams

even if conducted by independent "researchers"

prolly can't torture out a signifigant difference

in fit

i suspect

the diff is not all that discern able

if we take any core price change numbers however barbered

---and we have a plethora of barber shops clipping out shape charged data streams --

we'll prolly never isolate the unit labor cost data stream

convincingly as THE prime mover of credit flow policy

particularly

if we restrict ourselves to data since say

the on set of post volcker dammerung

ie the great moderation and on thru the fall 08 crisis and

the following contraction and present trap and stag act

given the speed of adjustment on the price side this follows

only when wages stag even as core prices accelerate could we "see" the unit labor cost determination emerge

as motivator from the price clusters

such an event hasn't as yet occured only commodity prices are sufficiently unhinged from

domestic labor costs

perhaps import prices rising and flowing thru the domestic final product price structure

say after relentless changes in forex

could trick out this truth :

its about nominal wage control stupid

Friday, April 29, 2011

old adage modified

the dispersal of the service workers

over large areas

breaks their power of resistence

while concentration increases that of industrial workers

has Clio turned this upside down

in the globalized market place

non traded products seem now a better basis for rent sharing

with certain sectors and strata of the job class

in the metropole eh ??

over large areas

breaks their power of resistence

while concentration increases that of industrial workers

has Clio turned this upside down

in the globalized market place

non traded products seem now a better basis for rent sharing

with certain sectors and strata of the job class

in the metropole eh ??

Thursday, April 28, 2011

viewing interest payments on pub debt as a transfer system

who is the transfer going to

today ??

the graph a few stops below here is pre crisis debt freshet

obviously we could tax these issues at point and time of issue

and allow the amount of withheld funds to be used as a credit against other taxes owed

this could be fractionalized and targeted on the credit side

to what ever part of that tax we wished and to which ever payees we wish

conceptually we create a ricardian equivalence

if we tax away the income from interest on borrowings

ie for those subject to the 100% witholding and with zero credit

we in effect create for the holders

default risk free

zero coupon bonds

that decay at the rate of inflation

and for uncle a expending zero cost source of funds

that does not require monetization and can be sold to qualified credit entitlers

ya ya some logical holes here no viable market could emerge to support such issues

..just sketching folks ...just doodling and sketching

trying to divise a system where rentiers as a class unwilling to pay adequate taxes

and substitutiing loans to gubmint instead get caught on the back side while not losing their safe store of value

today ??

the graph a few stops below here is pre crisis debt freshet

obviously we could tax these issues at point and time of issue

and allow the amount of withheld funds to be used as a credit against other taxes owed

this could be fractionalized and targeted on the credit side

to what ever part of that tax we wished and to which ever payees we wish

conceptually we create a ricardian equivalence

if we tax away the income from interest on borrowings

ie for those subject to the 100% witholding and with zero credit

we in effect create for the holders

default risk free

zero coupon bonds

that decay at the rate of inflation

and for uncle a expending zero cost source of funds

that does not require monetization and can be sold to qualified credit entitlers

ya ya some logical holes here no viable market could emerge to support such issues

..just sketching folks ...just doodling and sketching

trying to divise a system where rentiers as a class unwilling to pay adequate taxes

and substitutiing loans to gubmint instead get caught on the back side while not losing their safe store of value

fortunately no change in the prevailing direction but not improvement in wind speeds

Wednesday, April 27, 2011

Tuesday, April 26, 2011

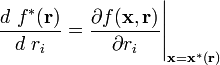

envelope theorem

Envelope theorem

Consider an arbitrary maximization (or minimization) problem where the objective function depends on some parameters

depends on some parameters  :

:

is the problem's optimal-value function — it gives the maximized (or minimized) value of the objective function

is the problem's optimal-value function — it gives the maximized (or minimized) value of the objective function  as a function of its parameters

as a function of its parameters  .

.

Let be the (arg max) value of

be the (arg max) value of  , expressed in terms of the parameters, that solves the optimisation problem, so that

, expressed in terms of the parameters, that solves the optimisation problem, so that  . The envelope theorem tells us how

. The envelope theorem tells us how  changes as a parameter changes, namely:

changes as a parameter changes, namely:

with respect to ri is given by the partial derivative of

with respect to ri is given by the partial derivative of  with respect to ri, holding

with respect to ri, holding  fixed, and then evaluating at the optimal choice

fixed, and then evaluating at the optimal choice  .

.

We are considering the following optimisation problem in formulating the theorem (max may be replaced by min, and all results still hold):

are treated as constants during differentiation of the Lagrangian function, then their values as functions of the parameters are substituted in afterwards.

are treated as constants during differentiation of the Lagrangian function, then their values as functions of the parameters are substituted in afterwards.

Consider an arbitrary maximization (or minimization) problem where the objective function

depends on some parameters

depends on some parameters  :

: is the problem's optimal-value function — it gives the maximized (or minimized) value of the objective function

is the problem's optimal-value function — it gives the maximized (or minimized) value of the objective function  as a function of its parameters

as a function of its parameters  .

.Let

be the (arg max) value of

be the (arg max) value of  , expressed in terms of the parameters, that solves the optimisation problem, so that

, expressed in terms of the parameters, that solves the optimisation problem, so that  . The envelope theorem tells us how

. The envelope theorem tells us how  changes as a parameter changes, namely:

changes as a parameter changes, namely: with respect to ri is given by the partial derivative of

with respect to ri is given by the partial derivative of  with respect to ri, holding

with respect to ri, holding  fixed, and then evaluating at the optimal choice

fixed, and then evaluating at the optimal choice  .

.[edit] General envelope theorem

There also exists a version of the theorem, called the general envelope theorem, used in constrained optimisation problems which relates the partial derivatives of the optimal-value function to the partial derivatives of the Lagrangian function.We are considering the following optimisation problem in formulating the theorem (max may be replaced by min, and all results still hold):

is the dot product

is the dot product

are treated as constants during differentiation of the Lagrangian function, then their values as functions of the parameters are substituted in afterwards.

are treated as constants during differentiation of the Lagrangian function, then their values as functions of the parameters are substituted in afterwards.

Monday, April 25, 2011

Sunday, April 24, 2011

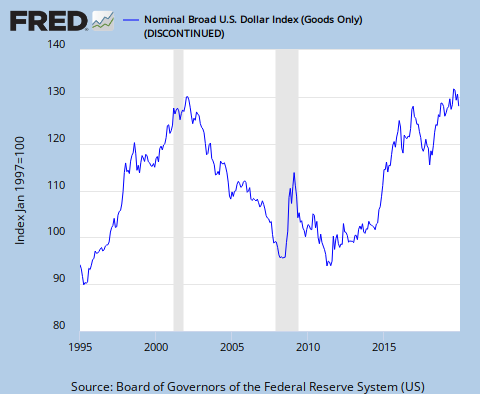

the dollar palladin of arbitrage profit questing

note where the damage was done

clintons second term

undone by bush prior to the flight to safety during the recent credit crisis

Saturday, April 23, 2011

green-stig theorem -- ubiquitous pareto hierarchies--

where

blah blah blah

...............................................

after lots more specification

---to be slipped in later ---

Arrow type welfare theorems about spontaneous market pareto optima only hold

in this model

IF IF IF

equals

ie

Friday, April 22, 2011

concentrate concentrate the law of moses and the prophets

Table 1. Percentage of Sales for Four Largest Firms in Selected U.S. Retail Industries

Industry (NAICS code) | 1992 | 1997 | 2002 | 2007 |

Food & beverage stores (445) | 15.4 | 18.3 | 28.2 | 27.7 |

Health & personal care stores (446) | 24.7 | 39.1 | 45.7 | 54.4 |

General merchandise stores (452) | 47.3 | 55.9 | 65.6 | 73.2 |

Supermarkets (44511) | 18.0 | 20.8 | 32.5 | 32.0 |

Book stores (451211) | 41.3 | 54.1 | 65.6 | 71.0 |

Computer & software stores (443120) | 26.2 | 34.9 | 52.5 | 73.1 |

Thursday, April 21, 2011

uncle milty won

the upshot of the uncle milty offensive circa 67-79

was a switch to credit policy driven macro

is this a horror

the death of fiscal macro ??

well obviously the recent zero bound contraint has shown the limits of credit

with the loan out string

now in push mode

but were greater grounds lost

i mean if ...if you can induce firms and households to borrow enough

is that any worse macro wise then uncle borrowing more

well yes

because if for no other reason

uncle's debt level and rate of climb

can't trigger a valid self fulling default panic

-----------

the hideous public goods versus private goods fetish of most pwogs

was nevef a good reason to prefer juicing uncles borrowing over

juicing the borrowings

of homer

and

Fuckuverymuch inc

was a switch to credit policy driven macro

is this a horror

the death of fiscal macro ??

well obviously the recent zero bound contraint has shown the limits of credit

with the loan out string

now in push mode

but were greater grounds lost

i mean if ...if you can induce firms and households to borrow enough

is that any worse macro wise then uncle borrowing more

well yes

because if for no other reason

uncle's debt level and rate of climb

can't trigger a valid self fulling default panic

-----------

the hideous public goods versus private goods fetish of most pwogs

was nevef a good reason to prefer juicing uncles borrowing over

juicing the borrowings

of homer

and

Fuckuverymuch inc

new money versus new bonds notes iou's etc

this distinction has to do with one point

the payments grid neutral nature of money

all the others have a future foot print in the payments grid

in fact that's all they are

money paid out by the issuer of legal tender ie the (CB)

casts no shadow on the future at all

money completely present and potentially immortal

if not removed by the CB in exchange for some instrument

that does add to the payment grid

and is indeed quite finite in its foot print

------------

the beauty of the payments grid

it is what it is

regardless of movements in the various price levels around it

that is unless it has some payment streams have indexed obligation

which render them neutral to the potential impact of price level change

of the indexed price level

in the case of price level change thru endogeonous money growth

ie thru net credit creation in a fractional reserve system

or exogenous infusions ie monetizing actions by the CB

or of course the reserve of either of these

interestingly we have no sub zero index adjustments usually

the payments grid neutral nature of money

all the others have a future foot print in the payments grid

in fact that's all they are

money paid out by the issuer of legal tender ie the (CB)

casts no shadow on the future at all

money completely present and potentially immortal

if not removed by the CB in exchange for some instrument

that does add to the payment grid

and is indeed quite finite in its foot print

------------

the beauty of the payments grid

it is what it is

regardless of movements in the various price levels around it

that is unless it has some payment streams have indexed obligation

which render them neutral to the potential impact of price level change

of the indexed price level

in the case of price level change thru endogeonous money growth

ie thru net credit creation in a fractional reserve system

or exogenous infusions ie monetizing actions by the CB

or of course the reserve of either of these

interestingly we have no sub zero index adjustments usually

when invisible agency runs your model

will we ever get past factors to firms in cross border trade theory

for that matter will we ever really have a cross border firm based flow of funds/credit theory

for that matter will we ever really have a cross border firm based flow of funds/credit theory

Monday, April 18, 2011

my plan

.

Do you think that I'm crazy?

Out of my mind?

Do you think that I creep in the night

And sleep in a phone booth?

Lemme take a minute &

tell you my plan

Lemme take a minute & tell who I am

If it doesn't show,

Think you better know

I'm another person

Do you think that my pants are too tight?

Do you think that I'm creepy?

Lemme take a minute &

tell you my plan

Lemme take a minute & tell who I am

If it doesn't show

Think you better know

I'm another person

better look around before

you say you don't care

Shut your fuckin' mouth about

the length of my hair

How would you survive

If you were alive

Shitty little person?

We are the other people

We are the other people

We are the other people

You're the other people too

Found a way to get to you

Lemme take a minute &

tell you my plan

Lemme take a minute & tell who I am

If it doesn't show

Think you better know

I'm another person

Do you think that I'm crazy?

Out of my mind?

Do you think that I creep in the night

And sleep in a phone booth?

Lemme take a minute &

tell you my plan

Lemme take a minute & tell who I am

If it doesn't show,

Think you better know

I'm another person

Do you think that my pants are too tight?

Do you think that I'm creepy?

Lemme take a minute &

tell you my plan

Lemme take a minute & tell who I am

If it doesn't show

Think you better know

I'm another person

better look around before

you say you don't care

Shut your fuckin' mouth about

the length of my hair

How would you survive

If you were alive

Shitty little person?

We are the other people

We are the other people

We are the other people

You're the other people too

Found a way to get to you

Lemme take a minute &

tell you my plan

Lemme take a minute & tell who I am

If it doesn't show

Think you better know

I'm another person

Wednesday, April 13, 2011

basic clash of models resumes

plenty for the government to do

or not to do

as far as the range of academic main stream models

ultimately because

models can co exist with each other

like angels

models can squeeze together

on almost anything in almost any number

at the point where model meets policy

and policy must take action..

there's the rub

there it's always

to do or not to do

even if the question is only

how much

the fork in the road never disappears

academical parallel battles ??

the no contact tournaments

yes they are fair parallels

between two merlins like

say taylor and krugman

we have enough of a conflict

to keep snarls and nips alive.... for now

what dastardly models unbuilt

lurk on the far margins

only the shadow of clio knows

or not to do

as far as the range of academic main stream models

ultimately because

models can co exist with each other

like angels

models can squeeze together

on almost anything in almost any number

at the point where model meets policy

and policy must take action..

there's the rub

there it's always

to do or not to do

even if the question is only

how much

the fork in the road never disappears

academical parallel battles ??

the no contact tournaments

yes they are fair parallels

between two merlins like

say taylor and krugman

we have enough of a conflict

to keep snarls and nips alive.... for now

what dastardly models unbuilt

lurk on the far margins

only the shadow of clio knows

open minds about close economies

if there's one outcome wildly attacked by the cosmos its

emerging market economies must not close in on themselves

not just economically but politically

open for business and open for non violent interventions

"my my what big teeth you have grandma ..."

keep an open mind about closed societies

recall given the internal nature of the decisive contradictions

missing that point is

the 1984 fallacy

closed borders can't close interiors

you can't enforce steady states

there are no ultimately stable

closed social orbits

emerging market economies must not close in on themselves

not just economically but politically

open for business and open for non violent interventions

"my my what big teeth you have grandma ..."

keep an open mind about closed societies

recall given the internal nature of the decisive contradictions

missing that point is

the 1984 fallacy

closed borders can't close interiors

you can't enforce steady states

there are no ultimately stable

closed social orbits

Monday, April 11, 2011

history drives out equilibrium

market systems though creatures of time and place are not like buildings

they are always in motion always changing

like oral languages

the notion of a steady state is jejune and even more important badly misleading

more later

they are always in motion always changing

like oral languages

the notion of a steady state is jejune and even more important badly misleading

more later

as long as people are starving somewhere on earth

cosmo humanitarians can' t be overly bothered

about low stagnating wage rates and high unemployment here

ameliorate ...at the margin

about low stagnating wage rates and high unemployment here

ameliorate ...at the margin

one task taxes/subsidies thru the two way street of the transfer system does better then households

extract any funds necessary to reach optimal social accumulation goals

or inject any funds necessay to reach socially optimal consumption levels

we don't need no damn home front prudence here

between the system state based transfer system and the system state based credit system

we can automate the systemic adjustment to many agent actions and transactions

that have external effects

think of the interest rate as a pigou tax or subsidy a registration of the externality effect

of any units choice of expenditure on consumption or investment goods

in particular durable goods

obviously a tax/subsidy on expenditures is a full symetrical system that a borrowing rate isn't

unless the borrowing rate can be both charge in one system state and discount in another

or inject any funds necessay to reach socially optimal consumption levels

we don't need no damn home front prudence here

between the system state based transfer system and the system state based credit system

we can automate the systemic adjustment to many agent actions and transactions

that have external effects

think of the interest rate as a pigou tax or subsidy a registration of the externality effect

of any units choice of expenditure on consumption or investment goods

in particular durable goods

obviously a tax/subsidy on expenditures is a full symetrical system that a borrowing rate isn't

unless the borrowing rate can be both charge in one system state and discount in another

bottom twenty blues ...more or less true every where in the advanced market sections of the planet

"Households in the top 20 percent of the income distribution spend 11.6 percent of total expenditures on food and energy, which adds up to 7.9 percent of disposable income. For the bottom 20 percent these shares rise to 20.4 percent of expenditures and a whopping 44.1 percent of after-tax income!"

these are recent US numbers but ...

the point ??

for the bottom 20%

the transfer system is critical

consider this

approximately 20% of E = 45% of D I *

right ??

do the math

---* " percent of after tax income " = DI ---

without these elastiic contingent earned income triggered transfer payment mechanisms

dropping into the bottom 20

would feel like a belly flop into a pool ...from 15 feet up

these are recent US numbers but ...

the point ??

for the bottom 20%

the transfer system is critical

consider this

approximately 20% of E = 45% of D I *

right ??

do the math

---* " percent of after tax income " = DI ---

without these elastiic contingent earned income triggered transfer payment mechanisms

dropping into the bottom 20

would feel like a belly flop into a pool ...from 15 feet up

max hardon strikes one for intertemporal trade

"The global imbalances are widely seen as a problem, especially by the US government and US economists. Sometimes they are even seen as a cause of the financial crisis (Suominen 2010). "

like the note of airy expository delivery ???

"Yet ..."

"...such imbalances – i.e. current-account surpluses and deficits – reflect international intertemporal trade, and there should be gains from such trade as from “ordinary” trade, on the basis of standard arguments for free trade (see Obstfeld and Rogoff 1996, Chapter 1)."

there you have it ..why in a model market earth where something called "intertemporal tadre" ...trade

is real ie a done deal contracted and barter based too i assume ....

ie not simple a choice process to contract for some trade now with unit agent expectational notions of trade tomorrow and tomorrow and tomorrow.. all quite collectively unresolved beyond the barest futures markets and proxy markets ie forex and national long run interest rates ..

oh i could go on but reification triumphs right here in the front hall eh ...like lots of good magic tricks the fix

is in from jump street

" Furthermore..."

"... an advantage of the present system is that an international general equilibrium is established which yields a set of current-account imbalances that do not require international central planning or coordination, but which respond to particular circumstances in different countries. "

wonderful ..the lack of overt central "coordination" is not a basis for concern in the face of chronic spontaneous "bop imbalances " but a feature of the systems iemergent ptovidential feature

the miracle of the planets markets.... once liberated ie the borders opened wide to exchanges

of products and ....assets comrades assets

entendez vous

"The system depends, of course, on a relatively free international capital market."

depends ??? sounds like the degree of relative capital market free ness might be the stinger

on this moral tail eh ??

the emeritus meistro calls his ".. approach .."

" a neoclassical way of looking at the international system "

alert

"... has to be subject to qualifications. These qualifications provide possible rationales for the common concern with global imbalances."

"A key issue is that funds from countries that are net savers called the savings-glut countries (where savings exceed domestic investment) have been lent to borrowers (notably the US) who have used these funds unwisely, namely for current consumption and for investment that is not “fruitful.” "

unfruitful C and I ????

"The main form of “unfruitful” investment has been in excess housing construction. "

don't you mean house lots here ..how could we seriously over build housing it self ??

now after that wag of calvin's finger the shoulda

"The funds coming from the savings-glut countries should have financed fruitful investment in the US and elsewhere."

" Instead"

besides house lots there's lending " to the US government, financing a war and tax cuts. "

"the result "

"...the US, have failed to build up resources out of which interest, dividends, and necessary repayments can be made."

we didn't spend our international borrowings to build some domestic future export producing capacity

" Yet such debt service or returns from purchases of equity are an essential feature of intertemporal trade."

and apparently they don't emerge out of any inner necessity of this global trading and investing process eh ??

but now we begin to turn down the long long home stretch

"Above all, we have to explain why more funds did not go to finance ..."

get your belt buckle tight as hell here

".. fruitful investment, whether in the US or elsewhere, notably in developing countries. "

ie we at least in part needed to take those incoming funds and buy /build productive capacity in the emerging world

lets say thats all we needed to do fruitful investments are fruitful investments if we own em in the long run the where of it doesn't matter to ...us ...us ...US ..err meaning the amerikan investor class

now we see just how much this is about fruitful over there investment by US

"... In developing countries there is often an aversion to incur current-account deficits for two reasons – namely the instability of capital inflows and the dislike of real appreciations. These are understandable motives, but have created a problem when there was a worldwide search for sound investments to place the funds coming from the savings-glut countries."

get that the savings glut countries ...not US face barriers to investment in the emerging markets because...well the inflows lead to ...outflows hot money wise

and yes the glut is in hot money ..right ??? hot money chasing liquid investment ie investment in obligatory paper denominated in some one elses currency or ...your own

the pivot

obligations of one zones agents to another zones agents in the other or a third zones currency

that said

now we get ...keynes !!!

"A useful concept, originating with Keynes, is the “paradox of thrift”. This idea suggests that an increase in savings motivated by the admirable Victorian virtue of prudence – which involves foregoing consumption today for the sake of more consumption tomorrow – does not necessarily lead to greater capacity to consume tomorrow. It may just lead to a current decline in aggregate demand."

closed system keynes circa 1947 samuelson !!!!

but watch

" Extended to the world economy"

ie going to a network of inter connected market sustems with heterogenious characteristics etc

not the simplicity of the closed K system

" it helps " that is the keynes C model i guess

"to explain the common criticisms of those countries, notably China, that have had large current-account surpluses."

they aren't spendng enough on exports

" But the increase in net savings by the savings-glut countries did not actually lead to a decline in worldwide aggregate demand, as the simple Keynesian approach would imply. "

"Rather it led to borrowing for consumption and for unfruitful investment."

yikes this is muddle eh

aggregate demand isn't necessarily inadequate its just not fruitful

keynes just got his walking papers exit stage left

"Hence"

hence indeed

"the effect was indeed adverse. " but not keynesian eh ??

just the result of unfruitful expenditure

looked at inter temporally that is

the climactic proposition:

"The recognition of this adverse effect, as well as various well-known inefficiencies in the world’s financial sector, led to the world financial crisis."

recognition of this effect ??

you mean suddenly collective market expectations revalued the future outcome of existing

international

trade and investment patterns ???

and that hit the global asset markets and that led to contracting trade in products ??

"The basic neoclassical model really requires increased net savings to lead – induced by the decline in the real interest rate – to borrowing for more fruitful investment. "

i think we got you on that ..the key is fruitful

ie productive of future gain ...profit ...surplus value

just to de mystify it here

"There was a failure of the world’s financial sector in turning increased savings into fruitful investment"

why was there a car crash at the coner of hollywood and rose ??

failure to drive correctly

" and that meant -- to repeat-- that the savings glut led to a debt crisis. The crisis was thus caused by an interaction of the particular global imbalances that led to low interest rates and high credit availability with the failure of the financial sector."

the circle is not unwinding if you borrow real monety and buy lots that will lose mucho value post purchase and blow the rest on beer and wide screen s for sports watching ....you got nothing more on the future income side to service the added debt ??

the old house hold paradigm

"Here we should just mention that if there had been an increase in US savings rather than in other countries, there would also have been a decline in world interest rates, but this would have actually reduced the US current-account deficit and thus reduced (and not increased) the global imbalances.

"

in other briefer words

if it had all gone down different if uncle and his people had ben the planets biggest savers not biggest borrowers and over consumers

then it would have worked out lot different

"The basic problem has been not the global imbalances as such, but rather the sharp and prolonged decline in real interest rates, when combined with the inadequacies of the financial sector."

oh no a sudden swerve here ..warning there's an emertus at the wheel here

not a swerve into on coming traffic just off an exit ramp and onto a utility road not running

exactly parallel to the fruitful investmant turnpike in fact its more like a weighing station without the scales

now the basic problem don't exist along the frutful non frutful axis

now its the low real rated funds themselves

presumably thrown up by the trade imbalances

flowing into a waco system of international hi fi fun houses

and i guess blowing balloons that burst

"Going back to what actually happened in the period that ended in 2008, we might then ask: “were net savings of the savings-glut countries too high or were sound, fruitful investments in the rest of the world too low?”

gosh now we're off on another quest is x too high or y too low ?

often that has no signifigant answer

"The particular global imbalances caused by the increase in savings (plus declines in investment in some cases) in the savings-glut countries led to the decline in the world real interest rates and high credit availability. This provided an investment opportunity for the rest of the world. But the inefficiency of the world’s financial sector and other factors led to an inadequate response in fruitful investment in the rest of the world, notably the US. "

for what now the fourth time we get this ??

to be fair a restatement is part of communication eh ??

i'll only note "and other factors " that can no doubt cover a lot of unmapped ground

then comes this:

"As noted above, one of the other factors was the reluctance of some developing countries with good investment opportunities to run current-account deficits."

" There could also have been more fruitful investment – notably in infrastructure – by governments, especially in the US."

infrastructure including the merit class system of pyramids no doubt

health education research

the arts and parks even

of course he's a citizen haut borgeois

a goo goo a public sector investment guy not just a corporate private investment hack

there's fruit trees to be grown in the pub sec too

starting with human capital

produced in part right there at the hopkins

"I would also add here that the reluctance to run current-account deficits by various smaller economies – whether Latin American, Asian or European – is thoroughly understandable when we take note of the instability of capital inflows that have caused so many crises, notably the Asian crisis of 1997-98 but also the current European ones. And this instability is yet another manifestation of a weakness in the world’s financial sector."

parting shot at

the WFS

implict we need a freer but more stable WFS to emerge out of emergence

how ???

like the note of airy expository delivery ???

"Yet ..."

"...such imbalances – i.e. current-account surpluses and deficits – reflect international intertemporal trade, and there should be gains from such trade as from “ordinary” trade, on the basis of standard arguments for free trade (see Obstfeld and Rogoff 1996, Chapter 1)."

there you have it ..why in a model market earth where something called "intertemporal tadre" ...trade

is real ie a done deal contracted and barter based too i assume ....

ie not simple a choice process to contract for some trade now with unit agent expectational notions of trade tomorrow and tomorrow and tomorrow.. all quite collectively unresolved beyond the barest futures markets and proxy markets ie forex and national long run interest rates ..

oh i could go on but reification triumphs right here in the front hall eh ...like lots of good magic tricks the fix

is in from jump street

" Furthermore..."

"... an advantage of the present system is that an international general equilibrium is established which yields a set of current-account imbalances that do not require international central planning or coordination, but which respond to particular circumstances in different countries. "

wonderful ..the lack of overt central "coordination" is not a basis for concern in the face of chronic spontaneous "bop imbalances " but a feature of the systems iemergent ptovidential feature

the miracle of the planets markets.... once liberated ie the borders opened wide to exchanges

of products and ....assets comrades assets

entendez vous

"The system depends, of course, on a relatively free international capital market."

depends ??? sounds like the degree of relative capital market free ness might be the stinger

on this moral tail eh ??

the emeritus meistro calls his ".. approach .."

" a neoclassical way of looking at the international system "

alert

"... has to be subject to qualifications. These qualifications provide possible rationales for the common concern with global imbalances."

"A key issue is that funds from countries that are net savers called the savings-glut countries (where savings exceed domestic investment) have been lent to borrowers (notably the US) who have used these funds unwisely, namely for current consumption and for investment that is not “fruitful.” "

unfruitful C and I ????

"The main form of “unfruitful” investment has been in excess housing construction. "

don't you mean house lots here ..how could we seriously over build housing it self ??

now after that wag of calvin's finger the shoulda

"The funds coming from the savings-glut countries should have financed fruitful investment in the US and elsewhere."

" Instead"

besides house lots there's lending " to the US government, financing a war and tax cuts. "

"the result "

"...the US, have failed to build up resources out of which interest, dividends, and necessary repayments can be made."

we didn't spend our international borrowings to build some domestic future export producing capacity

" Yet such debt service or returns from purchases of equity are an essential feature of intertemporal trade."

and apparently they don't emerge out of any inner necessity of this global trading and investing process eh ??

but now we begin to turn down the long long home stretch

"Above all, we have to explain why more funds did not go to finance ..."

get your belt buckle tight as hell here

".. fruitful investment, whether in the US or elsewhere, notably in developing countries. "

ie we at least in part needed to take those incoming funds and buy /build productive capacity in the emerging world

lets say thats all we needed to do fruitful investments are fruitful investments if we own em in the long run the where of it doesn't matter to ...us ...us ...US ..err meaning the amerikan investor class

now we see just how much this is about fruitful over there investment by US

"... In developing countries there is often an aversion to incur current-account deficits for two reasons – namely the instability of capital inflows and the dislike of real appreciations. These are understandable motives, but have created a problem when there was a worldwide search for sound investments to place the funds coming from the savings-glut countries."

get that the savings glut countries ...not US face barriers to investment in the emerging markets because...well the inflows lead to ...outflows hot money wise

and yes the glut is in hot money ..right ??? hot money chasing liquid investment ie investment in obligatory paper denominated in some one elses currency or ...your own

the pivot

obligations of one zones agents to another zones agents in the other or a third zones currency

that said

now we get ...keynes !!!

"A useful concept, originating with Keynes, is the “paradox of thrift”. This idea suggests that an increase in savings motivated by the admirable Victorian virtue of prudence – which involves foregoing consumption today for the sake of more consumption tomorrow – does not necessarily lead to greater capacity to consume tomorrow. It may just lead to a current decline in aggregate demand."

closed system keynes circa 1947 samuelson !!!!

but watch

" Extended to the world economy"

ie going to a network of inter connected market sustems with heterogenious characteristics etc

not the simplicity of the closed K system

" it helps " that is the keynes C model i guess

"to explain the common criticisms of those countries, notably China, that have had large current-account surpluses."

they aren't spendng enough on exports

" But the increase in net savings by the savings-glut countries did not actually lead to a decline in worldwide aggregate demand, as the simple Keynesian approach would imply. "

"Rather it led to borrowing for consumption and for unfruitful investment."

yikes this is muddle eh

aggregate demand isn't necessarily inadequate its just not fruitful

keynes just got his walking papers exit stage left

"Hence"

hence indeed

"the effect was indeed adverse. " but not keynesian eh ??

just the result of unfruitful expenditure

looked at inter temporally that is

the climactic proposition:

"The recognition of this adverse effect, as well as various well-known inefficiencies in the world’s financial sector, led to the world financial crisis."

recognition of this effect ??

you mean suddenly collective market expectations revalued the future outcome of existing

international

trade and investment patterns ???

and that hit the global asset markets and that led to contracting trade in products ??

"The basic neoclassical model really requires increased net savings to lead – induced by the decline in the real interest rate – to borrowing for more fruitful investment. "

i think we got you on that ..the key is fruitful

ie productive of future gain ...profit ...surplus value

just to de mystify it here

"There was a failure of the world’s financial sector in turning increased savings into fruitful investment"

why was there a car crash at the coner of hollywood and rose ??

failure to drive correctly

" and that meant -- to repeat-- that the savings glut led to a debt crisis. The crisis was thus caused by an interaction of the particular global imbalances that led to low interest rates and high credit availability with the failure of the financial sector."

the circle is not unwinding if you borrow real monety and buy lots that will lose mucho value post purchase and blow the rest on beer and wide screen s for sports watching ....you got nothing more on the future income side to service the added debt ??

the old house hold paradigm

"Here we should just mention that if there had been an increase in US savings rather than in other countries, there would also have been a decline in world interest rates, but this would have actually reduced the US current-account deficit and thus reduced (and not increased) the global imbalances.

"

in other briefer words

if it had all gone down different if uncle and his people had ben the planets biggest savers not biggest borrowers and over consumers

then it would have worked out lot different

"The basic problem has been not the global imbalances as such, but rather the sharp and prolonged decline in real interest rates, when combined with the inadequacies of the financial sector."

oh no a sudden swerve here ..warning there's an emertus at the wheel here

not a swerve into on coming traffic just off an exit ramp and onto a utility road not running

exactly parallel to the fruitful investmant turnpike in fact its more like a weighing station without the scales

now the basic problem don't exist along the frutful non frutful axis

now its the low real rated funds themselves

presumably thrown up by the trade imbalances

flowing into a waco system of international hi fi fun houses

and i guess blowing balloons that burst

"Going back to what actually happened in the period that ended in 2008, we might then ask: “were net savings of the savings-glut countries too high or were sound, fruitful investments in the rest of the world too low?”

gosh now we're off on another quest is x too high or y too low ?

often that has no signifigant answer

"The particular global imbalances caused by the increase in savings (plus declines in investment in some cases) in the savings-glut countries led to the decline in the world real interest rates and high credit availability. This provided an investment opportunity for the rest of the world. But the inefficiency of the world’s financial sector and other factors led to an inadequate response in fruitful investment in the rest of the world, notably the US. "

for what now the fourth time we get this ??

to be fair a restatement is part of communication eh ??

i'll only note "and other factors " that can no doubt cover a lot of unmapped ground

then comes this:

"As noted above, one of the other factors was the reluctance of some developing countries with good investment opportunities to run current-account deficits."

" There could also have been more fruitful investment – notably in infrastructure – by governments, especially in the US."

infrastructure including the merit class system of pyramids no doubt

health education research

the arts and parks even

of course he's a citizen haut borgeois

a goo goo a public sector investment guy not just a corporate private investment hack

there's fruit trees to be grown in the pub sec too

starting with human capital

produced in part right there at the hopkins

"I would also add here that the reluctance to run current-account deficits by various smaller economies – whether Latin American, Asian or European – is thoroughly understandable when we take note of the instability of capital inflows that have caused so many crises, notably the Asian crisis of 1997-98 but also the current European ones. And this instability is yet another manifestation of a weakness in the world’s financial sector."

parting shot at

the WFS

implict we need a freer but more stable WFS to emerge out of emergence

how ???

Sunday, April 10, 2011

ziffle's idiocy

larry calls for more equity less debt

as if this was either a stylistic option or a moral failing

debt build up ie fast flowing universal credit

accelerates development

and consquent high leverage concentrates and amplifies the profit rates of enterprise

----------------

his counter to public utility models for the credit system

"look at gosplan "

he is more clever about fully socialized public enterprise and unit level externalities

without realizing the own bottom fallacy that high equity ap[proximates

ie less and less equity is the progressive motion of the system

just as less and less cash sales versus credit sales is progress

as if this was either a stylistic option or a moral failing

debt build up ie fast flowing universal credit

accelerates development

and consquent high leverage concentrates and amplifies the profit rates of enterprise

----------------

his counter to public utility models for the credit system

"look at gosplan "

he is more clever about fully socialized public enterprise and unit level externalities

without realizing the own bottom fallacy that high equity ap[proximates

ie less and less equity is the progressive motion of the system

just as less and less cash sales versus credit sales is progress

different employments

"The whole of the advantages and disadvantages of the different employments of labour and stock must, in the same neighbourhood, be either perfectly equal or continually tending to equality. If in the same neighbourhood, there was any employment evidently either more or less advantageous than the rest, so many people would crowd into it in the one case, and so many would desert it in the other, that its advantages would soon return to the level of other employments"

--the original market adam--

just labor and stock in the same neighborhood how concise L and K

with that evil triade of abstractions

pandora's box is prised open

and yet the shade of a dynamic races thru the tableau of equal outcomes

"continually tending to equality "

the driver of equity is the profits of arbitrage

note :

there is no innovation here no product differentiation no process innovation

no continual race to escape the morphing processs from unique product to commodity

nor any sense of how well the continuing race to rub out profits closes the gap

between the transaction price reality with its quasi rent surplus and the grail price

the true instantaneous as if all markets cleared edgeworth core price set

the rule of value over the price of that commodity

between the continual relative movements among the prices of marketed commodity products

the lowering and risng of one against the other and the gains from trade in any one commodity product

what if the system convulses if the general rate of profit passes zero

and as a result of that convulsion profits are restored

the comvulsion that is the final blow to the positivity of too many quasi rent profits

produces its opposite

the return ...with time and suffering of ...quasi rent profits of enterprise

and we no where speak of wage markets eh

--the original market adam--

just labor and stock in the same neighborhood how concise L and K

with that evil triade of abstractions

pandora's box is prised open

and yet the shade of a dynamic races thru the tableau of equal outcomes

"continually tending to equality "

the driver of equity is the profits of arbitrage

note :

there is no innovation here no product differentiation no process innovation

no continual race to escape the morphing processs from unique product to commodity

nor any sense of how well the continuing race to rub out profits closes the gap

between the transaction price reality with its quasi rent surplus and the grail price

the true instantaneous as if all markets cleared edgeworth core price set

the rule of value over the price of that commodity

between the continual relative movements among the prices of marketed commodity products

the lowering and risng of one against the other and the gains from trade in any one commodity product

what if the system convulses if the general rate of profit passes zero

and as a result of that convulsion profits are restored

the comvulsion that is the final blow to the positivity of too many quasi rent profits

produces its opposite

the return ...with time and suffering of ...quasi rent profits of enterprise

and we no where speak of wage markets eh

Saturday, April 9, 2011

the human intention

We are creatures of our built in intentionality

Its inevitable that we have purposes its hard wiring

We're complex and contradictory enough as a mentating self motivating passion producing activistic creature

That we are not only at cross purposes at all times but we can super impose a rationalization

Over our actions that is at odds even opposed to our deeper dominant intentions

Now we get to human intention as a social product of our interactions as unit intenders

A collectively shared overt or covert group intention

Ie unserialized

an intention a priori collective in it's structure even if modeled in each unit and often inconsistently modeled

Its inevitable that we have purposes its hard wiring

We're complex and contradictory enough as a mentating self motivating passion producing activistic creature

That we are not only at cross purposes at all times but we can super impose a rationalization

Over our actions that is at odds even opposed to our deeper dominant intentions

Now we get to human intention as a social product of our interactions as unit intenders

A collectively shared overt or covert group intention

Ie unserialized

an intention a priori collective in it's structure even if modeled in each unit and often inconsistently modeled

my old eureka circa 1995

during my twenty year intellectual slumber

i had a few bright awakenings

one was what amounts to stochastic agent generated economies

which might have emergent laws like statistical mechanics

if agents with intentions are extensively like particles are essentially

and they aren't obviously

--------------

my eureka was simply to have m inner agent decision models that were distributed into n agents heads

the agents get an initial bundle of commodities assets jobs skills and money and theres a set of existing prices and wages

then trading etc begins

i had a few bright awakenings

one was what amounts to stochastic agent generated economies

which might have emergent laws like statistical mechanics

if agents with intentions are extensively like particles are essentially

and they aren't obviously

--------------

my eureka was simply to have m inner agent decision models that were distributed into n agents heads

the agents get an initial bundle of commodities assets jobs skills and money and theres a set of existing prices and wages

then trading etc begins

the great strateeegerry of the neoclassical GET

the GET models are all about unspecfied dynamics

ie winners and losers that are darlings or victims of sheer fortune not the merit or demerit of their own effort skill and wisdom

not that this isn't in the back of their minds they know market systems have to solve themselves by groping a bit

and sure wind falls happen

sometimes the wind drops a safe full of money on your door step

some times it drops an empty safe on your head

dismal science ideologian task

get to panglosville ...somehow

lesson must be

at the end of the day

markets

if left to their own devices more or less

are always and everywhere a B of APS phenomenon

ie winners and losers that are darlings or victims of sheer fortune not the merit or demerit of their own effort skill and wisdom

not that this isn't in the back of their minds they know market systems have to solve themselves by groping a bit

and sure wind falls happen

sometimes the wind drops a safe full of money on your door step

some times it drops an empty safe on your head

dismal science ideologian task

get to panglosville ...somehow

lesson must be

at the end of the day

markets

if left to their own devices more or less

are always and everywhere a B of APS phenomenon

john rawls trumps lou rawls

the veil of impersonality

in a system of justice doesn't care about the hairs on every head as part of unique creatures

ie what a personal god would care about

nope this justice is nothing personal

if the market system produces a certain specified set of individual outcxome

to hell with who gets what ....specifically eh ???

deistic paradiso class fairness

gods mysterious ways are his careles ways made into goodness and light

back up system that re personalizes everrything

judgement dau heaven hell and the whole razzle dazzle of saved and unsaved immortal souls

immortalk state ever after state despite any discount will obvious flood out the finite misery of this existence

in a system of justice doesn't care about the hairs on every head as part of unique creatures

ie what a personal god would care about

nope this justice is nothing personal

if the market system produces a certain specified set of individual outcxome

to hell with who gets what ....specifically eh ???

deistic paradiso class fairness

gods mysterious ways are his careles ways made into goodness and light

back up system that re personalizes everrything

judgement dau heaven hell and the whole razzle dazzle of saved and unsaved immortal souls

immortalk state ever after state despite any discount will obvious flood out the finite misery of this existence

market globes have bounded spaces

the theory of exchange takes on an intrinsic spacial dimension of regions can border themselves and articulate local all market differences

the basics of gem are simple

a sherical market world all inter connected where firms can go any where to buy sell produce or extract

all that exists in the origanal edenic egg is firms and located labor facilities and resources

the basics of gem are simple

a sherical market world all inter connected where firms can go any where to buy sell produce or extract

all that exists in the origanal edenic egg is firms and located labor facilities and resources

money income and utlity

its a great magic trick of econ con to conflate these two

a cardinal utlity ie a phlogiston with the humble market based cash income of a household

the medium of exchange has certain very useful characteristics

that even a well behaved utlity function cardinal or ordinal lacks

money value = utility value

much mischief starts with this only semi concious act

that the firm which is motivated by net income max

is somehow analogous to a household that is utliity maximizing

takes a certain rationalized stylized "realism " and makes it dissapear

the for proft firm mediating exchange gets vanished

in particular if the market system can zero out profits at equilibrium

even if equilibrium is only at the end of a path of accumulation

firms are reduced to the socially minimzed cost of transactions

the transactions that are producing by exchange pareto improving

maybe even socially maximized prior constrained aggregate utlity

now if in the market place one can only bring ones laboring capacity

skilled or not

then pareto improvement occurs at any hiring above some dreadful minimum

a cardinal utlity ie a phlogiston with the humble market based cash income of a household

the medium of exchange has certain very useful characteristics

that even a well behaved utlity function cardinal or ordinal lacks

money value = utility value

much mischief starts with this only semi concious act

that the firm which is motivated by net income max

is somehow analogous to a household that is utliity maximizing

takes a certain rationalized stylized "realism " and makes it dissapear

the for proft firm mediating exchange gets vanished

in particular if the market system can zero out profits at equilibrium

even if equilibrium is only at the end of a path of accumulation

firms are reduced to the socially minimzed cost of transactions

the transactions that are producing by exchange pareto improving

maybe even socially maximized prior constrained aggregate utlity

now if in the market place one can only bring ones laboring capacity

skilled or not

then pareto improvement occurs at any hiring above some dreadful minimum

Friday, April 8, 2011

what is socialism ?

Socialism in it's many morphs and various different class based conceptions

fleshes out rather compactly

iobviously quite conciously

socialism is an attempt by some class or other

to use the state to complete or to thwart

the necessary remaining world historical tasks of The bourgeois stage of class cloven social evolution

tasks that lead one way or another toward class cloven society's own sublation ... class-less society

Ie

it is a means by implementaion of legal force

to progress socially ie by other means then pure volitional private property based capitalism

In fact despite this intention

it is capitalism in other guises

capitalism pretending to be not itself

or not seeing itself for what it is or will become

capitalism

pretending or tricking itself in some cases

into thinking its being anti capitalism

...begging the big question...

this goes for any form of socialism other then the prole dictatorship form of socialism

which by exception as agent of the wage class might embody ...might ..

world historical measures that accelerate the trip time to communism

sum up

in the last analysis most socialism is simply or complexly capitalism by other means

means that in time come back around on themselves and become eventually

once again really the same means

such is clio's rubber railed road system

elastic but only finitely so

fleshes out rather compactly

iobviously quite conciously

socialism is an attempt by some class or other

to use the state to complete or to thwart

the necessary remaining world historical tasks of The bourgeois stage of class cloven social evolution

tasks that lead one way or another toward class cloven society's own sublation ... class-less society

Ie

it is a means by implementaion of legal force

to progress socially ie by other means then pure volitional private property based capitalism

In fact despite this intention

it is capitalism in other guises

capitalism pretending to be not itself

or not seeing itself for what it is or will become

capitalism

pretending or tricking itself in some cases

into thinking its being anti capitalism

...begging the big question...

this goes for any form of socialism other then the prole dictatorship form of socialism

which by exception as agent of the wage class might embody ...might ..

world historical measures that accelerate the trip time to communism

sum up

in the last analysis most socialism is simply or complexly capitalism by other means

means that in time come back around on themselves and become eventually

once again really the same means

such is clio's rubber railed road system

elastic but only finitely so

lesson

use of analogy here never got to the clear one to one map

between the two formal models elements

that is until the analogy fell apart

because a market system is not analogous to a classical thermo dynamic ideal gas system

its more like granular systems that are indeed path dependent hysterisus ridden etc etc

the intent is clear the researchers wanted certain propertties found in the classical gas to hold in a real free market system

because it made that free market system

Bof APS

between the two formal models elements

that is until the analogy fell apart

because a market system is not analogous to a classical thermo dynamic ideal gas system

its more like granular systems that are indeed path dependent hysterisus ridden etc etc

the intent is clear the researchers wanted certain propertties found in the classical gas to hold in a real free market system

because it made that free market system

Bof APS

the final dope out

"Though some aspects

of the utility/potential correspondence

can be salvaged ...."

"the lack of a natural cardinalization for general utilities

reflects the deeper fact that welfare functions simply do

not exist for general path-dependent economies."and real economiies ARE path dependent

more flaw

"gradients would equal prices

a global cardinalized welfare function

ie

the sum of all agent utilities in the economy is arrived at by adding up comensurate pools of utiles

consumed or stored by the constituent maximizing units

for all the equilibria of arbitrarily composed economies.

Such a condition is equivalent to requiring that equilibria

be maxima of " a global cardinalized welfare function

ie

the sum of all agent utilities in the economy is arrived at by adding up comensurate pools of utiles

consumed or stored by the constituent maximizing units

walrasian deadly blunder

"The fatal flaw in the Walrasian correspondence was

the assumption that cardinal forms for utilities could be

constructed"and

:"a universal addition rule for unit utilities" existed

just not so eh

at least not beyond crazy imaginary

substance abuse

utility cardinalize able utility

amounts to postulating a unicorn

walras's conflation and bad analogy

walras according to dunc :

d foley sez wrong !!!

his thermo-con paper:

a mechanical system at rest ie with all forces initially in balance absent a shock willl stay in balance

ie in equilibrium ie at rest

and will stay at rest a mechanical system in motion will stay in motion

you gotta go thermal if you want an analogy to utility based exchange systems

fisher found that out thanks to mentor gibbs :

the original thermo con trickster mr W

was actually a simple newtonian mechanist

without a dynamic theory to get him to equilibrium

and on top of that operating with a nasty conflation of his the unit level the trader

and the aggregate level the market system and its total utility state

come now statistical mechanics

but another errorfisher thinks his agents are analogous to innocent stocastic objects

particles insideless balls in stochastic motion

AND

Tto the deterministic state arrived at by these particles in mutual and interacting motion

walras/fishers unit was an optimizing utiliton a simple maximizer of a substance

it stores or eats

loose in a free for all vol-trade market opportunity full of other such concious maximizer units

ready to be trading for utils with each other

d foley sez wrong !!!

his thermo-con paper:

"A mechanical analogue in

economics would require not only forces, but dynamical

equivalents to inertia."a mechanical system at rest ie with all forces initially in balance absent a shock willl stay in balance

ie in equilibrium ie at rest

and will stay at rest a mechanical system in motion will stay in motion

you gotta go thermal if you want an analogy to utility based exchange systems

fisher found that out thanks to mentor gibbs :

"thermodynamics, and not mechanics, is the correct physical theory

to explain how disequilibrium systems can converge to equilibrium

and remain there."

the original thermo con trickster mr W

was actually a simple newtonian mechanist

without a dynamic theory to get him to equilibrium

and on top of that operating with a nasty conflation of his the unit level the trader

and the aggregate level the market system and its total utility state

come now statistical mechanics

but another errorfisher thinks his agents are analogous to innocent stocastic objects

particles insideless balls in stochastic motion

AND

Tto the deterministic state arrived at by these particles in mutual and interacting motion

walras/fishers unit was an optimizing utiliton a simple maximizer of a substance

it stores or eats

loose in a free for all vol-trade market opportunity full of other such concious maximizer units

ready to be trading for utils with each other

"The potential minimized at physical equilibria is not the energy,

as was believed in Walras’s time, but a quantity called free energy

which also receives contributions from the entropy"

as was believed in Walras’s time, but a quantity called free energy

which also receives contributions from the entropy"

"Fisher was ...drawing analogies of the economic agent to both stochastic

and deterministic physical objects at the same time""utility .. a measurable

quantity analogous to potential energy in mechanics"

Thursday, April 7, 2011

foley on path dependent market motion

dunc's a careful guy and a wonderland type too

this paper worries the thermo-util axis pretty hard

but he [produces the essential result

there's nothing remotely like a one product one price rule in actual market driving

and there's no way to form a unique and robust social welfare function

in anything remotely like a realistic exchange system

this adds fill to the skeptical blitz or relative blitz that has over run the samuelson paradigm