)

) Monday, July 18, 2011

input hours time their wage rate ???

so what is VA a vector of units x the prices and fees and wages and borrow rates and lease rates

always units and rates

old rates compared to new rates

last period units compared to this period units

composite units recomposited are new units not existent last period

if in the recombination of elemental units additial usefulness emerges ???

who caputres the expression of that added use value as captured in a higher price ie producer surplus

rather then in consumer surplus

and even if extruded at "cost" thru one transaction node how about extrusion all the way to the final products surplus realized in consumption by the final consumer ???

ie as the commodity form is disolved into not reproduction of "labor power " but mere over plus surplus

luxury ???

always units and rates

old rates compared to new rates

last period units compared to this period units

composite units recomposited are new units not existent last period

if in the recombination of elemental units additial usefulness emerges ???

who caputres the expression of that added use value as captured in a higher price ie producer surplus

rather then in consumer surplus

and even if extruded at "cost" thru one transaction node how about extrusion all the way to the final products surplus realized in consumption by the final consumer ???

ie as the commodity form is disolved into not reproduction of "labor power " but mere over plus surplus

luxury ???

Sunday, July 17, 2011

late ike to barry

b4 ronnie and ever since reagan it might be partitioned

the morning in america share climb

from what

around both sides of 62 to nicking the bottom of 64 as early as 60 but always well under 65

but come morning in america

---usury properlled ??-- a nearly unbroken rise to plus 70

and held there more or less since the arrival of the baby bush

------------------------------

new housing expenditures ??

the health cost distributed

| Share of health care spenders | Cumulative share of US medical spending |

| Top 1% | 30% |

| Top 5% | 58% |

| Top 10% | 72% |

| Top 30% | 90% |

| Total population | 100% |

Saturday, July 16, 2011

the universal language of a plan or the incoherent unintelligable babble of markets voiced

the parallels between these two great social contrivances

markets and written languages

are unendingly diverting and filled with fruitful analogy

the tower project damned to doom

by its artificially segmented willfully partitioned

ultimately mutually un intelligable cacophony

viva gosplan II

the next leap

the next essay in social re-totalization

likely as bold and no doubt as hazardous as the last

but there is no choice but to greatly leap again across the dark unknown

no way else to discover

the deeper truths of our future's right and righeous path

the truths essential that only leaps and their attendent

practical failures and short falls reveal

in the process

building the new us out of the existing we

the bold mad scientist stumbling forward

thru one frankensten monster after another

okay

looking back

yes we can project a far far straighter path

clean of blood and tragedy and farce

a path decidely not taken

but now ridiculously visible in hind sight

all the way up to here today

from those first eves and adams one hundred millenia ago

but looking on....looking as we must look forward

and with faith hope and charity

ought we not to expect a crooked twisted backward swooping course

much like we indeed did trod that original and alas only real time

we travelled cross the past's unreturnable timescape

behind us

and between us and our originating parents

is a existence in motion

thru 5 thousand essentially

un mutated generations

each agency the work

of one original natural complex composite set of organismic conditions

that yet miracle of miracles

produced out of themselves a thousand cultural transitions

a thousand !!! disntict cracked totalizations

to get us from scattered forest or savanah bands

to the urbanite class cloven mega formations of today

from mother nature's

inceptional contradictory makings of us

what amazing outputs

a thousand brave new worlds each inside the last

markets and written languages

are unendingly diverting and filled with fruitful analogy

the tower project damned to doom

by its artificially segmented willfully partitioned

ultimately mutually un intelligable cacophony

viva gosplan II

the next leap

the next essay in social re-totalization

likely as bold and no doubt as hazardous as the last

but there is no choice but to greatly leap again across the dark unknown

no way else to discover

the deeper truths of our future's right and righeous path

the truths essential that only leaps and their attendent

practical failures and short falls reveal

in the process

building the new us out of the existing we

the bold mad scientist stumbling forward

thru one frankensten monster after another

okay

looking back

yes we can project a far far straighter path

clean of blood and tragedy and farce

a path decidely not taken

but now ridiculously visible in hind sight

all the way up to here today

from those first eves and adams one hundred millenia ago

but looking on....looking as we must look forward

and with faith hope and charity

ought we not to expect a crooked twisted backward swooping course

much like we indeed did trod that original and alas only real time

we travelled cross the past's unreturnable timescape

behind us

and between us and our originating parents

is a existence in motion

thru 5 thousand essentially

un mutated generations

each agency the work

of one original natural complex composite set of organismic conditions

that yet miracle of miracles

produced out of themselves a thousand cultural transitions

a thousand !!! disntict cracked totalizations

to get us from scattered forest or savanah bands

to the urbanite class cloven mega formations of today

from mother nature's

inceptional contradictory makings of us

what amazing outputs

a thousand brave new worlds each inside the last

Friday, July 15, 2011

if we had a constant short fall of effective demand

then deficit dollars would over time convert from expenditures and transfers

to interest payments but continue to fill the ED gap

uncle would become the bailiff of a class of risk averse rentiers funds foundations and institutions

to interest payments but continue to fill the ED gap

uncle would become the bailiff of a class of risk averse rentiers funds foundations and institutions

institutional entrepreneurs

abba lerner's definition of realytic economists

MAP as market based anti DIS -inflation plan

the warrants of course run the other way when the macronauts at the helm want higher inflation

under that regime

those firms reducing unit prices or simply not increasing them enough period to period

ie end up with a "delta" that is below the period's GPLC ( the general price level change )

must BUY warrants from those who EXCEED the GPLC

under that regime

those firms reducing unit prices or simply not increasing them enough period to period

ie end up with a "delta" that is below the period's GPLC ( the general price level change )

must BUY warrants from those who EXCEED the GPLC

MARK UP MARKETS FACE THE UNITS PROBLEM

value added taxes don't care what combo of p's and q's make up a firms va

but the mark up market warrant match does

what's to stop firm level p and q fudging ???

one has the prior periods declared unit pricing

and this periods declared unit pricing

and one has the two periods patterns of unit inputs and outputs

all this can be hooked into the vendors and customers "numbers "

a massive input output firm to firm matrix emerges

can computers flag unusual changes in "real "imputs and outputs ???

at any rate step one has to be a brutal penalty for fraud

but the mark up market warrant match does

what's to stop firm level p and q fudging ???

one has the prior periods declared unit pricing

and this periods declared unit pricing

and one has the two periods patterns of unit inputs and outputs

all this can be hooked into the vendors and customers "numbers "

a massive input output firm to firm matrix emerges

can computers flag unusual changes in "real "imputs and outputs ???

at any rate step one has to be a brutal penalty for fraud

krug gets to the real policy control target : wage rate change

"Headline prices actually down, as predicted, but core inflation running above the Fed target

about that core: it’s important to make a distinction between core-as-concept and core-as-usually-measured.

The concept is that of inertial prices, which are set for extended periods and can get into a leapfrogging pattern of sustained inflation that’s hard to undo."

The usual measure is just consumer prices less food and energy.

it’s clear that core-as-measured prices are “adulterated” by commodity prices.

Looking at the forest instead of the trees

and in particular

NOTING THAT WAGES ARE STILL FLAT

it’s hard to see an inflation problem looming here. "

qed

about that core: it’s important to make a distinction between core-as-concept and core-as-usually-measured.

The concept is that of inertial prices, which are set for extended periods and can get into a leapfrogging pattern of sustained inflation that’s hard to undo."

The usual measure is just consumer prices less food and energy.

it’s clear that core-as-measured prices are “adulterated” by commodity prices.

Looking at the forest instead of the trees

and in particular

NOTING THAT WAGES ARE STILL FLAT

it’s hard to see an inflation problem looming here. "

qed

Thursday, July 14, 2011

altig ...what ????

"The Beveridge curve appears to have shifted out over time, meaning that the amount of unemployment relative to the number of job openings has increased over the past several years relative to the patterns of the decade or so prior to the beginning of this recovery. "

"This shift in the Beveridge curve is usually interpreted as representing a change in the efficiency with which workers looking for jobs are matched with employers looking to fill jobs "

what ????

we have a huge imbalance

a horrid B ratio

and its not effective demand driving it ???

its inefficiency ???

and or

poor job to skill match ups ??

what's in the water cooler down there hoss ???

--------------------

"There is a debate about whether the recent shift in the Beveridge curve

is a normal cyclical feature of recoveries"

debate ???

why the sentence makes no sense

are you saying over the employment cycle

the ratio oughta stay constant ???

simply bob up and down along some line ???

what is it about thses numbers

you find worthy of debate ???

now one might look at employment cycles versus employment cycles

to see how the change in the ratios over the cycle compare

cycle versus cycle

but you ain't got a cycle here yet pard

the hot house agonizing over

is this huge jobless army structural ??

pure misdirection

plain and simple

and

its hard to imagine you take it seriously

"This shift in the Beveridge curve is usually interpreted as representing a change in the efficiency with which workers looking for jobs are matched with employers looking to fill jobs "

what ????

we have a huge imbalance

a horrid B ratio

and its not effective demand driving it ???

its inefficiency ???

and or

poor job to skill match ups ??

what's in the water cooler down there hoss ???

--------------------

"There is a debate about whether the recent shift in the Beveridge curve

is a normal cyclical feature of recoveries"

debate ???

why the sentence makes no sense

are you saying over the employment cycle

the ratio oughta stay constant ???

simply bob up and down along some line ???

what is it about thses numbers

you find worthy of debate ???

now one might look at employment cycles versus employment cycles

to see how the change in the ratios over the cycle compare

cycle versus cycle

but you ain't got a cycle here yet pard

the hot house agonizing over

is this huge jobless army structural ??

pure misdirection

plain and simple

and

its hard to imagine you take it seriously

ny fed blog tells all

http://libertystreeteconomics.newyorkfed.org/2011/07/would-a-stronger-renminbi-narrow-the-us-china-trade-imbalance.html

message

pay no attention to exchange rates

let differential national "growth " rates rebalance trade

the forex arbitrage must be maintained

"We find that a stronger renminbi would have a relatively small near-term impact

on the U.S. bilateral trade deficit with China and an even more modest impact on the overall U.S. deficit..

......we think that the gap will shrink.... primarily as a consequence of the high rate of economic growth in China"

message

pay no attention to exchange rates

let differential national "growth " rates rebalance trade

the forex arbitrage must be maintained

"We find that a stronger renminbi would have a relatively small near-term impact

on the U.S. bilateral trade deficit with China and an even more modest impact on the overall U.S. deficit..

......we think that the gap will shrink.... primarily as a consequence of the high rate of economic growth in China"

Wednesday, July 13, 2011

the dream of a perfect mechanism

the market as perfect mechanism ???

mark up markets have merely a distributive task

the target is centrally determined

in the sumner system

absolute prices set freely by firms

get guessed at as to outcome by this sumners dollar futures market

mark up markets have merely a distributive task

the target is centrally determined

in the sumner system

absolute prices set freely by firms

get guessed at as to outcome by this sumners dollar futures market

scott sumner's money supply rule

"The Fed defines the dollar as a given fraction of 12- or 24-month forward nominal GDP, and make dollars convertible into futures contracts at the target price."

" If the public expected NGDP to veer off target, purchases and sales of these contracts would automatically adjust the money supply and interest rates in such a way as to move expected NGDP back on target."

". The public, not policymakers in Washington, would determine the level of the money supply and interest rates most consistent with a stable economy."

" If the public expected NGDP to veer off target, purchases and sales of these contracts would automatically adjust the money supply and interest rates in such a way as to move expected NGDP back on target."

". The public, not policymakers in Washington, would determine the level of the money supply and interest rates most consistent with a stable economy."

taylor rule follies

andy harmless on Taylor rules :

So how do we fix these problems? I suggest the following solutions:

- It’s not really a rule at all. The Taylor rule depends on an estimate of potential output. In practice, most of the discretion that goes into central banking is in the estimate of potential output. Even “discretionary” central bank policy is effectively constrained by the consensus of what would be considered reasonable policy actions, and any of those actions can be rationalized by changing your assumption about potential output. Usually, a central bank that has committed to following a “strict” Taylor rule has roughly the same set of options available as one that is ostensibly operating entirely on its own discretion.

- It doesn’t self-correct for missed inflation rates. Since the inflation rate in the Taylor rule is over the previous four quarters, the rule “forgets” any inflation that happened more than four quarters ago. This is a problem for four reasons:

- It leaves the price level indeterminate in the long run, thus interfering with long-term nominal contracting and decisions that involve prices in the distant future.

- It leaves the central bank without an effective tool to reverse deflation when the expected deflation rate exceeds the natural interest rate.

- It reduces the credibility of central bank attempts to bring down high inflation rates, because the bank always promises to forgive itself when it fails.

- It aggravates the “convexity” problem described below, because the central bank effectively ignores small deviations from its inflation target, even when they accumulate.

- It doesn’t allow for convexity in the short-run Philips curve. If the estimate of potential output is too low, for example, and the coefficient on output is sufficiently low, then, if the short-run Philips curve is convex, the central bank will allow output to persist below potential output for a long time before “realizing” that it has made an error. In the extreme case, where the short-run Phillips curve is L-shaped, the central bank may allow actual output to be permanently lower than potential output. More generally, the convexity problem can be aggravated by hysteresis effects, in which lower actual output leads to lower potential output, so that the central bank’s wrong estimate of potential output becomes a (permanently) self-fulfilling prophecy.

- It can prescribe a negative interest rate target, which is impossible to implement. This appears to have been the case for at least part of 2009 and 2010, although there is disagreement about the details.

So how do we fix these problems? I suggest the following solutions:

- Adopt a fixed method for estimating potential output. (One might allow future changes to the method, but they should be implemented only with a long lag: otherwise, they’ll interfere with the central bank’s credibility, since they can be used to rationalize discretionary policy changes.) Since I like simplicity, I suggest the following method: take the level of actual output in the 4th quarter of 2007 (when most estimates have the US near its potential) and increase it at an annual rate of 3% (the approximate historical growth rate of output) in perpetuity.

- Replace the target inflation term with a target price level term. In other words, express it as a deviation from a target price level that rises over time by the target inflation rate. To be clear what I mean by the “target inflation term,” take Taylor’s original equation

r = p + .5y + .5(p - 2) + 2 (where p refers to the inflation rate)

and note that I am referring to the “p – 2” term but not to the initial “p” term, which is not really a target but part of the definition of the instrument (an approximation of the real interest rate). In my new formulation, “p – 2” becomes “P – P*,” where “P is (100 times the log of) the actual price level and P* is (100 times the log of) the target price level (i.e., what the price level would be if the inflation rate had always been on target since the base period). - Increase the coefficient on output. If you wish, in order to avoid a loss in credibility, you can also increase the coefficient on the price term by the same amount. What we have then is a more aggressive Taylor rule. It doesn’t solve the convexity problem completely, but it does assure that, when output is far from target, the central bank will take aggressive action to bring it back (unless the price level is far from target in the other direction). That way at least you don’t end up with a long, unnecessary period of severe economic weakness. (John Taylor claims that, according to David Papell’s research, there is “no reason to use a higher coefficient, and…the lower coefficient works better.” But that research only looks at changing the coefficient on the output term without either changing the coefficient on the inflation term or replacing it with a price term, as I suggest above. Having a too-small coefficient on the output term, as in the original rule, is only a second-best way of achieving the results that those other changes would achieve.)

- “Borrow” basis points from the future when there are no more basis points available today. In other words, if the prescribed interest rate is below zero, the central bank promises to undershoot the prescribed interest rate once it rises above zero again, such that the number of basis-point-years of undershoot exactly cancel the number of basis-point-years of (unavoidable) overshoot. This method will only work, of course, if the market knows what rule the central bank is following, hence (among other reasons) the need for a rule that really is a rule. If the rule is well-defined, the overshoot will be well-defined, the market will expect the central bank to “pay back” the “borrowed” basis points, and the central bank will be obliged to do so in order to maintain its subsequent credibility.

what's sublational about rat ex modeling

the indirection required to centrally and socially "produce "

certain firm level actions forces a deeper understanding of objective optima

unforced moves that are globally rational require autonomy combined with solidarity

thru overtly constructed systemic bounds like the mark up market

or wages and hours laws or tax subsidy auto stab

certain firm level actions forces a deeper understanding of objective optima

unforced moves that are globally rational require autonomy combined with solidarity

thru overtly constructed systemic bounds like the mark up market

or wages and hours laws or tax subsidy auto stab

once the absolute price level is socially determined ....

once that becomes a controled dynamic

then firm level pricing becomes purely a matter of relative motions

combined with certain "market making " intersticial non linear state contingent

tax /subsidy moves .....

the irony is of course gosplan I

nationalized production itself where as gosplan II will nationalize only the hi fi credit cloud

the payment system and the obligation grid

the key to firm change

the zeroed out average rate of profits of enterprise

the full socialization of firm funding

the firm faced funds rate

as a complex interactive system wide algorithm

then firm level pricing becomes purely a matter of relative motions

combined with certain "market making " intersticial non linear state contingent

tax /subsidy moves .....

the irony is of course gosplan I

nationalized production itself where as gosplan II will nationalize only the hi fi credit cloud

the payment system and the obligation grid

the key to firm change

the zeroed out average rate of profits of enterprise

the full socialization of firm funding

the firm faced funds rate

as a complex interactive system wide algorithm

price level stablization and its zero change implicit optimal

the policy universe was created with a notion of stable zero change price levels

when the existence of forward obligations nominally fixed implies an optimal relationship between

absolute product prices and thos obligations that likely requires price level adjustments

these adjustments suggest a paradigm built on dynamic principles not static optima

like constant purchasing power of a unit of currency over time

credit money has no predisposition to value change built into it

no anchor in intrinsic "real costs" of additional production

however the hang time well into the era of credit money

of notions inherited from the earlier epoch of commodity money is substantial

the price level as a fact given "spontaneous uncertainty " remains

like a persistent fog we can't see thru sharply enough

a fog produced by our own minds

utterly unrelated to the possibilities of the pure credit money based exchange economy

of today and tomorrow

when the existence of forward obligations nominally fixed implies an optimal relationship between

absolute product prices and thos obligations that likely requires price level adjustments

these adjustments suggest a paradigm built on dynamic principles not static optima

like constant purchasing power of a unit of currency over time

credit money has no predisposition to value change built into it

no anchor in intrinsic "real costs" of additional production

however the hang time well into the era of credit money

of notions inherited from the earlier epoch of commodity money is substantial

the price level as a fact given "spontaneous uncertainty " remains

like a persistent fog we can't see thru sharply enough

a fog produced by our own minds

utterly unrelated to the possibilities of the pure credit money based exchange economy

of today and tomorrow

macro telekinesis woodford

We have argued that the key to dealing with a situation in which monetary

policy is constrained by the zero lower bound on short-term nominal

interest rates is the skillful management of expectations regarding the

future conduct of policy. By "management of expectations" we do not

mean that the central bank should imagine that, if it uses sufficient guile,

it can lead the private sector to believe whatever the central bank wishes it

to believe, no matter what it actually does. Instead we have assumedabout. But we do contend that it is highly desirable for a central bank to be

able to commit itself in advance to a course of action that is desirable

because of the benefits that flow from its being anticipated, and then to

work to make that commitment credible to the private sector.

In the context of a simple optimizing model of the monetary transmission

mechanism, we have shown that a purely forward-looking approach

to policy—which allows for no possibility of committing future policy to

respond to past conditions—can lead to quite bad outcomes in the event

of a temporary decline in the natural rate of interest, regardless of the kind

of policy pursued at the time of the disturbance. We have also characterized

optimal policy, under the assumption that credible commitment is

possible, and shown that it involves a commitment to eventually bring the

general price level back up to a level even higher than would have prevailed

had the disturbance never occurred. Finally, we have described a

type of history-dependent price-level targeting mle with the following

properties: that a commitment to base interest rate policy on this mle

determines the optimal equilibrium, and that the same foim of targeting

mle continues to describe optimal policy regardless of which of a large

number of types of disturbances may affect the economy.

Given the role of private sector anticipation of history-dependent policy

in realizing a desirable outcome, it is important for central banks to

develop effective methods of signaling their policy commitments to the

private sector. An essential precondition for this, certainly, is for the central

bank itself to clearly understand the kind of history-dependent behavior

to which it should be seen to be committed. It can then communicate

its thinking on the matter and act consistently with the principles that it

wishes the private sector to understand. Simply conducting policy in

accordance with a mle may not suffice to bring about an optimal, or

nearly optimal, equilibrium, but it is the place to start.

the temple of wishes and spells managing expectations of firms and households

that is the macronautics of new keynesianism

it amounts to a timeless model

where the future markets are side by side by sondheim

with present markets

in a connected simultaneous globality of time region based market areas

interests rate are time travel costs .... inter temporal transportation costs

and the macronauts provide the travel cost

how this construction of virtual markets notional markets shadow markets

" related " to the real forward obligation grid

is as schein surrounds and interpenetrates essence

the macronauts like conjured gods

to be puisant must be believed

as much as believed in

when they set "targets "

targets as oughts in a world so surely about is

targets they can not enforce

"in this world " nor punish the transgressors

any gaming of the system must be believed to lead agents and principals

to an inferior outcome

only that belief enforces that outcome

if the macro nauts have no lightening bolts to loose upon the transgressors

fragile ???

magically miraculously so...... eh ??

the talk of price level targets is indeed a move in the right direction

but until price levels are social managed the entire macro nautic enterprise

is something even less then a house of straw

a temple of wishes and spells

it amounts to a timeless model

where the future markets are side by side by sondheim

with present markets

in a connected simultaneous globality of time region based market areas

interests rate are time travel costs .... inter temporal transportation costs

and the macronauts provide the travel cost

how this construction of virtual markets notional markets shadow markets

" related " to the real forward obligation grid

is as schein surrounds and interpenetrates essence

the macronauts like conjured gods

to be puisant must be believed

as much as believed in

when they set "targets "

targets as oughts in a world so surely about is

targets they can not enforce

"in this world " nor punish the transgressors

any gaming of the system must be believed to lead agents and principals

to an inferior outcome

only that belief enforces that outcome

if the macro nauts have no lightening bolts to loose upon the transgressors

fragile ???

magically miraculously so...... eh ??

the talk of price level targets is indeed a move in the right direction

but until price levels are social managed the entire macro nautic enterprise

is something even less then a house of straw

a temple of wishes and spells

Tuesday, July 12, 2011

food stamps are paultry

there's a program that oughta gallop these days eh ???

temporary expansion of eitc ??

that oughta be a big part of auto stab

if you want to copunter the increased dis incentive to get a job when jobless benefits rise

then super jack the eitc

and as top health premiums a rebate program tied to fed income tax earned income might be kool too eh ???

if you want to copunter the increased dis incentive to get a job when jobless benefits rise

then super jack the eitc

and as top health premiums a rebate program tied to fed income tax earned income might be kool too eh ???

how much did transfers need to expand in 09

| ||||||

|  |  | ||||

|  | |||||

|  | |||||

" Total government payments rose to $2.3 trillion in 2010, from $1.7 trillion in 2007, an increase of about 35 percent"

up 600 billion ???

try 2 trillion on for size

right now transfers from gub amount to 20% of personal income that oughta be more like 37%

and weightened way toward bottom feeders

retireds unemployeds and wagelings

massive paying of health premiums would help

its simple really

what amount of household spending and induced corporate spending

gets us 7 million additional jobs .....quick !!!!

Monday, July 11, 2011

Sunday, July 10, 2011

uncle at least oughta have a monopoly on asset collateralized loans

since only uncle has the limitless liquidity to hold forfeited assets poff the market

is pressuring the pub sec a wally world "policy" as big as the trade re-balance ??

well if you look at the north economy as a whole squeezing the pub sec seems on the agenda

but is it mere vehicle or prime objective

the ratio norms for an optimal MNC dominated national system

may well call for a relatively smaller transfer system

but i doubt it

look at the present array of institutional arrangements

lots can be done thru either

pub sec transfers or corporate or union mediated transfers

hey a loan is a transfer just like a grant

a tax no worse then an interest payment

in particular i doubt the social "wage" is too big even in nordic systems

or the auto stabs too effective

the reserve army seems well enough managed despite these socialized transfer systems

but hacking away at the over head cost of education and health ???

sounds "sensible" eh ???

but is it mere vehicle or prime objective

the ratio norms for an optimal MNC dominated national system

may well call for a relatively smaller transfer system

but i doubt it

look at the present array of institutional arrangements

lots can be done thru either

pub sec transfers or corporate or union mediated transfers

hey a loan is a transfer just like a grant

a tax no worse then an interest payment

in particular i doubt the social "wage" is too big even in nordic systems

or the auto stabs too effective

the reserve army seems well enough managed despite these socialized transfer systems

but hacking away at the over head cost of education and health ???

sounds "sensible" eh ???

90k per month ??

"the Congressional Budget Office projects that the underlying rate of labor force growth is now just 0.7 percent annually. This comes to roughly 1,050,000 a year or just under 90,000 a month"

--dino--

hmmm

--dino--

hmmm

controling product price level moves relative to equity and lot market price level moves

the ability to socially and reliably adjust the product price level to the price levels

of various asset markets ---including the debt grid ---

example

todays federal debt to gdp ratio can be rectified by a combo of pinned nominal interest rates

and faster price level increases

a repeat of the glorious 40's but under precise control

this bench mark suggests the stag has worked very well since the winter of 2010

keeping the job market in steady state expansion ...err till recently at least ..

for the moment pub sec axing seems to threaten that balanced absorption

of various asset markets ---including the debt grid ---

example

todays federal debt to gdp ratio can be rectified by a combo of pinned nominal interest rates

and faster price level increases

a repeat of the glorious 40's but under precise control

this bench mark suggests the stag has worked very well since the winter of 2010

keeping the job market in steady state expansion ...err till recently at least ..

for the moment pub sec axing seems to threaten that balanced absorption

adjusting the product price level to the debt grid

greece has a euro denominated debt grid

a reduction in its price level will indeed cut the trade gap

but what about the increased burden of the existing debt grid

there greece faces the same problem any deval of the national currency

system faces if burdened with a debt grid denominated in foreign currencies

the ability to expand foreign earnings faces the marshall lerner effect short term

a reduction in its price level will indeed cut the trade gap

but what about the increased burden of the existing debt grid

there greece faces the same problem any deval of the national currency

system faces if burdened with a debt grid denominated in foreign currencies

the ability to expand foreign earnings faces the marshall lerner effect short term

original purpose of MAP

cure inflation

this very targeted purpose perhaps missed the greater use of such a mark up market

to socially control the changes in the price level

greece today needs such a social mechanism design

to allow orderly reduction of its relative price level within the euro zone

compared to its "partner systems "

the national economy can not adjust its trade balance by a simple if grave deval

the system is multinational

at the same time greece devals germany a major surplus trader vis a vis greece

must virtually reval ...not possible eh ??

within a unified currency zone

so it has to come thru relative rates of change in either import absorption or price level moves

now forex allows a very precise adjustment to a trade imbalance by

incentivizing a rise in import prices and a lowering of export prices on trade able products

ie getting the substitution effect working

while leaving non trade ables "as is " at least in terms of their own va

the price level mechanism however can by broader means get the system the real system to the same place

this very targeted purpose perhaps missed the greater use of such a mark up market

to socially control the changes in the price level

greece today needs such a social mechanism design

to allow orderly reduction of its relative price level within the euro zone

compared to its "partner systems "

the national economy can not adjust its trade balance by a simple if grave deval

the system is multinational

at the same time greece devals germany a major surplus trader vis a vis greece

must virtually reval ...not possible eh ??

within a unified currency zone

so it has to come thru relative rates of change in either import absorption or price level moves

now forex allows a very precise adjustment to a trade imbalance by

incentivizing a rise in import prices and a lowering of export prices on trade able products

ie getting the substitution effect working

while leaving non trade ables "as is " at least in terms of their own va

the price level mechanism however can by broader means get the system the real system to the same place

map frame work part II

5) additional credits equal to estimated next period general rate of real growth

(net output per unit of input )

6) period net sales must equal period credits by changes in prices or credit purchases

7) map system tracks firms "ins and outs " of employees

changes in capital investments purchases and sales of credits

8) gub firms and np firms all in same system with profit firms

part I http://earthmart.blogspot.com/2011/07/map-frame-work.html

(net output per unit of input )

6) period net sales must equal period credits by changes in prices or credit purchases

7) map system tracks firms "ins and outs " of employees

changes in capital investments purchases and sales of credits

8) gub firms and np firms all in same system with profit firms

part I http://earthmart.blogspot.com/2011/07/map-frame-work.html

nominal wage increases career and careen

notice anything round about 1979-1983 ???

1965 to 1979 might be called the age of the great nominal wage hurri-keynes

yes martha corporate amerika had a problem

---------------------

a recent estimate of the distribution of wage rate increases

hard to make those nominal cuts

better to fire and replace

america's goods economy

and from production to truckers and on to the dealerships

Saturday, July 9, 2011

tales of taylor

On the 10th Anniversary of the Keynesian Revival: Echoes

columbian calender this is year 519

present date minus 1492

20011 - 1492 = 519

see original posting

http://www.kapshow.com/houseofpaine/archives/2000_12.html

20011 - 1492 = 519

see original posting

http://www.kapshow.com/houseofpaine/archives/2000_12.html

the map frame work part I

here's the original map frame work

1 fed empowered by congress to maintain "price stablity"

-------------------------

2 set up within the fed a MAP credit office issue map credits to each firm

equal to "net sales " in the prior year

< net sales = (gross sales + cost of inventory change) - (purchases from other firms ) >

ie

profits + wages = net sales

profits

broadly defined to include interest dividends fees rental payments

and

wages

broadly defined to include all other payments that constitute income to individuals including fringe benefits

note:

national net sales must (by identity )

equal

total national spending on final products (goods and services)

----------------------------

3 firms making additional hires are credited at the hire's prvious wage

and firms reducing staff surrender the equivalent credits

------------------------

4 new investment entitles firms to credits equal to interest payments

( at the current borrowing rate ) imputed to the investment

-------------------------------

part II http://earthmart.blogspot.com/2011/07/map-frame-work-part-ii.html

1 fed empowered by congress to maintain "price stablity"

-------------------------

2 set up within the fed a MAP credit office issue map credits to each firm

equal to "net sales " in the prior year

< net sales = (gross sales + cost of inventory change) - (purchases from other firms ) >

ie

profits + wages = net sales

profits

broadly defined to include interest dividends fees rental payments

and

wages

broadly defined to include all other payments that constitute income to individuals including fringe benefits

note:

national net sales must (by identity )

equal

total national spending on final products (goods and services)

----------------------------

3 firms making additional hires are credited at the hire's prvious wage

and firms reducing staff surrender the equivalent credits

------------------------

4 new investment entitles firms to credits equal to interest payments

( at the current borrowing rate ) imputed to the investment

-------------------------------

part II http://earthmart.blogspot.com/2011/07/map-frame-work-part-ii.html

map a narrow vision expended

market anti inflation plan MAP

was one of the immediate responses

to the chronic emergence of wage price spirals from the late 60's thru the full 70's

the earlier respones in effect administrative mechanisms for price control

income policies failed in peace time or more generally over the long haul

there ws chatter about a pigou like inflation tax

but MAP joined a short list of proposed "intentionally "designed market mechanisms

cap and trade mechanisms

by the end of the 70's traditional credit constraints were applied

ending the spirals everywhere and as anticipated ended them

with large contractions of output and jobs

since then credit policy has in essence crimped off expansions as they reached the taboo line where

wage rate increases begin to exceed horly value added increases

ie crunch out the nominal expansion on the demand side by reducing its credit supply

ie a contrived output cycle with all its gaps

all its episodic

implied waste of existing productive capacity

the long term dismal integeral of

lost output

lost welfare

lost happiness

was one of the immediate responses

to the chronic emergence of wage price spirals from the late 60's thru the full 70's

the earlier respones in effect administrative mechanisms for price control

income policies failed in peace time or more generally over the long haul

there ws chatter about a pigou like inflation tax

but MAP joined a short list of proposed "intentionally "designed market mechanisms

cap and trade mechanisms

by the end of the 70's traditional credit constraints were applied

ending the spirals everywhere and as anticipated ended them

with large contractions of output and jobs

since then credit policy has in essence crimped off expansions as they reached the taboo line where

wage rate increases begin to exceed horly value added increases

ie crunch out the nominal expansion on the demand side by reducing its credit supply

ie a contrived output cycle with all its gaps

all its episodic

implied waste of existing productive capacity

the long term dismal integeral of

lost output

lost welfare

lost happiness

mark up mart

the objective : manage price levels

create an institutional set up at the national level

that does for price level dynamics

in the trinity markets (product commodity and asset)

what the fed does for the dollar and interest rates

end the equivalent for price levels

of the wild and wooly reign of precious metals

over the credit flows of the national economy

ie

end the anarchy of absolute pricing within market types

and the relative levels between market types

the absolute and relative price levels of various genre of markets

explicitly and socially determined by democratic policy processes

create an institutional set up at the national level

that does for price level dynamics

in the trinity markets (product commodity and asset)

what the fed does for the dollar and interest rates

end the equivalent for price levels

of the wild and wooly reign of precious metals

over the credit flows of the national economy

ie

end the anarchy of absolute pricing within market types

and the relative levels between market types

the absolute and relative price levels of various genre of markets

explicitly and socially determined by democratic policy processes

Friday, July 8, 2011

Thursday, July 7, 2011

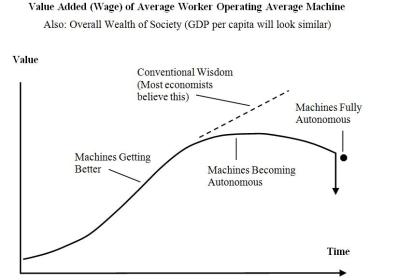

rogoff blue sky's it on mind automation ...with a few comments

nut shell version:

"Many commentators seem to believe that the growing gap between rich and poor is an inevitable byproduct of increasing globalization and technology. In their view, governments will need to intervene radically in markets to restore social balance.

I disagree....... the past is not necessarily prologue: given the remarkable flexibility of market forces, it would be foolish, if not dangerous, to infer rising inequality in relative incomes in the coming decades by extrapolating from recent trends."

----------------------

long form:

"Until now, the relentless march of technology and globalization has played out hugely in favor of high-skilled labor, helping to fuel record-high levels of income and wealth inequality around the world."

okay

but simple point right there

china and india can are now and will in the future build minds with these marketable high skill sets cheaper by far then norte amigo

and that puts aside this issue :

how true this proposition anyway ??

after a proper sorting out of income sources here in america

first we remove property income and talent or positional rents hey ??

artificial society constructed relative scarcity unrelated to "supply price "

-------------

the professional class may indeed have opened a bigger spread between its median

and say

the median income of the unskilled

but a clean set of numbers i've not seen ...which of course isn't saying it doesn't exist

only that it gets little mass media broadcasting

at any rate back to the ken doll of harvard econ con

" Will the endgame be renewed class warfare, with populist governments coming to power, stretching the limits of income redistribution, and asserting greater state control over economic life?"

provoked fans ??

"There is no doubt that income inequality is the single biggest threat to social stability around the world, whether it is in the United States, the European periphery, or China. "

nonsense the threat is crisis and break down o0f the various national market based hi fi fueled social production systems

because of the "contradictions" inside a fully cross border financialized

multi national corporation dominated global economy

"Yet it is easy to forget that market forces, if allowed to play out, might eventually exert a stabilizing role. "

"Simply put, the greater the premium for highly skilled workers, the greater the incentive to find ways to economize on employing their talents."

fine

examples follow from his "world" ie competitive chess and grading papers .

then this:

"Expert computer systems are also gaining traction in medicine, law, finance, and even entertainment. "

that comrades is lovely

"Given these developments, there is every reason to believe that technological innovation will lead ultimately to commoditization of many skills that now seem very precious and unique."

good show kenny

then he comes in with this hay maker :

".. once studied the relative price movements of a number of goods over a 700-year period. ...

found that the relative prices of grains, metals, and many other basic goods tended to revert to a central mean tendency over sufficiently long periods. "

"...conjectured that even though random discoveries, weather events, and technologies might dramatically shift relative values for certain periods, the resulting price differentials would create incentives for innovators to concentrate more attention on goods whose prices had risen dramatically."

" people are not goods, but the same principles apply. As skilled labor becomes increasingly expensive relative to unskilled labor, firms and businesses have a greater incentive to find ways to “cheat” by using substitutes for high-price inputs. The shift might take many decades, but it also might come much faster as artificial intelligence fuels the next wave of innovation."

"Perhaps skilled workers will try to band together to get governments to pass laws and regulations making it more difficult for firms to make their jobs obsolete. But if the global trading system remains open to competition, skilled workers’ ability to forestall labor-saving technology indefinitely should prove little more successful than such attempts by unskilled workers in the past."

"The next generation of technological advances could also promote greater income equality by leveling the playing field in education. ..... If the commoditization of education eventually extends to at least lower-level college courses, the impact on income inequality could be profound."

conclusion offered from a nice private office near the flexing grays and steel blues of the charles basin

.

"we need genuinely progressive tax systems, respect for workers’ rights, and generous aid policies on the part of rich countries"

". But the past is not necessarily prologue: given the remarkable flexibility of market forces, it would be foolish, if not dangerous, to infer rising inequality in relative incomes in the coming decades by extrapolating from recent trends."

dangerous ???

"Many commentators seem to believe that the growing gap between rich and poor is an inevitable byproduct of increasing globalization and technology. In their view, governments will need to intervene radically in markets to restore social balance.

I disagree....... the past is not necessarily prologue: given the remarkable flexibility of market forces, it would be foolish, if not dangerous, to infer rising inequality in relative incomes in the coming decades by extrapolating from recent trends."

----------------------

long form:

"Until now, the relentless march of technology and globalization has played out hugely in favor of high-skilled labor, helping to fuel record-high levels of income and wealth inequality around the world."

okay

but simple point right there

china and india can are now and will in the future build minds with these marketable high skill sets cheaper by far then norte amigo

and that puts aside this issue :

how true this proposition anyway ??

after a proper sorting out of income sources here in america

first we remove property income and talent or positional rents hey ??

artificial society constructed relative scarcity unrelated to "supply price "

-------------

the professional class may indeed have opened a bigger spread between its median

and say

the median income of the unskilled

but a clean set of numbers i've not seen ...which of course isn't saying it doesn't exist

only that it gets little mass media broadcasting

at any rate back to the ken doll of harvard econ con

" Will the endgame be renewed class warfare, with populist governments coming to power, stretching the limits of income redistribution, and asserting greater state control over economic life?"

provoked fans ??

"There is no doubt that income inequality is the single biggest threat to social stability around the world, whether it is in the United States, the European periphery, or China. "

nonsense the threat is crisis and break down o0f the various national market based hi fi fueled social production systems

because of the "contradictions" inside a fully cross border financialized

multi national corporation dominated global economy

"Yet it is easy to forget that market forces, if allowed to play out, might eventually exert a stabilizing role. "

"Simply put, the greater the premium for highly skilled workers, the greater the incentive to find ways to economize on employing their talents."

fine

examples follow from his "world" ie competitive chess and grading papers .

then this:

"Expert computer systems are also gaining traction in medicine, law, finance, and even entertainment. "

that comrades is lovely

"Given these developments, there is every reason to believe that technological innovation will lead ultimately to commoditization of many skills that now seem very precious and unique."

good show kenny

then he comes in with this hay maker :

".. once studied the relative price movements of a number of goods over a 700-year period. ...

found that the relative prices of grains, metals, and many other basic goods tended to revert to a central mean tendency over sufficiently long periods. "

"...conjectured that even though random discoveries, weather events, and technologies might dramatically shift relative values for certain periods, the resulting price differentials would create incentives for innovators to concentrate more attention on goods whose prices had risen dramatically."

" people are not goods, but the same principles apply. As skilled labor becomes increasingly expensive relative to unskilled labor, firms and businesses have a greater incentive to find ways to “cheat” by using substitutes for high-price inputs. The shift might take many decades, but it also might come much faster as artificial intelligence fuels the next wave of innovation."

"Perhaps skilled workers will try to band together to get governments to pass laws and regulations making it more difficult for firms to make their jobs obsolete. But if the global trading system remains open to competition, skilled workers’ ability to forestall labor-saving technology indefinitely should prove little more successful than such attempts by unskilled workers in the past."

"The next generation of technological advances could also promote greater income equality by leveling the playing field in education. ..... If the commoditization of education eventually extends to at least lower-level college courses, the impact on income inequality could be profound."

conclusion offered from a nice private office near the flexing grays and steel blues of the charles basin

.

"we need genuinely progressive tax systems, respect for workers’ rights, and generous aid policies on the part of rich countries"

". But the past is not necessarily prologue: given the remarkable flexibility of market forces, it would be foolish, if not dangerous, to infer rising inequality in relative incomes in the coming decades by extrapolating from recent trends."

dangerous ???

a national industrial policy

the last time we had one was the arsenal of democracy

-- some say the NRA was the only real full blown INDUSTRIAL POLICY

..fair enough ---

okay we had a partial policy e after

the kold war hit warp drive

post nsa 68

the point remains we as global hegemon

have sublated our narrow national interests

foor generations now

since 1945 uncle sam has more or less

operated official policy

with the larger earth wide interests

of our multi national trans border corporations

upper most in his mind

in fact so much upper most

even secondary MNC concerns

trump primary DOMESTIC JOB CLASS concerns

to pull this off

within the formalities of a two party liberal democracy

is really quite a feat ..no ??

housing a totalizing global security state

completely inside

a liberal nation state

like a matryoshka doll ???

the mind gapes

and rattles itself

in an aweful trembling

-- some say the NRA was the only real full blown INDUSTRIAL POLICY

..fair enough ---

okay we had a partial policy e after

the kold war hit warp drive

post nsa 68

the point remains we as global hegemon

have sublated our narrow national interests

foor generations now

since 1945 uncle sam has more or less

operated official policy

with the larger earth wide interests

of our multi national trans border corporations

upper most in his mind

in fact so much upper most

even secondary MNC concerns

trump primary DOMESTIC JOB CLASS concerns

to pull this off

within the formalities of a two party liberal democracy

is really quite a feat ..no ??

housing a totalizing global security state

completely inside

a liberal nation state

like a matryoshka doll ???

the mind gapes

and rattles itself

in an aweful trembling

the rationality assumption is just useful short hand

human units learn and developments lop off the most egregious sub maximizers

if you are doing simple comp stat modeling why not metaphor the deciders as rational

its only the acompanying story

the point is this

relying on irrational elements within the flocks of deciders to counter an inner optimality course

as defined by a certain class economic interest ... for a signifigantly extended period is ....a bad bet

assuming rational units as agents is a short cut method

of course reifying that method annointing a class interest based rationality

with global "rationality "24/7 365

is just class pushed agit prop

and often transparently so

and yet even at its most idiotic it serves a consolidating purpose

like doing your roasry as a hurricane approaches

--------------

i hasten to add

the lop process that is market mechanics as mediated by existing institutiuons

not only lops off the most egregious sub maximizers but lots of other agents too

as w h auden sez of long term cultural retention of works by artists

nothing that is bad survives very long

but of course

much good may well be lost in Clios ever finite wake

if you are doing simple comp stat modeling why not metaphor the deciders as rational

its only the acompanying story

the point is this

relying on irrational elements within the flocks of deciders to counter an inner optimality course

as defined by a certain class economic interest ... for a signifigantly extended period is ....a bad bet

assuming rational units as agents is a short cut method

of course reifying that method annointing a class interest based rationality

with global "rationality "24/7 365

is just class pushed agit prop

and often transparently so

and yet even at its most idiotic it serves a consolidating purpose

like doing your roasry as a hurricane approaches

--------------

i hasten to add

the lop process that is market mechanics as mediated by existing institutiuons

not only lops off the most egregious sub maximizers but lots of other agents too

as w h auden sez of long term cultural retention of works by artists

nothing that is bad survives very long

but of course

much good may well be lost in Clios ever finite wake

WHEN ( X) - (M) = 0 THEN (G) - (T) = 0

talk of the structural budget balance

requires

talk of the structural trade balance

example

prime question:

if trade were balanced at full employment

what would be the remaining budget imbalance at full employment ???

next ??

the imbalances between (after tax and debt service) gross income

of operating production firms and firm gross spending

and then and only then

imbalances in household (after tax and debt service ) income and household spending

note the interlacings here provided by movements up and down to and from the credit cloud are omitted

omitted

but hardly irrelevent

for a start

cloud net domestic income must equal net domestic new lending

growth ???

expanded reproduction ???

oh more complexity

requires

talk of the structural trade balance

example

prime question:

if trade were balanced at full employment

what would be the remaining budget imbalance at full employment ???

next ??

the imbalances between (after tax and debt service) gross income

of operating production firms and firm gross spending

and then and only then

imbalances in household (after tax and debt service ) income and household spending

note the interlacings here provided by movements up and down to and from the credit cloud are omitted

omitted

but hardly irrelevent

for a start

cloud net domestic income must equal net domestic new lending

growth ???

expanded reproduction ???

oh more complexity

Tuesday, July 5, 2011

sinn on the pigs sin

he calls em the gips

but he considers them pigs

"...Some 90% of the refinancing debt that the commercial banks of the GIPS countries (Greece, Ireland, Portugal, and Spain) hold with their respective national central banks served to purchase a net inflow of goods and assets from other eurozone countries."

" Two-thirds of all refinancing loans within the eurozone were granted within the GIPS countries, despite the fact that these countries account for only 18% of eurozone GDP. "

"Indeed, 88% of these countries’ current-account deficits over the last three years were financed via the extension of credit within the Eurosystem."

"By the end of 2010, ECB loans, which originated primarily from Germany’s Bundesbank, amounted to €340 billion."

" This figure includes ECB credit that financed capital flight from Ireland totaling €130 billion over the past three years."

nasty fact roll eh ???

conclusion:

" The ECB bailout program has enabled the people of the peripheral countries to continue to live beyond their means, and well-heeled asset holders to take their wealth elsewhere."

sinn's loop misses the obvious mobius strip like gambits availible to the ECB :

he prefers to act as if money creation powers do not exist :

"The capacity for continuing this policy will soon be depleted, as the central-bank money flowing from the GIPS countries to the core countries of the eurozone increasingly crowds out the money created through refinancing operations there. If this continues for two more years as it has for the past three, the stock of refinancing loans in Germany will disappear altogether."

" If German banks drop out of the refinancing business, the European Central Bank will lose the direct control over the German economy that it used to have via its interest-rate policy. "

"The main refinancing rate would then only be the rate at which the peripheral EU countries draw ECB money for purchases in the center of Europe, which ultimately would be the source of all the money circulating in the euro area."

the real nexus:

"The GIPS’ enormous current-account deficits"

which along with "...the massive exodus of capital from Ireland "

"... would not have been possible without ECB financing. "

"Without the additional money that GIPS central banks created in excess of their countries’ requirements for internal circulation, trade deficits could not have been sustained, and the GIPS’ commercial banks would have been unable to prop up asset prices "

.

" the longer bailout loans continue, the longer the GIPS’ current-account deficits will persist, and the more their external debts will grow. Eventually, these debts will become unsustainable."

"The sole exception is Ireland, which is suffering not from a lack of competitiveness, but from capital flight. Ireland is the only country that has lowered its prices and wages, and its current-account deficit is about to swing into surplus. By contrast, Spain’s external deficit is still above 4% of GDP, while Portugal and Greece recently recorded astronomical figures of around 10%."

how impossible is produced by chopping away the relevence of the possible :

.

"Apart from China, central banks don’t intervene to protect their currencies anymore. "

"Europe, too, will get a bloody nose if it keeps trying to artificially prop up asset prices in the periphery."

really why ??? by whom ??

" The sums required for this could ultimately run into trillions.... This would shatter Europe."

again really ??

why ???

we are left holding a mere assertion in our mitts

the rectification sinn style ??

"Apart from financial restructuring, which is crucial, Greece and Portugal must become cheaper in order to regain their competitiveness. Estimates for Greece assume that prices and wages need to come down by 20-30%. Things won’t be much different in Portugal."

there you have it the teutonic climax the orgasmic thought

real wage cuts equal to 20-30 % !!!!

hey herr sinn

why not send pigs wages back to the fuckin post war years ???

and this is really delightful

"If these countries lack the political consensus they need to pull this off, they should in their own interest consider leaving the eurozone temporarily to depreciate their currencies. "

but alas reality pulls him back from the rapsody of ravishment

"The banking system would not survive this without help, so the EU’s bailout activities should be refocused accordingly."

yikes the euro harnesss will become a haulter ....the debt structure a gibbet

so how exactly will the pigs "... benefit from a furlough from the eurozone." ???

no way out by staying in either since

"Depreciation inside the eurozone in the form of deflation...

would drive large parts of the real economy into excessive debt "

"only the value of (pigs) assets, not that of bank debts, would decline."

after providing the assurity of misery without any real up side

the sum up:

"It is time to face the fact that Europe’s peripheral countries have to shrink their nominal GDP to regain competitiveness. "

and then the implicit advice to jetison the fuckers now

" The only question is whether they will take the euro down as well."

but he considers them pigs

"...Some 90% of the refinancing debt that the commercial banks of the GIPS countries (Greece, Ireland, Portugal, and Spain) hold with their respective national central banks served to purchase a net inflow of goods and assets from other eurozone countries."

" Two-thirds of all refinancing loans within the eurozone were granted within the GIPS countries, despite the fact that these countries account for only 18% of eurozone GDP. "

"Indeed, 88% of these countries’ current-account deficits over the last three years were financed via the extension of credit within the Eurosystem."

"By the end of 2010, ECB loans, which originated primarily from Germany’s Bundesbank, amounted to €340 billion."

" This figure includes ECB credit that financed capital flight from Ireland totaling €130 billion over the past three years."

nasty fact roll eh ???

conclusion:

" The ECB bailout program has enabled the people of the peripheral countries to continue to live beyond their means, and well-heeled asset holders to take their wealth elsewhere."

sinn's loop misses the obvious mobius strip like gambits availible to the ECB :

he prefers to act as if money creation powers do not exist :

"The capacity for continuing this policy will soon be depleted, as the central-bank money flowing from the GIPS countries to the core countries of the eurozone increasingly crowds out the money created through refinancing operations there. If this continues for two more years as it has for the past three, the stock of refinancing loans in Germany will disappear altogether."

" If German banks drop out of the refinancing business, the European Central Bank will lose the direct control over the German economy that it used to have via its interest-rate policy. "

"The main refinancing rate would then only be the rate at which the peripheral EU countries draw ECB money for purchases in the center of Europe, which ultimately would be the source of all the money circulating in the euro area."

the real nexus:

"The GIPS’ enormous current-account deficits"

which along with "...the massive exodus of capital from Ireland "

"... would not have been possible without ECB financing. "

"Without the additional money that GIPS central banks created in excess of their countries’ requirements for internal circulation, trade deficits could not have been sustained, and the GIPS’ commercial banks would have been unable to prop up asset prices "

.

" the longer bailout loans continue, the longer the GIPS’ current-account deficits will persist, and the more their external debts will grow. Eventually, these debts will become unsustainable."

"The sole exception is Ireland, which is suffering not from a lack of competitiveness, but from capital flight. Ireland is the only country that has lowered its prices and wages, and its current-account deficit is about to swing into surplus. By contrast, Spain’s external deficit is still above 4% of GDP, while Portugal and Greece recently recorded astronomical figures of around 10%."

how impossible is produced by chopping away the relevence of the possible :

.

"Apart from China, central banks don’t intervene to protect their currencies anymore. "

"Europe, too, will get a bloody nose if it keeps trying to artificially prop up asset prices in the periphery."

really why ??? by whom ??

" The sums required for this could ultimately run into trillions.... This would shatter Europe."

again really ??

why ???

we are left holding a mere assertion in our mitts

the rectification sinn style ??

"Apart from financial restructuring, which is crucial, Greece and Portugal must become cheaper in order to regain their competitiveness. Estimates for Greece assume that prices and wages need to come down by 20-30%. Things won’t be much different in Portugal."

there you have it the teutonic climax the orgasmic thought

real wage cuts equal to 20-30 % !!!!

hey herr sinn

why not send pigs wages back to the fuckin post war years ???

and this is really delightful

"If these countries lack the political consensus they need to pull this off, they should in their own interest consider leaving the eurozone temporarily to depreciate their currencies. "

but alas reality pulls him back from the rapsody of ravishment

"The banking system would not survive this without help, so the EU’s bailout activities should be refocused accordingly."

yikes the euro harnesss will become a haulter ....the debt structure a gibbet

so how exactly will the pigs "... benefit from a furlough from the eurozone." ???

no way out by staying in either since

"Depreciation inside the eurozone in the form of deflation...

would drive large parts of the real economy into excessive debt "

"only the value of (pigs) assets, not that of bank debts, would decline."

after providing the assurity of misery without any real up side

the sum up:

"It is time to face the fact that Europe’s peripheral countries have to shrink their nominal GDP to regain competitiveness. "

and then the implicit advice to jetison the fuckers now

" The only question is whether they will take the euro down as well."

Hans-Werner Sinn is Professor of Economics and Public Finance, University of Munich, and President of the Ifo Institute

tensions versus contradictions

the end of liberal thought

ie respectable academic thought

is the posing of a tensional relationship(s)

antinomy to use another word for it

with at least large over lapping signifigance

why the non use of the word contradiction ??

or dialectical

one might venture a guess

ie respectable academic thought

is the posing of a tensional relationship(s)

antinomy to use another word for it

with at least large over lapping signifigance

why the non use of the word contradiction ??

or dialectical

one might venture a guess

neo classical developments in a nut shell

some time in the late 60's the neo classicals abandoned the real economy

the production systems markets for the financial cloud economy above it

there they set up camp with all the old verities restored to full honors

the production systems markets for the financial cloud economy above it

there they set up camp with all the old verities restored to full honors

Monday, July 4, 2011

the spell over both pk and taylor

permanent income hypothesis uncle milty

one of akerloffs big five

the irrelevance of current profits to investment spending (the Modigliani-Miller theorem);

the long-run independence of inflation and unemployment (natural rate theory);

the inability of monetary policy to stabilize output (the Rational Expectations hypothesis);

the irrelevance of taxes and budget deficits to consumption (Ricardian equivalence)

one of akerloffs big five

the independence of consumption and current income

(the life-cycle permanent income hypothesis);

(the life-cycle permanent income hypothesis);

the irrelevance of current profits to investment spending (the Modigliani-Miller theorem);

the long-run independence of inflation and unemployment (natural rate theory);

the inability of monetary policy to stabilize output (the Rational Expectations hypothesis);

the irrelevance of taxes and budget deficits to consumption (Ricardian equivalence)

pk joins hands with taylor

"the tax cuts that made up much of the stimulus were probably largely saved"

the transfer system ineffective at system stablizing

that must include auto stabs how could it not ??

nothing is less perminent in income flux then auto stab action eh ???

not sure why this hasn't received direct address

the transfer system ineffective at system stablizing

that must include auto stabs how could it not ??

nothing is less perminent in income flux then auto stab action eh ???

not sure why this hasn't received direct address

more taylor

"Small or unreliable multipliers, the legacy of increased debt, the unpredictability and temporariness of such policies "

taylor in contradiction ????

"The theory that a short-run government spending stimulus will jump-start the economy is based on old-fashioned, largely static Keynesian theories. These approaches do not adequately account for the complex dynamics of a modern international economy"

"In a simple Keynesian model, all the government has to do to combat a recession is quickly increase government purchases, but the difficulty with doing so in practice is one of the classic arguments against discretionary fiscal policy"

"automatic stabilizers ...help stabilize the economy,"

"In a simple Keynesian model, all the government has to do to combat a recession is quickly increase government purchases, but the difficulty with doing so in practice is one of the classic arguments against discretionary fiscal policy"

"automatic stabilizers ...help stabilize the economy,"

Sunday, July 3, 2011

was QEII anticipated by market ??

|

was the higher expected rate of inflation after announcement of QEII "priced into markets ???

|

|

bending taylor rule meets ground zero => dirty stability region

.note the japan green circles trapped in zone of inefffective liquidity injections