Socially necessary work SNW gets spelled JOB

The grave strategic horror of the 20th century welfare state

The transfer system was from domestic producers as producers to citizens as consumers

The real progressive system would keep it all

Intra domestic producers as producers

Nouse of magical place of origin or other

Partitionings into haves and have nots

No

barrier borders

Produce here and to that extent

you are in the transfer system

The ratio of job hours to age becomes the basis for the provisioning rate

The social contract requires full employment at all times

And well designed jobs for all ages and abilities

Wednesday, February 29, 2012

Bandh in amerika ?

the occ might think of building to one

the closest fore runner the immigrant jobster demo-strike

April 10, 2006

build a milo reno cult ?

the closest fore runner the immigrant jobster demo-strike

April 10, 2006

build a milo reno cult ?

Tuesday, February 28, 2012

Securitization is progress toward fully socialized capital

The argument runs like this if you can sell your equity why bother to intervene

in that firms decider stream?

Big publicly held firms are near sighted

And top management tempted by fraud and looting

Okay I get the incentive package reform for top management

But why worry about anything more ?

in that firms decider stream?

Big publicly held firms are near sighted

And top management tempted by fraud and looting

Okay I get the incentive package reform for top management

But why worry about anything more ?

Managerial myopia .... private closely held and public corporations...studies suggest a difference in behavior

Closely held outfits invest more

And look further ahead

Public firms exposed to open markets in their equity

Tend to look only one quarter ahead

Cliche ?

That bit about investing more sounds in my ear

like a stone falling thru a bottomless well

Where's the plunk ?

Is there some sense in which a system of corporations all of which

Were public would in aggregate invest less then system of private firms ?

Invest here means not in securities or buying other firms up out right

But investing in real new production facilities

The whole game of social design of corporations seems pruned

Of systemic functions

Firms morph over time

Take on new forms

The whole system may require all the different forms to function sustainably

as it does

Too much reform seems to recommend running the broader evolution of the corporate form

In reverse

Why should it be a systemic virtue to isolate parts of the social capital ?

If private closely held firms seem to pounce faster on opportunity

Is that locally good but perhaps globally inferior

Surely the social capital needs to flow where it finds highest use

Or is that not about equity capital but credit funds

And is the law of equity capital to control with the smallest share of invested capital possible

Once founders cash in why out equity share in that corporations assets rise ?

Concentrating the gain from a well chosen path seems preferable

Given the top management class takes de facto ten percent of earnings

Why not the rest all be debt

Other then the need to easily transfer control over " the residual"

Equity is the handle on the suit case

Securitization of ownership capital

surely is that much closer to full socialization

And look further ahead

Public firms exposed to open markets in their equity

Tend to look only one quarter ahead

Cliche ?

That bit about investing more sounds in my ear

like a stone falling thru a bottomless well

Where's the plunk ?

Is there some sense in which a system of corporations all of which

Were public would in aggregate invest less then system of private firms ?

Invest here means not in securities or buying other firms up out right

But investing in real new production facilities

The whole game of social design of corporations seems pruned

Of systemic functions

Firms morph over time

Take on new forms

The whole system may require all the different forms to function sustainably

as it does

Too much reform seems to recommend running the broader evolution of the corporate form

In reverse

Why should it be a systemic virtue to isolate parts of the social capital ?

If private closely held firms seem to pounce faster on opportunity

Is that locally good but perhaps globally inferior

Surely the social capital needs to flow where it finds highest use

Or is that not about equity capital but credit funds

And is the law of equity capital to control with the smallest share of invested capital possible

Once founders cash in why out equity share in that corporations assets rise ?

Concentrating the gain from a well chosen path seems preferable

Given the top management class takes de facto ten percent of earnings

Why not the rest all be debt

Other then the need to easily transfer control over " the residual"

Equity is the handle on the suit case

Securitization of ownership capital

surely is that much closer to full socialization

Monday, February 27, 2012

Thesis: in the absence of exploitation and antagonistic classes the civic sector might not fail in it's attempts to find non state solutions to various market failures

Think about a complex of memes derived from say

Stiglitz and Shelling

What market failures those two unearthed

Might require nothing less then states to resolve ?

Simply Suggesting we locate the boundaries of effective free individual choice

Misses all the voluntary hierarchies of civic society

Rules are not state laws

Coercion is far broader then police and court action

Stiglitz and Shelling

What market failures those two unearthed

Might require nothing less then states to resolve ?

Simply Suggesting we locate the boundaries of effective free individual choice

Misses all the voluntary hierarchies of civic society

Rules are not state laws

Coercion is far broader then police and court action

Libertarians and civic failure

We here lots about market and state failure

And the symbiotic not just the predation and parasitism of that interaction

What about a broader failure then mere marketplace failures

What about general failure of The civic sector ?

We may consider the state as the civic sector operating by different means

Failure of the civic sector might explain the states necessity

Given rampant market failure

Let's look at other non commercial civic failures

Example close to the bone:

Many market failures might be resolved by civic action

But this fails

And the symbiotic not just the predation and parasitism of that interaction

What about a broader failure then mere marketplace failures

What about general failure of The civic sector ?

We may consider the state as the civic sector operating by different means

Failure of the civic sector might explain the states necessity

Given rampant market failure

Let's look at other non commercial civic failures

Example close to the bone:

Many market failures might be resolved by civic action

But this fails

turing's simple morphogenetic model verified

".. an activator and an inhibitor work together, a pencil and eraser."

" The activator’s expression would do something—say, make a stripe—

and the inhibitor would shut off the activator.

This repeats, and voilà, stripe after stripe after stripe."

profits soar but where's the revenue ??

"Over the last few decades, U.S. corporate tax revenue plunged to historic lows, falling from about 6 percent of GDP in the 1950s to barely more than 1 percent of GDP today."

"....while corporate profits have rebounded to their pre-recession heights, setting a record in the third quarter of 2011, corporate tax revenue..."

"Corporate tax revenue has plummeted for several reasons, but one of the big ones is the growth of deductions, loopholes, and outright tax evasion .... 30 major corporations, in fact,paid no corporate income taxes over the last three years, while making $160 billion in profits."

"....while corporate profits have rebounded to their pre-recession heights, setting a record in the third quarter of 2011, corporate tax revenue..."

"..., corporate taxes measured on a 12-month basis were still under $200 billion in November. That is well below a precrisis peak of about $380 billion and still far below the government’s fiscal 2012 target of $332 billion."

"Corporate tax revenue has plummeted for several reasons, but one of the big ones is the growth of deductions, loopholes, and outright tax evasion .... 30 major corporations, in fact,paid no corporate income taxes over the last three years, while making $160 billion in profits."

Sunday, February 26, 2012

"It is actual or potential balance of payments crises which have been decisive in breaking the habit of Keynesian demand management at the national level"

a cripps-o-gram circa early 80's

throwing in the towel here

a bad moment indeed

yes eng-soc labor was checked when in power

thru the 60's

by forex " idiocy "

and yet once broken free in the 70's

with the burst of class struggle thru wage risings

this ! ...this ...is the pwog sum up ?? thatcherism uber alles ... indeed

throwing in the towel here

a bad moment indeed

yes eng-soc labor was checked when in power

thru the 60's

by forex " idiocy "

and yet once broken free in the 70's

with the burst of class struggle thru wage risings

this ! ...this ...is the pwog sum up ?? thatcherism uber alles ... indeed

gross to net move in canada flips share dynamic

"... labour share as labour compensation divided by NDP"

( GDP less CCA*, taxes less subsidies, inventory valuation adjustment, and statistical discrepancy)

"the labour share rose between 1980 and 2005 from 70.0 per cent of NDP to 71.1 per cent

while the capital share fell from 30.0 per cent to 28.9 per cent of NDP. "

accounting trick warning

be ready for this pinkos

* CCA => capital consumption allowance

( GDP less CCA*, taxes less subsidies, inventory valuation adjustment, and statistical discrepancy)

"the labour share rose between 1980 and 2005 from 70.0 per cent of NDP to 71.1 per cent

while the capital share fell from 30.0 per cent to 28.9 per cent of NDP. "

accounting trick warning

be ready for this pinkos

* CCA => capital consumption allowance

why the median wage average productivity divergence ?

measurement issues

rising earnings inequality

falling terms of trade of labour

(the relationship between the prices workers receive for output and the cost of living)

falling labour share

"In the U.S. non-farm business sector, real median hourly wages rose at an average annual rate of 0.33 per cent between 1980 and 2005, while labour productivity increased at an average annual rate of 1.73 per cent over the same period."

The gap was therefore 1.40 percentage points per year."

" Rising inequality, captured by the difference between median and average real hourly compensation, was the most important explanation for the gap, explaining 45 per cent. "

"Labour‘s terms of trade, defined as the difference between the rate of growth of the price of output and the rate of growth of the price of consumption goods, contributed 23 per cent of the gap as the GDP deflator rose 2.99 per cent per year, while the CPI showed price inflation of 3.31 per cent. ....most (85 per cent) of the deterioration in labour‘s terms of trade stemmed from the quality-adjusted prices of private investment rising much less quickly than the CPI. The slow growth in the quality-adjusted prices of investment goods resulted from very slow growth in the prices of non-residential structures and real declines in the prices of equipment and software "

"The increasing importance of supplementary labour income explained 12 per cent of the gap between the growth rates of median wages and labour productivity."

" the decline in the labour share of GDP from 65.0 per cent in 1980 to 61.3 per cent in 2005, accounted for 17 per cent of the gap between the growth rates of median real wages and labour productivity. "

rising earnings inequality

falling terms of trade of labour

(the relationship between the prices workers receive for output and the cost of living)

falling labour share

"In the U.S. non-farm business sector, real median hourly wages rose at an average annual rate of 0.33 per cent between 1980 and 2005, while labour productivity increased at an average annual rate of 1.73 per cent over the same period."

The gap was therefore 1.40 percentage points per year."

" Rising inequality, captured by the difference between median and average real hourly compensation, was the most important explanation for the gap, explaining 45 per cent. "

"Labour‘s terms of trade, defined as the difference between the rate of growth of the price of output and the rate of growth of the price of consumption goods, contributed 23 per cent of the gap as the GDP deflator rose 2.99 per cent per year, while the CPI showed price inflation of 3.31 per cent. ....most (85 per cent) of the deterioration in labour‘s terms of trade stemmed from the quality-adjusted prices of private investment rising much less quickly than the CPI. The slow growth in the quality-adjusted prices of investment goods resulted from very slow growth in the prices of non-residential structures and real declines in the prices of equipment and software "

"The increasing importance of supplementary labour income explained 12 per cent of the gap between the growth rates of median wages and labour productivity."

" the decline in the labour share of GDP from 65.0 per cent in 1980 to 61.3 per cent in 2005, accounted for 17 per cent of the gap between the growth rates of median real wages and labour productivity. "

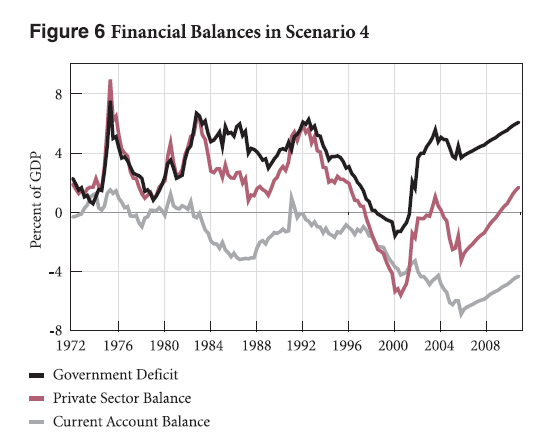

graphs that make my gut wrench

so where does this take a wage class advocate !

the chains of value added are so indeterminate

so much edgeworth slack in the various barter boxes

not to mention what in hell is a "return to capital"

ya ya

the gros surplus value has a certain meaning

err in a closed system

like market earth

at any level lower then that

nope !!!!

----------------------

now a refined prufrockian scepticism is a mere luxury

and the goal of the wage class is get a macro wage

that is at the feasible "rate max"

share max ?

might be an accounting trick

so on the national macro level

just push push push higher rates less hours

till aggregate surplus vanishes

once again "the real rotten core".... fuggled with a lousy graphic

IMF):

this is of course dumb without the size of the economy too

that modest % of gdp CAB surplus germany ran over the measured interval

big bucks

but

luxembourg ???

Saturday, February 25, 2012

comes the owl at dusk...

just as the trend of 40 years begins to reverse we get a flood of insight

"..A new --NBER-- study ....shows that the rapid rise in low-wage manufacturing industries overseas has indeed had a significant impact on the United States. "

"The disappearance of U.S. manufacturing jobs frequently leaves former manufacturing workers unemployed for years, if not permanently, "

".... creating a drag on local economies

and raising the amount of taxpayer-borne social insurance

necessary to keep workers and their families afloat "

file this under

"put some numbers to it ":

"A city at the 75th percentile of exposure to Chinese manufacturing,

compared to one at the 25th percentile,

will have roughly a 5 percent decrease in the number of manufacturing jobs

and an increase of about $65 per capita in the amount of social insurance needed"

".. $65 per capita wipes out one-third of the per-capita gains

realized by trade with China, in the form of cheaper goods"

-----------------------------------------------

what's obvious thru the front windshield

becomes conventional wisdom

only in the rear view mirror

"..A new --NBER-- study ....shows that the rapid rise in low-wage manufacturing industries overseas has indeed had a significant impact on the United States. "

"The disappearance of U.S. manufacturing jobs frequently leaves former manufacturing workers unemployed for years, if not permanently, "

".... creating a drag on local economies

and raising the amount of taxpayer-borne social insurance

necessary to keep workers and their families afloat "

file this under

"put some numbers to it ":

"A city at the 75th percentile of exposure to Chinese manufacturing,

compared to one at the 25th percentile,

will have roughly a 5 percent decrease in the number of manufacturing jobs

and an increase of about $65 per capita in the amount of social insurance needed"

".. $65 per capita wipes out one-third of the per-capita gains

realized by trade with China, in the form of cheaper goods"

-----------------------------------------------

what's obvious thru the front windshield

becomes conventional wisdom

only in the rear view mirror

Tuesday, February 21, 2012

menzie flies high

Markups, Competitiveness, and the Bush Tax Cuts and Deficits

The Administration released the annual Economic Report of the President on Friday. Many topics were covered, but here I’ll remark upon a few issues, motivated by several graphs.

First is price markup over unit labor cost. The interesting trend since 2001 has been the rise in this variable.

" From this graph, one would be hard pressed to find American business in terrible shape. Productivity has increased, labor compensation growth has been modest, so that it’s obvious where profits have come from. "

"This also means (to me) that there is substantial space for rising wages to be absorbed without a commensurate wage-price spiral.....rapid productivity growth combined with slow compensation growth has improved American competitiveness. Nominal dollar depreciation over that period emphasized that improvement."

" From this graph, one would be hard pressed to find American business in terrible shape. Productivity has increased, labor compensation growth has been modest, so that it’s obvious where profits have come from. "

"This also means (to me) that there is substantial space for rising wages to be absorbed without a commensurate wage-price spiral.....rapid productivity growth combined with slow compensation growth has improved American competitiveness. Nominal dollar depreciation over that period emphasized that improvement."

see the eye pop in recent profit bling

"During the recession of 2007-2009, the real aggregate annualized value of wages and salaries declined steeply, falling from $6,760 billion in the fourth quarter of 2007 to $6,424 billion in the second quarter of 2009, a decline of $336 billion or 5%.

Further reductions in these wage and salary accruals took place through the first quarter of 2010 before reversing course and rising by $124 billion or about 2% by the end of the year.

This implies that aggregate wages and salaries in real 2010 dollars failed to grow over the first seven quarters of the recovery, declining by $22 billion or .3%, the first ever such decline in any post-World War II recovery."

corporate profits (before tax and including capital consumption allowances and inventory change)

Annualized corporate profits in constant 2010 dollars rose very strongly in the first six quarters of the recovery, rising from $1,203 billion in the second quarter of 2009 to $1,667 billion in 2010 IV.

". Between the second quarter of 2009 and the fourth quarter of 2010, real national income in the U.S. increased by $528 billion. Pre-tax corporate profits by themselves had increased by $464 billion while aggregate real wages and salaries rose by only $7 billion or only .1%. Over this six quarter period, corporate profits captured 88% of the growth in real national income while aggregate wages and salaries accounted for only slightly more than 1% of the growth in real national income."

"the first six quarters following the end of the 2001 recession corporate profits captured 53% of the growth in real national income

. In the first six quarters of recovery from the 1990-91 recession, corporate profits experienced no growth

on average corporate profits generated 30 per cent of national income growth during the recoveries from the 1981-82 and 1973-75 recessions.

.

"The absence of any positive share of national income growth due to wages and salaries received by American workers during the current economic recovery is historically unprecedented. The lack of any net job growth in the current recovery combined with stagnant real hourly and weekly wages is responsible for this unique, devastating outcome."

Further reductions in these wage and salary accruals took place through the first quarter of 2010 before reversing course and rising by $124 billion or about 2% by the end of the year.

This implies that aggregate wages and salaries in real 2010 dollars failed to grow over the first seven quarters of the recovery, declining by $22 billion or .3%, the first ever such decline in any post-World War II recovery."

corporate profits (before tax and including capital consumption allowances and inventory change)

Annualized corporate profits in constant 2010 dollars rose very strongly in the first six quarters of the recovery, rising from $1,203 billion in the second quarter of 2009 to $1,667 billion in 2010 IV.

". Between the second quarter of 2009 and the fourth quarter of 2010, real national income in the U.S. increased by $528 billion. Pre-tax corporate profits by themselves had increased by $464 billion while aggregate real wages and salaries rose by only $7 billion or only .1%. Over this six quarter period, corporate profits captured 88% of the growth in real national income while aggregate wages and salaries accounted for only slightly more than 1% of the growth in real national income."

"the first six quarters following the end of the 2001 recession corporate profits captured 53% of the growth in real national income

. In the first six quarters of recovery from the 1990-91 recession, corporate profits experienced no growth

on average corporate profits generated 30 per cent of national income growth during the recoveries from the 1981-82 and 1973-75 recessions.

.

"The absence of any positive share of national income growth due to wages and salaries received by American workers during the current economic recovery is historically unprecedented. The lack of any net job growth in the current recovery combined with stagnant real hourly and weekly wages is responsible for this unique, devastating outcome."

Why the eurozone is not a united states of Europe

When the uncle 's transfer system on balance

Takes from one state and gives to another it's just the stabilizing equalizing compensating

That makes the whole in the long run more then the some of it's states

In the euro zone such a transfer is from nation to nation

is discretionary and gets called aide

The US gets a bum rap from the euros about our meager transfer system

They like to base this on white racism etc

it's Just the conflicts between nationalisms

as the wanna be united states of Europe is finding out

Takes from one state and gives to another it's just the stabilizing equalizing compensating

That makes the whole in the long run more then the some of it's states

In the euro zone such a transfer is from nation to nation

is discretionary and gets called aide

The US gets a bum rap from the euros about our meager transfer system

They like to base this on white racism etc

it's Just the conflicts between nationalisms

as the wanna be united states of Europe is finding out

Equalization versus liberation

There's a critical path here how wide may vary over any one course and between

Different national courses

But the split Germany experiment suggests neither is as basic

as material improvement in particular relative material improvement

Modern class self- consciousness is in part a product of material stagnation

Of the job class and ...and it's relative falling behind the upper rungs

Of it's own exploiter class

National consciousness obviously comes from cross national comparisons of peer nations

Germany nicely intensified the national consciousness of east Germans by making their national rival the other " 3/4's " of their own nation

Different national courses

But the split Germany experiment suggests neither is as basic

as material improvement in particular relative material improvement

Modern class self- consciousness is in part a product of material stagnation

Of the job class and ...and it's relative falling behind the upper rungs

Of it's own exploiter class

National consciousness obviously comes from cross national comparisons of peer nations

Germany nicely intensified the national consciousness of east Germans by making their national rival the other " 3/4's " of their own nation

Even elites stampede

The notion deeply embedded in the Madisonian design of our government

Among other hog ties

Contrived to retard swings of opinion and preference by scattering terms of elective office

No one election mandates for simple majority

The Brit system produced the post war labor government with a single election

This essay in formalism is meant to reveal a slightly divided mind

Among other hog ties

Contrived to retard swings of opinion and preference by scattering terms of elective office

No one election mandates for simple majority

The Brit system produced the post war labor government with a single election

This essay in formalism is meant to reveal a slightly divided mind

in GDR"teachers generally were staunch supporters of the GDR, but the author does not explain what was cause and what effect"

schooling as a sort of pre emptive version of a "re education kamp "

were teachers screened

or " did they choose this profession, in part at least, as a type of political act"

were teachers screened

or " did they choose this profession, in part at least, as a type of political act"

snipperts from a short retell of the account in vic grossmann's memoir

.

"...seemingly inherent in the system, was the nature of the GDR’s political life, which the Communist Party monopolized. ....individuals’ political differences with the regime—in thinking as well as in action—potentially entailed the withholding of advancement, privileges and rewards. The result was, of course, a virulent brew of dissembling and resentment......As a politically active Communist during the McCarthy Era, Grossman knew that ..."

".....the benefits of American-style democracy were largely limited to those who accepted the basic premises of the capitalist system.....and yet the curtailment of American civil liberties in this period did not seem to damage the capitalist system.

" However, the unraveling of the socialist system in the GDR and its ultimate dénouement was organically tied to the absence of democracy."

" Ultimately, the lack of genuine mass participation in its political life led to almost universal acquiescence in the demise of the GDR, and consequently of socialism, by those for whom it was intended—and whom it frequently did in fact benefit. Over time, most of its citizens had withdrwn into a private world of family and immediate community.....

there is a great nostalgia among former East Germans, including Grossman, for what many now describe as immensely satisfying society..."

"the largest group of people in the GDR, albeit somewhat grudgingly, had become accepting of a system that had become familiar and which provided definite advantages."

"However, the nature of the system promoted a mindset where a specific setback or disappointment—a fight with a supervisor or the inability to obtain a better apartment—led to renunciation of the entire system. After all, the point that the GDR was socialist was constantly put before people, whereas in the West, similar experiences rarely caused individuals to question capitalism."

".. there was no apparent class struggle in East Germany, so that the endless anti-capitalist appeals sounded hollow and unconvincing."

"...this denial of democratic rights... in turn alienated and pacified the general population and corrupted those who held or sought power, thereby creating the conditions for a massive implosion."

" Yet, the establishment of democracy within a socialist society seems to depend on a number of unlikely occurrences."

" Among these is the acquiescing to this system by those (such as managers and professionals) who could gain more under capitalism"

" and the acceptance by highly skilled groups of workers (such as electricians and master craftsmen) of less remuneration so that overall levels of income become more or less equalized"

Monday, February 20, 2012

but its still mostly about automation

"During our sample period, offshoring still was not a primary driver of aggregate employment changes in U.S. manufacturing. "

surprise surprise

its an NBER op :

at any rate might as well see the damn statistics

as in there are lies damn lies statistic and damn statistic

"..After decomposing the 17-percentage-point decline in U.S. manufacturing employment at home and assigning different causal factors to the decline, we find that the usual suspects account for only a tiny fraction of the observed decline. Greater import penetration accounts for 2 percentage points; lower and falling real wages in low-income countries where U.S. companies expanded their offshore operations only account for 2.4 percentage points of the reduction in U.S. manufacturing employment. We show that 12 percentage points out of the 17-percentage-point decline in U.S. employment can be attributed to the falling cost of capital. As the price of investment goods fell relative to wages, companies replaced people with machines. "

notes:

as above

please focus here

this was a NBER paper

translation

it is tilted pro MNC

and not about to indict the sponsoring "elements "

till the deed is done

--------------------

i think clear papers like this btw suggest we are entering a new era when de industrializing the north american continent will taper off

and re industrialization slowly crawl up

these are multi decade trends here

and places like NBER managed to keep these long trends obscure through out the goden years of MNC led deindustrialization

------------------

so why the reversal ?

one its time to expand markets inside east asia

and

the 30 year clobbering of industrial job forces has produced

a brand new wage environment

or at least is well past worrying about

the realizationn of that "happy " outcome

the treaty of detraoit is effectively abrogated

so lets re up the roduction system

slowly of course ever so slowly

surprise surprise

its an NBER op :

at any rate might as well see the damn statistics

as in there are lies damn lies statistic and damn statistic

"..After decomposing the 17-percentage-point decline in U.S. manufacturing employment at home and assigning different causal factors to the decline, we find that the usual suspects account for only a tiny fraction of the observed decline. Greater import penetration accounts for 2 percentage points; lower and falling real wages in low-income countries where U.S. companies expanded their offshore operations only account for 2.4 percentage points of the reduction in U.S. manufacturing employment. We show that 12 percentage points out of the 17-percentage-point decline in U.S. employment can be attributed to the falling cost of capital. As the price of investment goods fell relative to wages, companies replaced people with machines. "

notes:

as above

please focus here

this was a NBER paper

translation

it is tilted pro MNC

and not about to indict the sponsoring "elements "

till the deed is done

--------------------

i think clear papers like this btw suggest we are entering a new era when de industrializing the north american continent will taper off

and re industrialization slowly crawl up

these are multi decade trends here

and places like NBER managed to keep these long trends obscure through out the goden years of MNC led deindustrialization

------------------

so why the reversal ?

one its time to expand markets inside east asia

and

the 30 year clobbering of industrial job forces has produced

a brand new wage environment

or at least is well past worrying about

the realizationn of that "happy " outcome

the treaty of detraoit is effectively abrogated

so lets re up the roduction system

slowly of course ever so slowly

aggy quant estimation attempt ;" a 10 percentage point reduction in wages in low-income countries is associated with a 1 percent reduction in U.S. parent employment"

now summon a properly calibrated forex fiddle and ....

you can generate the last 30 years of hirky jerky ziggy zaggy

de industrialization of the north economy

you can generate the last 30 years of hirky jerky ziggy zaggy

de industrialization of the north economy

" In 1982, only one out of four employees of U.S. multinationals was located offshore, and over 90 percent of those employees were in industrial countries. By 2007, the share of offshore employment had reached 44 percent, and the majority of those jobs were in low-income countries"

and to think

the cosmo corporate elite

play on this spherical game board

with pieces

that have largely

self made "moving rules "

meaning ??

the last 30 years

" workers in low income countries appear to be substitutes for U.S. workers in several highly visible industries, including computers, electronics, and transportation.

following up with this trend

"... over the past two decades imports from low-wage countries have more than doubled

......different incentives for foreign investment lead to different organizational structures, which should produce different degrees of substitution between employment at home and abroad. Horizontal multinationals (H-FDI), defined as firms that produce the same products in different locations, are primarily motivated to locate abroad by trade costs. For H-FDI, investment abroad substitutes for parent exports, and foreign-affiliate employment should substitute for home employment. Vertically integrated enterprises (V-FDI) are motivated to locate different components of production in different locations by factor price differences. For V-FDI, sourcing different stages of production elsewhere can be complementary to employment growth at home."

btw

there you have a specimen of the perfect analytic result

utter ambiguity as to aggragate impact

but lets hustle ast that debating point....

to a forecast:

i suspect we will see

--- after the yellow track here in the low wage product

catchers mitt couintries--

a signifigant reversal of structural flows

to follow the change in MNC target output markets

and platform locations

faster internal sector expansion down under

out of existing and augmented MNC "holdings"

plus

a slow re industrialization "at the extensive margin "

here in the economic north

the cosmo corporate elite

play on this spherical game board

with pieces

that have largely

self made "moving rules "

meaning ??

the last 30 years

" workers in low income countries appear to be substitutes for U.S. workers in several highly visible industries, including computers, electronics, and transportation.

following up with this trend

"... over the past two decades imports from low-wage countries have more than doubled

......different incentives for foreign investment lead to different organizational structures, which should produce different degrees of substitution between employment at home and abroad. Horizontal multinationals (H-FDI), defined as firms that produce the same products in different locations, are primarily motivated to locate abroad by trade costs. For H-FDI, investment abroad substitutes for parent exports, and foreign-affiliate employment should substitute for home employment. Vertically integrated enterprises (V-FDI) are motivated to locate different components of production in different locations by factor price differences. For V-FDI, sourcing different stages of production elsewhere can be complementary to employment growth at home."

btw

there you have a specimen of the perfect analytic result

utter ambiguity as to aggragate impact

but lets hustle ast that debating point....

to a forecast:

i suspect we will see

--- after the yellow track here in the low wage product

catchers mitt couintries--

a signifigant reversal of structural flows

to follow the change in MNC target output markets

and platform locations

faster internal sector expansion down under

out of existing and augmented MNC "holdings"

plus

a slow re industrialization "at the extensive margin "

here in the economic north

what might we produce if had a go at full throttle macro injections

...

btw

in this context today

talk of large wide spread output bottle necks

right out there up ahead over the demand horizon

is a disgrace to reason

if our purpose is mass RE employment

and for the job class what else ought it to be ?

then

generate the demand and the system will find

the products the machines

and

the labor to produce them

or ...and here is the or

that kicks in .....we simply will import them !!!

yes that certainly reduces the efficiency of the multipliers

and adds to the potential external nominal debt

but these are matters we can deal with

in the goodness of time and by multiple means

---think recycle into a real shrink thru product and wage inflation ---

in this context today

talk of large wide spread output bottle necks

right out there up ahead over the demand horizon

is a disgrace to reason

if our purpose is mass RE employment

and for the job class what else ought it to be ?

then

generate the demand and the system will find

the products the machines

and

the labor to produce them

or ...and here is the or

that kicks in .....we simply will import them !!!

yes that certainly reduces the efficiency of the multipliers

and adds to the potential external nominal debt

but these are matters we can deal with

in the goodness of time and by multiple means

---think recycle into a real shrink thru product and wage inflation ---

...

bill vickrey and abba lerner

zeroed in on a far more important observation

the capitalist system requires excess capacity to operate effectively

ie profitably ..at all times...throughout the cycle

if the capitalist system is to operate sustainably

and without a class crisis

we will always have excss capacity

and as we approach the limits at the top of the cycle

either "the state "

will pre empt continued booming

if the hi fi system alone can't hault the expansion by its own spontaneous cycling

ie contraction will "emerge or be contrived

thru credit flow rate reduction

if the hi fi system doesn't spontaneously hit one of its minsky moments

and it doesn't too often these decades

i think we can see post 1945

a distinct preference here in the economic north

for contrived contractions

over big wallys

but still ...look out

fall 08 !!

that's why the fed is indy

to cut off the booms b4

either wages go wild

or

imports cause a forex crisis

ie the bottle necks are

"institutional"(credit availability )

not

physical (plant and equipment )

or

mass mental (hu cap ---know how )

zeroed in on a far more important observation

the capitalist system requires excess capacity to operate effectively

ie profitably ..at all times...throughout the cycle

if the capitalist system is to operate sustainably

and without a class crisis

we will always have excss capacity

and as we approach the limits at the top of the cycle

either "the state "

will pre empt continued booming

if the hi fi system alone can't hault the expansion by its own spontaneous cycling

ie contraction will "emerge or be contrived

thru credit flow rate reduction

if the hi fi system doesn't spontaneously hit one of its minsky moments

and it doesn't too often these decades

i think we can see post 1945

a distinct preference here in the economic north

for contrived contractions

over big wallys

but still ...look out

fall 08 !!

that's why the fed is indy

to cut off the booms b4

either wages go wild

or

imports cause a forex crisis

ie the bottle necks are

"institutional"(credit availability )

not

physical (plant and equipment )

or

mass mental (hu cap ---know how )

vintage larry keinism

If. Uncle taxes households with a high marginal propensity to save out of income

and transfer the proceeds to households with a high marginal propensity

to spend out of income

You can increase spending without changing the fiscal budget balance

And if domestic investment by firms

is in some way positively related to final household demand

You can induce higher investment

Larry Klein I think in the golden 40's was keen on some way to implement

this transfer

Much of post high 60's macro has been about destroying this simple mechanism

At the theoretical level

But its never failed empirically because it has never been tested

Of. Course one can well imagine. Both the target of the tax and the various claimants to the payments could create a very complex and

well blocked passage way

and transfer the proceeds to households with a high marginal propensity

to spend out of income

You can increase spending without changing the fiscal budget balance

And if domestic investment by firms

is in some way positively related to final household demand

You can induce higher investment

Larry Klein I think in the golden 40's was keen on some way to implement

this transfer

Much of post high 60's macro has been about destroying this simple mechanism

At the theoretical level

But its never failed empirically because it has never been tested

Of. Course one can well imagine. Both the target of the tax and the various claimants to the payments could create a very complex and

well blocked passage way

Sunday, February 19, 2012

Just how much could the compensation structure be altered...

And still produce the equivalent of today's social output

Of course equivalent would have to be carefully defined and since production and distribution can't really be separated without significant alterations to both ...

But too often the market value of an "earned " income is tacitly assumed

to be justified

By some higher wisdom vested in the radically free play of markets

These theoretical pure merit outcomes have long since vaporized

Under the scrutiny of micronomical analysts

Failure to optimize and justify outcomes is everywhere

That being Amazing enough in itself

Imagine vesting this authority in our real market outcomes

Just comparing relative hourly compensations for various activities across borders and bodies of water shows the range in the edgeworth hyper box

The open arc of the n contract curves to be ... if not huge then certainly

Well beyond ignorable

And hardly the bed rock for some socially contrived

tax and transfer based system of redistribution

Of course equivalent would have to be carefully defined and since production and distribution can't really be separated without significant alterations to both ...

But too often the market value of an "earned " income is tacitly assumed

to be justified

By some higher wisdom vested in the radically free play of markets

These theoretical pure merit outcomes have long since vaporized

Under the scrutiny of micronomical analysts

Failure to optimize and justify outcomes is everywhere

That being Amazing enough in itself

Imagine vesting this authority in our real market outcomes

Just comparing relative hourly compensations for various activities across borders and bodies of water shows the range in the edgeworth hyper box

The open arc of the n contract curves to be ... if not huge then certainly

Well beyond ignorable

And hardly the bed rock for some socially contrived

tax and transfer based system of redistribution

nk and them moronic mentalisms

when building models

implanting simplifying mentalisms

may be far worse

then building in a few simple mechanisms

implanting simplifying mentalisms

may be far worse

then building in a few simple mechanisms

Saturday, February 18, 2012

decoupling wages and value added

"First, Figure 1—‘net decoupling’—is based on an average measure. As a result, it captures the total compensation going to workers in the economy divided by the number of hours worked. By contrast, Figure 2 is based on a median, specifically the hourly wage of the middle worker. The two therefore diverge when the average is pulled up (and the median isn’t) when pay grows very strongly at the top, as it has in the past ten years.

Second, Figure 1 looks at total compensation rather than just wages. This means it includes things like employer pension contributions and employer National Insurance Contributions (NICs), which Figure 2 doesn’t. As such, there’s a reasonable argument that Figure 1 is a better gauge of the complete rewards derived by workers. Again, recent years have seen a widening gap between these two measures. As non-wage aspects of compensation have grown significantly, compensation has grown faster than wages.

The third difference, and the most technical, is that the two measures are calculated using different inflation indices. The first, used for net decoupling, is calculated using the GDP deflator, while the second uses the Retail Prices Index (RPI). What’s the difference and which one is right? The answer is that it depends what you’re analysing. If you want to compare productivity and pay fairly, you should use the same deflator for both—that is, the GDP deflator. But if you want to know how the purchasing power of pay is changing over time, you want to use the RPI. These two measures have moved apart very slightly in recent years. As the paper acknowledges, this trend is hard to interpret."

quick plan v slow think

learning is slow thinka grope and a crawl

central plans can pull off a leap

so comparative dynamics

that looks at one system

that requires emergent learning

ie trial and error n steps

versus another that can leap to the conclusion in one step

well that's not quick think versus slow think

its core path is toward the rational either way

but one is fast and trick or treat ish

the other slow and burkeanly reassuring

give me the leap

central plans can pull off a leap

so comparative dynamics

that looks at one system

that requires emergent learning

ie trial and error n steps

versus another that can leap to the conclusion in one step

well that's not quick think versus slow think

its core path is toward the rational either way

but one is fast and trick or treat ish

the other slow and burkeanly reassuring

give me the leap

austerity expansion is the price we pay for these NK models .......

.....with their expectation based

mental mechanics

if firms had deciders that thought a certain way

all at once

some really kool things become possible

and if you want to fool people

these hopes get brightly lit up

so more sordid real aims can slip thru

like pruning the social transfer system

and reducing the popular capacity to resist corporate dictates

the squeezing down of the social transfer system

the reduction of social payments

makes the job class nearly helpless

when fighting the private job and credit rationers

there is no income or credit

except thru your jobholding

occupy represents a symbolic rejection

of wall street dictat

real rejection would require a material base to exist for long spells

without a full time job

living room for the non corporate exploited

mental mechanics

if firms had deciders that thought a certain way

all at once

some really kool things become possible

and if you want to fool people

these hopes get brightly lit up

so more sordid real aims can slip thru

like pruning the social transfer system

and reducing the popular capacity to resist corporate dictates

the squeezing down of the social transfer system

the reduction of social payments

makes the job class nearly helpless

when fighting the private job and credit rationers

there is no income or credit

except thru your jobholding

occupy represents a symbolic rejection

of wall street dictat

real rejection would require a material base to exist for long spells

without a full time job

living room for the non corporate exploited

origins of the yellow flag moment

how can we explain the collective global certification

of oecd "go slow"

sometime during '09 ??

or how can a striking emergent outcome

look like and feel like a conspiracy

of oecd "go slow"

sometime during '09 ??

or how can a striking emergent outcome

look like and feel like a conspiracy

doctor ben's way is not the way

doc ben's way

doc ben's way was great

if all you want is to preserve and protect the existing wall street octopussy

notes on romer and moneatry policy at the zero bound

an inspiration to class founded thinking

some points on romer:

she makes a big fuss

about quantitaive easing and the use of monetary policy at the zero bound

the so called liquidity trap

better and more explicitly called

the for profit credit trap

she suggest by implication

these important distinctions

the austerian expansionists

fail to account for a stubborn reality resistent to their clavinist bromides

because they over look if not fail to consider

the impact of policy on the value of existing debt loads

lowering the expected nominal interest rate by squeezing

down uncle's expected borrow path

actually increases the real burden of existing debt

off setting reduced expected future costs of carrying addition debt

ie new deb used to finance spending on additional plant and equipment

there is a negative wealth effect/credit constraint effect

on all debtors that use existing balance sheets to collateralize loans

chrsity wants to use a price level target

to anchor higher inflation expectations

great ..if its effective

ie if the mentalism posited exists

it oughta work she claims

much as going off gold did in the mid 30's

--more prperly devaluing after pledges never to devalue ---

a regime change

that would among other things lower the expected debt burden of existing debt

ie

a postive wealth effect on existing debtors

as their real assets ie produced assets have a higher expeted replacement value

thru higher expected price paths for output

i higher product inflation and of course possibly higher wage rates

that increases the households expected income and the credit worthiness of lending against that households human capitals'

"expected lease rates"

i hate these sky high abstractions'

but you must get the gist

increased spending comes with a romer move

not so with a rubin move

ie an austerian move

the key is to think about product price moves

in conjunction with interest rate moves ie nominal rate moves

to determine the real rate on new debt

and the real and nominal value of existing debt

the real value is itself just the ration of two nominals

the numerator the interest rate

the denominator is the nominal "product price level "

in conjunction with interest rate moves ie nominal rate moves

to determine the real rate on new debt

and the real and nominal value of existing debt

the real value is itself just the ration of two nominals

the numerator the interest rate

the denominator is the nominal "product price level "

the direct approach is to do what will move the expected trend

in that denominator price level

relative to the expected trend in the numerator

nominal rates of interest

in that denominator price level

relative to the expected trend in the numerator

nominal rates of interest

.........

where romer falls away into abstraction

where precisely

the increase in interest rate sensitive spending comes from

where precisely

the increase in interest rate sensitive spending comes from

to get the kick up in spending requires more then just a reduced

market real borrowing rate

there must be an increase in profits and or wages not just to increase income

market real borrowing rate

there must be an increase in profits and or wages not just to increase income

and expected perminent firm or household income

but also firm and household credit worthiness

in a credit basec economy

margin spending is always credit based spending

-----------

obviously

the expected return on spending out of income

in future periods versus now

may or may not be borrowing versus lending rate sensitive

but may also --in credit constrained cases --

be impacted by changes in an independent shock like change

in risk sensitive delinquency and default noticing credit worthiness

------------------------------------

human capital is the real wealth of job class folks

no the value of their house lot

lot value is of course collateral borrowing

but the credit constraint bites when lot values are lowered

by a convulsion in the credit markets

only pre existing or coincident expectations

of a heating up in the job market

can set off the lending to job households

that funds their increased spending

most basically

RE EMPLOYMENT

the mentalism of decider expectations

needs a real out there mechanism running along side

enter fiscal policy

or in theory

a sudden loosening of credit constraints

a loosening

NOT based on a rise in expected rates of return

or reduced expected rates of delinquency and default

NOT based on a rise in expected rates of return

or reduced expected rates of delinquency and default

if you want to only use monetary ie credit policy

then you have to make uncle do massive counter cyclical lending

ie use a crazy loan qualification mechanism

the fed can't simply liquify and solventize

the existing "private"

credit institutions

ala gentle ben's way

............

since firms that are credit constrained exist

firms ready to spend out of new loans if they could qualify

as would ...of course... millions of credit constrained households

there is credit demand out there lots of it

but only uncle can sensibly take the risk involved in loaning to them

in fact uncle oughta be the ultimate risk taker at all times

the risk taker not just of last resort

nor the final holder of risk

but the initiator the originator of risk itself

in certain social improving sectors

nationalizing risk

was not the folly of the recent debacle

the folly was not clawing back form private hands

what was looted and thrown away

mostly thru that sublest of frauds

care less negligent gambling

firms ready to spend out of new loans if they could qualify

as would ...of course... millions of credit constrained households

there is credit demand out there lots of it

but only uncle can sensibly take the risk involved in loaning to them

in fact uncle oughta be the ultimate risk taker at all times

the risk taker not just of last resort

nor the final holder of risk

but the initiator the originator of risk itself

in certain social improving sectors

nationalizing risk

was not the folly of the recent debacle

the folly was not clawing back form private hands

what was looted and thrown away

mostly thru that sublest of frauds

care less negligent gambling

nra was a very cloudy indistinct attempt to use a mark up mechanism to lift the price level without altering the inflation trend line long term

a series of one time lifters

obviously a compulsory mark up market could accomplish this

simply directly accurately and without uneven bargained prices

and thus without that system's far worse micro distortions

operating with a rising floor not the spontaneous motion

that operated like a lowering ceiling

obviously a compulsory mark up market could accomplish this

simply directly accurately and without uneven bargained prices

and thus without that system's far worse micro distortions

operating with a rising floor not the spontaneous motion

that operated like a lowering ceiling

chris on her "big paper"

" the changes in fiscal policy were pretty small in the Great Depression. So in terms of accounting for what helped to end the Great Depression, the fiscal response mattered but was not very important because it was so small."

she means the recovery interval '33 to '37 of course

not the real full recovery triggred by the arsenal of democracy post sept '39

"What I showed in the paper was that there was a very aggressive monetary response – not only going off the gold standard, as Temin and Wigmore discuss, but following up with a big monetary expansion."

okay

the Temin expectational move was going off gold ie liberating the monetary base

" It was probably the one time in US history when we had a monetary expansion that was orchestrated by the executive branch rather than by the Federal Reserve."

no we had one from 43-51 as well

" In the mid-1930s a lot of gold was flowing to the US because of political tensions in Europe. Because we were back on the gold standard (but at a lower price for the dollar), the Treasury Department had the ability to turn the gold inflow into increases in the money supply."

okay now it was a devaluation not going off gold and an exogeneous safe haven flow

combining to allow easier credit

here called expanding the money supply

as if that were accomplished by a simple switch throw

as in

" As a result, the money supply grew rapidly after 1934."

but that today hasn't led to aggressive spending just ballooning real cash balances

" You can think of this as a very early version of quantitative easing – which economists describe as increasing the money supply even when interest rates are already at zero."

but chrissy what did the executive branch do

"I showed that this monetary expansion affected real interest rates by ending expectations of deflation."

note we're talking expectations of future real interest rates here

" In the data, interest-sensitive spending – such as business investment and consumer purchases of durable goods – responds to this fall in real interest rates. Interest-sensitive spending was a major engine leading us out of the Great Depression."

chrissy is relying on the same formal errr ..."mechanism" ..no mentalism

as the austerian expansionists ..no ?

the austerians argue fiscal budget tightening moves lead to lower expected or anticipated reral rates

ala bondage bobbly rubin

--though bondage boy was talking lower real because of lower nominal

where as chrissy is talking lower real because of higher inflation

i hate to say this but

maybe here is the rub

if we look at the re value of the existing debt jacket

there's a difference here

existing bonds in bobby R's regime change go up in nominal and real value

but

down in nominal and real value in chrissy's regime change

revaluation of the existing bond stock or devaluation ??

part of the recovery is lifting the burden of existing debt

"My study was one of the earlier papers to talk about whether monetary policy can be useful at the zero lower bound."

" I argued that absolutely it could be. "

"I think the Great Depression provides the best evidence we have that more aggressive monetary policy can help us to recover faster, even in a world of very low nominal interest rates"

wjhat are CR's parallels in todays driving

for devaluation

in particular

removing the pledge to stay as good as gold

and an nra policy of lifting prices ie administered inflation

she means the recovery interval '33 to '37 of course

not the real full recovery triggred by the arsenal of democracy post sept '39

"What I showed in the paper was that there was a very aggressive monetary response – not only going off the gold standard, as Temin and Wigmore discuss, but following up with a big monetary expansion."

okay

the Temin expectational move was going off gold ie liberating the monetary base

" It was probably the one time in US history when we had a monetary expansion that was orchestrated by the executive branch rather than by the Federal Reserve."

no we had one from 43-51 as well

" In the mid-1930s a lot of gold was flowing to the US because of political tensions in Europe. Because we were back on the gold standard (but at a lower price for the dollar), the Treasury Department had the ability to turn the gold inflow into increases in the money supply."

okay now it was a devaluation not going off gold and an exogeneous safe haven flow

combining to allow easier credit

here called expanding the money supply

as if that were accomplished by a simple switch throw

as in

" As a result, the money supply grew rapidly after 1934."

but that today hasn't led to aggressive spending just ballooning real cash balances

" You can think of this as a very early version of quantitative easing – which economists describe as increasing the money supply even when interest rates are already at zero."

but chrissy what did the executive branch do

"I showed that this monetary expansion affected real interest rates by ending expectations of deflation."

note we're talking expectations of future real interest rates here

" In the data, interest-sensitive spending – such as business investment and consumer purchases of durable goods – responds to this fall in real interest rates. Interest-sensitive spending was a major engine leading us out of the Great Depression."

chrissy is relying on the same formal errr ..."mechanism" ..no mentalism

as the austerian expansionists ..no ?

the austerians argue fiscal budget tightening moves lead to lower expected or anticipated reral rates

ala bondage bobbly rubin

--though bondage boy was talking lower real because of lower nominal

where as chrissy is talking lower real because of higher inflation

i hate to say this but

maybe here is the rub

if we look at the re value of the existing debt jacket

there's a difference here

existing bonds in bobby R's regime change go up in nominal and real value

but

down in nominal and real value in chrissy's regime change

revaluation of the existing bond stock or devaluation ??

part of the recovery is lifting the burden of existing debt

"My study was one of the earlier papers to talk about whether monetary policy can be useful at the zero lower bound."

" I argued that absolutely it could be. "

"I think the Great Depression provides the best evidence we have that more aggressive monetary policy can help us to recover faster, even in a world of very low nominal interest rates"

wjhat are CR's parallels in todays driving

for devaluation

in particular

removing the pledge to stay as good as gold

and an nra policy of lifting prices ie administered inflation

" I firmly believe that the stresses on the US economy in 2008 were much larger than those in 1929 and 1930. So why has this recession, as bad as it has been, not been a second Great Depression or even worse? I think the answer is a much better policy response."

"The bottom line is that the Great Recession showed us that we have effective tools to fight a terrible downturn. But we also have much to learn about how to use those tools more successfully"

gentle ben's license to intervene

that marks a new qualitative stage in central bank activism

ben bought in all the markets he chose to buy

and bought deep..... if he so chose

his counter part in 1930 as pivot master

of global credit flows

was good old crank monte norman

who lacked both the balls and the clout

ben does indeed look like an improvement over monte

---------------

but here's chrissy

"we learned from the Temin and Wigmore paper ... one way out of a recession

at the zero lower bound is by changing expectations"

"a regime change ...a new day "

as in ?

".. targeting a path for nominal GDP. If the Fed adopted such a nominal GDP target, they would start in some normal year before the crisis and say nominal GDP should have grown at a steady rate since then. Compared with that baseline, nominal GDP is dramatically lower today. Pledging to get back to the pre-crisis path for nominal GDP would commit the Fed to much more aggressive policy – perhaps more quantitative easing and deliberate actions to talk down the dollar. Such a strong change in the policy framework could have a dramatic effect on expectations, and hence on the behavior of consumers and businesses."

expectations management

my my

ben bought in all the markets he chose to buy

and bought deep..... if he so chose

his counter part in 1930 as pivot master

of global credit flows

was good old crank monte norman

who lacked both the balls and the clout

ben does indeed look like an improvement over monte

---------------

but here's chrissy

"we learned from the Temin and Wigmore paper ... one way out of a recession

at the zero lower bound is by changing expectations"

"a regime change ...a new day "

as in ?

".. targeting a path for nominal GDP. If the Fed adopted such a nominal GDP target, they would start in some normal year before the crisis and say nominal GDP should have grown at a steady rate since then. Compared with that baseline, nominal GDP is dramatically lower today. Pledging to get back to the pre-crisis path for nominal GDP would commit the Fed to much more aggressive policy – perhaps more quantitative easing and deliberate actions to talk down the dollar. Such a strong change in the policy framework could have a dramatic effect on expectations, and hence on the behavior of consumers and businesses."

expectations management

my my

the duchess of pop over quotes e cary brown and confirms the stag sitz krieg at the fed

“Fiscal policy....seems to have been an unsuccessful recovery device

“Fiscal policy....seems to have been an unsuccessful recovery devicein the ’thirties – not because it did not work, but because it was not tried.”

quoting e cary brown

gentle ben's actions to save the "credit system"

"there was real strain in financial markets starting from late 2007, with the meltdown in subprime mortgages. The Fed worked very hard throughout 2008 to mitigate the consequences of falling house prices and credit contraction. They were very proactive. Then when the crisis hit in the fall of 2008, the Fed was essential in helping to prevent a much more catastrophic meltdown. They kept the financial crisis from being much worse than it otherwise would have been. It's hard to second-guess them on that part of their response."

okay in other words all hands on deck all out to save our credit system

from siezing up here and there and by pre empting such siezures preventing serious dislocations ie disrupted systemic counter party interflows

ie keep the internal moving parts from grinding each other to powder

but now she turns on gentle ben:

"Where I think you can second-guess them is once we got through the immediate crisis. By the fall of 2009, the financial system had stabilised but the rest of the economy was still reeling from the fallout and unemployment was heading up to 10%."

wait ..the fall of 09 ..

try the spring of 09

at any rate

" Instead of further aggressive moves to encourage faster recovery, such as more quantitative easing or a bold communications policy, the Fed essentially took a breather. That was a mistake."

the why is of course left as a mistake

when we all know by now

stop the contraction was a mission that had to be completed swiftly

...once the convulsions began ..and proved quite unexpectedly severe ...

but a recovery ?

that was to be kept slow in the economic north

while the traders of the south might zoom back

this to improve north south trade imbalances

and within the oecd a second tier of double tracking

was clear policy

hence the teutonics v the piigs

and england too

uncle ?

as the global core

uncle was allowed to remain half and half

and obviously efforts to retain the euro harness required and continue to require

complex inner "workings" by the ECB

christie:

ohbummer with his larry recovery act

and ben's interventions

was better then hoover

" this recession, as bad as it was, wasn't a second Great Depression. The policy response was much more effective and much more aggressive than it was in the early thirties."

which nicely doesn't answer the question

ya but was it better then the new deals first two terms ?

which saw as e cary brown concluded

full fiscal action

"never tried"

as pk points out

ohbummer's first term after the first 6 months of '09

macro poicy wise

looks a heel of a lot like fdr's second term

chrissy

"....what happened in 1937. Basically, monetary and fiscal policymakers got tired of all the exceptional things they were doing to help the economy, and they tightened policy too soon. The result was a “depression within a depression” – a big downturn that sent unemployment shooting back up when we were far from fully recovered."

well ohbummer did better then that too so he's like sorta better then roosevelt

but not because he faced only conditions half so severe

would he have run the deficit needed to recovery from a 1933 economy ???

".. we learned over the first half of 2009 that the recession was much worse than almost anyone had expected, and that the recovery would likely be slow...I argued that it would be a terrible mistake to take away support for the economy too soon, and that in fact we needed to be doing more, not less, to help the economy."

she lost that debate

because the fuckers wanted a slow if fairly steady long arching recovery

here

in norte amigo

a recovery not led by a big fiscal deficit

but led by the MNCs and their backers the wally boys

under de facto wall street rules

fiscal deficits are used to stablize not to recovery

why uncle oughta have a make good transfer system for lower levels of gubmint

revenues expending at "potential output rates " is a dynamic stablizer

obviously

budget balancing requirements oughta include a make good federal trend spending mechanism

tied to state & county & local private sector performance

even a bulky trigger system based on a nation wide metric would be better then the precent discretionary nonsense

'

as pk in full soap opera mode suggests

"we could put well over a million people to work... without any need to come up with new projects; just transfer enough money to state and local governments to let them return to doing the essential business of government.."

--cue string quartet --

"... like educating our children."

ah yes perseverate perseverate about dah schoolin of dah keeeeds

Friday, February 17, 2012

vulture funds and the piigs ..and Oblomovshchina

good topic for some one not .....not .....more lazy then oblomov

the east is red .... capitalism

Ben Daniels said...

Here's my take (excerpted from page 5):

The partial privatization creates appropriate incentives for free exchange and demands efficiency gains from all enterprises, even government-owned ones, because of the impacts on share price and market capitalization that would result from mismanagement. The dual-track system of marginal privatization is utilized inthis context to create a robust market without eroding the core tenet of socialist public ownership.

http://www.scribd.com/doc/47752272/China%E2%80%99s-Social-Capitalism

The partial privatization creates appropriate incentives for free exchange and demands efficiency gains from all enterprises, even government-owned ones, because of the impacts on share price and market capitalization that would result from mismanagement. The dual-track system of marginal privatization is utilized inthis context to create a robust market without eroding the core tenet of socialist public ownership.

http://www.scribd.com/doc/47752272/China%E2%80%99s-Social-Capitalism

paine said in reply to Ben Daniels...

too much non precision

though capitalist at the margin has a nic set of

"possible "..."possible " meanings

---------------------

"the impacts on share price and market capitalization that would result from mismanagement"

no one has yet demonstrated equity markets provide a superior guidance system for corporate enterprise

particularly where funds can flow in by other means

law of corporate funding:

funds will be gotten if they can be gotten

by what ever means necessary

if both operate in a market system

the comparative dynamics of equity centered operations versus

flat out "state enterprise "

is at best ambiguous

----------------

the private margin of a state enterprise

can be as focused

as an efficient incentive plan

for top state enterprise

exceutive agents

on ownership forms

multi level state

and mixed state/public autonomous investment funds

strikes me as quite possibly superior

in many respects

including social welfare as broadly construed...

at least ab novo

then straight out at the extensive margin

private stock holding

though capitalist at the margin has a nic set of

"possible "..."possible " meanings

---------------------

"the impacts on share price and market capitalization that would result from mismanagement"

no one has yet demonstrated equity markets provide a superior guidance system for corporate enterprise

particularly where funds can flow in by other means

law of corporate funding:

funds will be gotten if they can be gotten

by what ever means necessary

if both operate in a market system

the comparative dynamics of equity centered operations versus

flat out "state enterprise "

is at best ambiguous

----------------

the private margin of a state enterprise

can be as focused

as an efficient incentive plan

for top state enterprise

exceutive agents

on ownership forms

multi level state

and mixed state/public autonomous investment funds

strikes me as quite possibly superior

in many respects

including social welfare as broadly construed...

at least ab novo

then straight out at the extensive margin

private stock holding

paine said in reply to paine...

"Chinese economic actors had their hands tied by the liberal expectations of massive multinationals"