there are just risks with too high premiums "

so uncle steps in ...right ?

how ?

let us count the ways uncle is unlike a private insurance compnay

uncle has risky mae for big cats

where did she come from ?

" Governmental disaster insurance schemes didn’t appear magically in a vacuum;

they were created because no one was willing to pay enough money in premiums

to allow insurance companies to properly fund for them,

and as a result the inevitable losses were uncovered."

Wednesday, October 31, 2012

a gaseous reply to the sandman

sand man:

"But... but... arguing over a multiplier makes it a value-free ideology!"

"But... but... arguing over a multiplier makes it a value-free ideology!"

Skillful divisions among specialists can parse out responsibility beyond recognition as such

This dark side of the moon has it's bright side

We can shorten the time line for Lady Progress

who as we all ought to know by now

is no damn humanist

This dark side of the moon has it's bright side

We can shorten the time line for Lady Progress

who as we all ought to know by now

is no damn humanist

...

Old Job's enlightenment is a cautionary lesson to us all

How dare we frail limited beings question the unfolding stages

Of Clio's working out of jehovah's grand imminent design

For us

Would you rewrite Shakespeare ?

How dare we frail limited beings question the unfolding stages

Of Clio's working out of jehovah's grand imminent design

For us

Would you rewrite Shakespeare ?

...

Have faith we as earth's top species

are headed toward something glorious

And ghosh darn it

a glory of our own making

are headed toward something glorious

And ghosh darn it

a glory of our own making

the constrained choice that preserves the system

mitt or barry ?

Okay so it could be a wee bit less constrained

but kalecki macro policy

Would prove to be the thin edge of the wedge

after all that more or less leads to a profit squeeze wage price spiral ...no ?

Why revisit the roaring70's ?

That is unless you have a cure

for the wage/ profit product price spiral

cures exist

but they break the constraints

cures would only push the system away from

it's self preserving center

of de facto state power

ahhh The private oligopoly outfits

they find the way forward eventually

after trying every other way first

and even when they move the system forward

one can easily count the piles of forgone private wages

and social output

latest example

the fall 08 crisis ...

12 trillion in sacrficed output

to find the way thru this

whilst keeping within the system constraints

Okay so it could be a wee bit less constrained

but kalecki macro policy

Would prove to be the thin edge of the wedge

after all that more or less leads to a profit squeeze wage price spiral ...no ?

Why revisit the roaring70's ?

That is unless you have a cure

for the wage/ profit product price spiral

cures exist

but they break the constraints

cures would only push the system away from

it's self preserving center

of de facto state power

ahhh The private oligopoly outfits

they find the way forward eventually

after trying every other way first

and even when they move the system forward

one can easily count the piles of forgone private wages

and social output

latest example

the fall 08 crisis ...

12 trillion in sacrficed output

to find the way thru this

whilst keeping within the system constraints

behind nick rowe's ass looms a barking dog ...or two

On Nick Rowe's point about the competing definitions of money, clearly both are there. Indeed, that they both operate is key to the fundamental contradiction that faces monetary policymakers all the time: whether to expand or limit the size of the money supply, whatever it is. The medium of exchange function says, "expand" so the economy can grow, while the unit of account function says "limit it" so that the unit of account can retain its value over time. There is no escape from this conflict.

Paine said in reply to Barkley Rosser...

Nick has simply drawn up another useless fragment world

The apparent significance comes from the word gold

The social choice of medium of account here needs motivation

Just what he can't provide

The pure medium of account is an entirely different sort of entity

From commodity money or commodities

Its like the word tree or the number two

The trick is realizing our obligations fixed in some medium of account

Untied to real supply constraints

Has a purely social existence like spoken language

I'm too bored to make full sense of this

But once again

Nick has draughted up a toon tale

From his own private Cockroach terrace of the dismal science

Again as usual

Nick has obliviously awakened

a frost giant he can hardly manage

It's supply is limitless and of no material cost

The apparent significance comes from the word gold

The social choice of medium of account here needs motivation

Just what he can't provide

The pure medium of account is an entirely different sort of entity

From commodity money or commodities

Its like the word tree or the number two

The trick is realizing our obligations fixed in some medium of account

Untied to real supply constraints

Has a purely social existence like spoken language

I'm too bored to make full sense of this

But once again

Nick has draughted up a toon tale

From his own private Cockroach terrace of the dismal science

Again as usual

Nick has obliviously awakened

a frost giant he can hardly manage

It's supply is limitless and of no material cost

Nick's consistent big trick

Turn everything into an exchange system super imposed on a pure human services

Production system

He abstracts from every particular that characterizes

our principal existing market system

private production relying primarily on co operating groups of wage paid

Skill divided machine assisted direct producers

A social production system Organized and activated for Private profit

Any goony toon

game board

spuriously essentializing conjury of his

Is just another. Duck blind another

Shooting gallery

To conceal our misery from ourselves

With his lates paper and paste potemkin citizen paradise

market system for real products in the full commodity form

Turn everything into an exchange system super imposed on a pure human services

Production system

He abstracts from every particular that characterizes

our principal existing market system

private production relying primarily on co operating groups of wage paid

Skill divided machine assisted direct producers

A social production system Organized and activated for Private profit

Any goony toon

game board

spuriously essentializing conjury of his

Is just another. Duck blind another

Shooting gallery

To conceal our misery from ourselves

With his lates paper and paste potemkin citizen paradise

market system for real products in the full commodity form

He's challenging for a big chair here

The George Will professor of play station PAC man political economy

The George Will professor of play station PAC man political economy

Paine said in reply to Barkley Rosser...

You get it of course

There has to be an implicit assumption

The inter temporal obligation grid

is set in units of what ever is the universally accepted means of payment

Providing more of this medium is costless to the supplier

So it could be provided limitlessly on demand

To pay for real products

But this may well alter product prices

And this mpacts the value of this inter temporal grid

There has to be an implicit assumption

The inter temporal obligation grid

is set in units of what ever is the universally accepted means of payment

Providing more of this medium is costless to the supplier

So it could be provided limitlessly on demand

To pay for real products

But this may well alter product prices

And this mpacts the value of this inter temporal grid

If some monarch set and reset the exchange ratio between the currency

and the unit of account used in the obligation grid superimposed on the payments system

Well...he or she would soon enough get out sourced along with his or her unit of account

Beyond his or her ability to extract tax payments etc in his or her choice of means of payment

and the unit of account used in the obligation grid superimposed on the payments system

Well...he or she would soon enough get out sourced along with his or her unit of account

Beyond his or her ability to extract tax payments etc in his or her choice of means of payment

The absurd genteel discourse among tenured Econ con coxcomb. Merlins

Is a blisteringly bad joke

Just call John Taylor a Plutocrats street whore mr Paul K

Sacrifice your skunk skin robes

Be a Nassau county St Francis

Go naked into the fields

Calling out these mountebanks by name and address

Do it for the great flocks of american peoples

you wish to serve

Is a blisteringly bad joke

Just call John Taylor a Plutocrats street whore mr Paul K

Sacrifice your skunk skin robes

Be a Nassau county St Francis

Go naked into the fields

Calling out these mountebanks by name and address

Do it for the great flocks of american peoples

you wish to serve

an exchange on mitt's han jeep jump whopper

pgl said...

Ah c'mon. Why is this news? Romney has lied about EVERYTHING. Don't you know he is running for LIAR IN CHIEF?

Paine said in reply to pgl...

I'm surprised at you pro growth

Here I must play the popular front defender of our bourgeois liberal institutions

Romney has campaigned as if to prove explicitly

The media can not stop a well funded all fronts assault on the objective truth

Yes I know the so called objective truth is such a bourgeois shibboleth

But surely this campaign if it succeeds

Will pave the way to..all future campaigns

Once a candidate loses fear of the media

so long as he or she retains ample donors

able to buy up adequate air time and space on this very same media

The challenge here is to the old elite channels of the news

Mitt has said to them

Fuck u

Here I must play the popular front defender of our bourgeois liberal institutions

Romney has campaigned as if to prove explicitly

The media can not stop a well funded all fronts assault on the objective truth

Yes I know the so called objective truth is such a bourgeois shibboleth

But surely this campaign if it succeeds

Will pave the way to..all future campaigns

Once a candidate loses fear of the media

so long as he or she retains ample donors

able to buy up adequate air time and space on this very same media

The challenge here is to the old elite channels of the news

Mitt has said to them

Fuck u

Yes the little bush big Chaney gang

had the essence of this on board

With their

" we are the makers of reality not it's observers "

meme

Now this campaign certifies the new politics

The genteel old broadcasting networks and big city daily outfits

With their confected objectivity in reportage

Is impudently insolently slapped in the face

Literally every day by the mitt band wagon

had the essence of this on board

With their

" we are the makers of reality not it's observers "

meme

Now this campaign certifies the new politics

The genteel old broadcasting networks and big city daily outfits

With their confected objectivity in reportage

Is impudently insolently slapped in the face

Literally every day by the mitt band wagon

Ya the old jags derseve no beter

But it's the American little guys white as well as rain bowed

that will take the shot to the chops here

But it's the American little guys white as well as rain bowed

that will take the shot to the chops here

I recall the media bringing down nixon

And I recall the media " deciding" to accept Reagan

But now the arrogant sclerotic bastards are getting cuffed around like parlor pets

And I recall the media " deciding" to accept Reagan

But now the arrogant sclerotic bastards are getting cuffed around like parlor pets

Paine said in reply to SomeCallMeTim...

Blaming the white uneducated low info electorate is silly

The liberal guardians of these narrow minded warped fools

And all their. Sacred " rights" and exceptional" prosperity"

The big media

are failing to protect them from this vulture

The liberal guardians of these narrow minded warped fools

And all their. Sacred " rights" and exceptional" prosperity"

The big media

are failing to protect them from this vulture

jonathan said...

Have you thought about this in terms of market theories?

One idea is that there is a marketplace for information and that more players, more information not only generates more "information" but acts as a corrective which encourages better information. This is a version of the idea that markets are beneficial; it takes the idea of market optimization and adds to it the kind of qualitative outcome proponents of market theories say are the natural result.

In contrast there is the idea that bad drives out good. Advertising for false medical remedies didn't go away until they were regulated, etc.

Looking at what's been happening, it looks like political advertising is more like medical remedies than what proponents of markets hope. There is a benefit in lying. Or at least a perceived benefit in lying and that's what counts. Lose the election and lie again the next time.

I'm going to remember how this has evolved whenever anyone says we should rely on markets to achieve an optimal result. We may want a result but that doesn't mean markets will generate what we want. This was the old rationale for regulation: unchecked, markets go their own way and that can be bad because markets generate outcomes that are optimal only in the sense they are generated by the market.

One idea is that there is a marketplace for information and that more players, more information not only generates more "information" but acts as a corrective which encourages better information. This is a version of the idea that markets are beneficial; it takes the idea of market optimization and adds to it the kind of qualitative outcome proponents of market theories say are the natural result.

In contrast there is the idea that bad drives out good. Advertising for false medical remedies didn't go away until they were regulated, etc.

Looking at what's been happening, it looks like political advertising is more like medical remedies than what proponents of markets hope. There is a benefit in lying. Or at least a perceived benefit in lying and that's what counts. Lose the election and lie again the next time.

I'm going to remember how this has evolved whenever anyone says we should rely on markets to achieve an optimal result. We may want a result but that doesn't mean markets will generate what we want. This was the old rationale for regulation: unchecked, markets go their own way and that can be bad because markets generate outcomes that are optimal only in the sense they are generated by the market.

Paine said in reply to jonathan...

The old media giants provided de facto regulations

Yes within broad margins

Used for Madison avenue as well

But this is medicine show stuff

Without a sheriff to run em out of the county

Yes within broad margins

Used for Madison avenue as well

But this is medicine show stuff

Without a sheriff to run em out of the county

denim said...

I hear that God is on our side, those of us who work righteousness. Acts 10:34:

"Then Peter opened his mouth, and said, Of a truth I perceive that God is no respecter of persons: But in every nation he that feareth him, and works righteousness, is accepted with him."

And for lying politicians of any ilk, Psalm 50:

"...14 Sacrifice thank offerings to God, fulfill your vows to the Most High, 15 and call upon me in the day of trouble; I will deliver you, and you will honor me.” 16 But to the wicked, God says: “What right have you to recite my laws or take my covenant on your lips? 17 You hate my instruction and cast my words behind you. 18 When you see a thief, you join with him; you throw in your lot with adulterers. 19 You use your mouth for evil and harness your tongue to deceit. 20 You speak continually against your brother and slander your own mother’s son. 21 These things you have done and I kept silent; you thought I was altogether like you. 14 Sacrifice thank offerings to God, fulfill your vows to the Most High, 15 and call upon me in the day of trouble; I will deliver you, and you will honor me.” 16 But to the wicked, God says: “What right have you to recite my laws or take my covenant on your lips? 17 You hate my instruction and cast my words behind you. 18 When you see a thief, you join with him; you throw in your lot with adulterers. 19 You use your mouth for evil and harness your tongue to deceit. 20 You speak continually against your brother and slander your own mother’s son. 21 These things you have done and I kept silent; you thought I was altogether like you. But I will rebuke you and accuse you to your face."

"These things you have done and I kept silent; you thought I was altogether like you. But I will rebuke you and accuse you to your face."

If looks could stop a clock,

http://nymag.com/daily/intel/2012/10/romney-says-hes-winning-its-a-bluff.html

"Then Peter opened his mouth, and said, Of a truth I perceive that God is no respecter of persons: But in every nation he that feareth him, and works righteousness, is accepted with him."

And for lying politicians of any ilk, Psalm 50:

"...14 Sacrifice thank offerings to God, fulfill your vows to the Most High, 15 and call upon me in the day of trouble; I will deliver you, and you will honor me.” 16 But to the wicked, God says: “What right have you to recite my laws or take my covenant on your lips? 17 You hate my instruction and cast my words behind you. 18 When you see a thief, you join with him; you throw in your lot with adulterers. 19 You use your mouth for evil and harness your tongue to deceit. 20 You speak continually against your brother and slander your own mother’s son. 21 These things you have done and I kept silent; you thought I was altogether like you. 14 Sacrifice thank offerings to God, fulfill your vows to the Most High, 15 and call upon me in the day of trouble; I will deliver you, and you will honor me.” 16 But to the wicked, God says: “What right have you to recite my laws or take my covenant on your lips? 17 You hate my instruction and cast my words behind you. 18 When you see a thief, you join with him; you throw in your lot with adulterers. 19 You use your mouth for evil and harness your tongue to deceit. 20 You speak continually against your brother and slander your own mother’s son. 21 These things you have done and I kept silent; you thought I was altogether like you. But I will rebuke you and accuse you to your face."

"These things you have done and I kept silent; you thought I was altogether like you. But I will rebuke you and accuse you to your face."

If looks could stop a clock,

http://nymag.com/daily/intel/2012/10/romney-says-hes-winning-its-a-bluff.html

Dave said...

My only quibble with this premise: We've never had a "truth" era in US politics, so we can't have a "post-truth" era. Pick a supposed idyllic time when men were real men, and I'll give you a completely outrageously wrong political lie that formed the centerpiece of a party agenda.

Paine said in reply to Dave...

Come now surely we can discuss degree changes

And surely as a system heats up it goes thru qualitative changes

Might we not have seen red hot lies final boil off the water in the pan here ?

Isn't this like global warming leading to climate change

And like climate change

Given the gravity of change

Imagine a completely impotent media

unable to mediate and moderate

the adversarial exchanges

It's certainly a conjecture one ought to consider thrusts the burden of proof on the rejection side

And surely as a system heats up it goes thru qualitative changes

Might we not have seen red hot lies final boil off the water in the pan here ?

Isn't this like global warming leading to climate change

And like climate change

Given the gravity of change

Imagine a completely impotent media

unable to mediate and moderate

the adversarial exchanges

It's certainly a conjecture one ought to consider thrusts the burden of proof on the rejection side

Oupoot said...

Only in the US. Freedom of speech is critical for democracy and should be protected. But most civilised countries have placed limits to this right precisely so that they remain civilised.

Mano Philips said...

My comment on Dana Milbank's Washington Post column

"Romney goes off-road with the truth"

The Elephant in the Room

It was Romney who shipped thousands of Auto jobs to China; why is MSM silent on this.

Investigative Reporter Greg Palast on Truthout

"The truth? On June 1, 2009, the Obama administration announced that Detroit Piston's owner Tom Gores, GM and the US Treasury would buy back Delphi.The plan called for saving 15 of 29 Delphi factories in the US. Then the vulture funds pounced. The Nation discovered that, in the two weeks immediately following the announcement of the Delphi jobs-saving plan, Paul Singer, Romney's partner, secretly bought up over a billion dollars of old Delphi bonds for pennies on the dollar. Singer and partners now controlled the company - and killed the return of Delphi to GM. These facts were revealed in a sworn deposition of Delphi's Chief Financial Officer John Sheehan, confidential, but now released on the Web. Sheehan said, under oath, that these speculators threatened to withhold key parts (steering columns), from GM. This would have brought the auto maker to its knees, immediately forcing GM's permanent closure. The extortion worked. The government money that was supposed to go to save jobs went to Singer's hedge fund, Elliott Management Corporation and its partners, including the Romneys. Once Singer's crew took control of Delphi, they rapidly completed the move to China, sticking the US taxpayers with the bill for the pensions of the Delphi workers cut loose. Dan Loeb, a million-dollar donor to the GOP, who made three-quarters of a billion dollars off the legal scam, proudly announced that, once he and Elliott took control, Delphi kept "virtually no North American unionized labor." In all, three hedge funds run by Romney's million-dollar donors have pocketed $4.2 billion, a return on their "investment" of over 3,000 percent - all care of the US taxpayer. The Romneys personally earned a minimum of $15.3 million, though more likely $115 million - a range their campaign does not dispute.

Please see these:

Delphi Workers - Greg Palast - http://www.gregpalast.com/how-mitt-romney-profited-from-delphi-workers-misery/ Truthout - http://truth-out.org/progressivepicks/item/12273-romney-company-shipped-every-single-delphi-uaw-job-to-china The Nation - Romney's Bailout Bonanza - http://www.thenation.com/article/170644/mitt-romneys-bailout-bonanza#

"Romney goes off-road with the truth"

The Elephant in the Room

It was Romney who shipped thousands of Auto jobs to China; why is MSM silent on this.

Investigative Reporter Greg Palast on Truthout

"The truth? On June 1, 2009, the Obama administration announced that Detroit Piston's owner Tom Gores, GM and the US Treasury would buy back Delphi.The plan called for saving 15 of 29 Delphi factories in the US. Then the vulture funds pounced. The Nation discovered that, in the two weeks immediately following the announcement of the Delphi jobs-saving plan, Paul Singer, Romney's partner, secretly bought up over a billion dollars of old Delphi bonds for pennies on the dollar. Singer and partners now controlled the company - and killed the return of Delphi to GM. These facts were revealed in a sworn deposition of Delphi's Chief Financial Officer John Sheehan, confidential, but now released on the Web. Sheehan said, under oath, that these speculators threatened to withhold key parts (steering columns), from GM. This would have brought the auto maker to its knees, immediately forcing GM's permanent closure. The extortion worked. The government money that was supposed to go to save jobs went to Singer's hedge fund, Elliott Management Corporation and its partners, including the Romneys. Once Singer's crew took control of Delphi, they rapidly completed the move to China, sticking the US taxpayers with the bill for the pensions of the Delphi workers cut loose. Dan Loeb, a million-dollar donor to the GOP, who made three-quarters of a billion dollars off the legal scam, proudly announced that, once he and Elliott took control, Delphi kept "virtually no North American unionized labor." In all, three hedge funds run by Romney's million-dollar donors have pocketed $4.2 billion, a return on their "investment" of over 3,000 percent - all care of the US taxpayer. The Romneys personally earned a minimum of $15.3 million, though more likely $115 million - a range their campaign does not dispute.

Please see these:

Delphi Workers - Greg Palast - http://www.gregpalast.com/how-mitt-romney-profited-from-delphi-workers-misery/ Truthout - http://truth-out.org/progressivepicks/item/12273-romney-company-shipped-every-single-delphi-uaw-job-to-china The Nation - Romney's Bailout Bonanza - http://www.thenation.com/article/170644/mitt-romneys-bailout-bonanza#

Paine said in reply to Mano Philips...

The tale here may be off some

But we have entered a period where something this enormous is too easily believed

By the educated liberal elite

We have no grand media guardians out there exposing this utterly grotesque activity

Once the large privately owned national media outfits are utterly impotent

Unable to enforce at least some measure of veracity and transparency

On the waring parties

The formal freedom of the press

Becomes completely irrelevant

And the illusion of truths media based guardianship

this formal freedom may sustain

Becomes more dangerous then a totally controled

1984 type state press

But we have entered a period where something this enormous is too easily believed

By the educated liberal elite

We have no grand media guardians out there exposing this utterly grotesque activity

Once the large privately owned national media outfits are utterly impotent

Unable to enforce at least some measure of veracity and transparency

On the waring parties

The formal freedom of the press

Becomes completely irrelevant

And the illusion of truths media based guardianship

this formal freedom may sustain

Becomes more dangerous then a totally controled

1984 type state press

It's always been the case a liar can simply replace one lie with the next

It's only if the media brands a serial liar just that

A serial liar

Not as opinion but as news

"Serial liar mitt Romney today said"

in the lede

As in serial killer ted bundy got labeled a serial killer

The big media has to call Romney out

Or it loses it's power to protect the low info citizen majority

Reality is a social construction

Right now the feckless big corporate press is failing it's chief mission

Yes the era of McCarthy saw serial liars abound

they were finally reigned in only years later and with the usual long half life

Here the consequence of mitt winning could last many political cycles

Perhaps this new era of info nets

Requires the old info net to fall flat on it's face

As part of the transition

If so let us hope the new info system quickly self organizes the corral within which a workable connection to the facts is maintained again

It's only if the media brands a serial liar just that

A serial liar

Not as opinion but as news

"Serial liar mitt Romney today said"

in the lede

As in serial killer ted bundy got labeled a serial killer

The big media has to call Romney out

Or it loses it's power to protect the low info citizen majority

Reality is a social construction

Right now the feckless big corporate press is failing it's chief mission

Yes the era of McCarthy saw serial liars abound

they were finally reigned in only years later and with the usual long half life

Here the consequence of mitt winning could last many political cycles

Perhaps this new era of info nets

Requires the old info net to fall flat on it's face

As part of the transition

If so let us hope the new info system quickly self organizes the corral within which a workable connection to the facts is maintained again

save_the_rustbelt said...

Stayed in my Toledo condo last night, a few miles from the Jeep plant.

Chrysler Jeep has in the past (until 2009) and will likely in the future produce Jeeps in China. The only promise by Marchionne (SP?) is that current Wrangler production will not be moved overseas.

The (Toledo) Blade has done better journalism on this than the national media.

Chrysler Jeep has in the past (until 2009) and will likely in the future produce Jeeps in China. The only promise by Marchionne (SP?) is that current Wrangler production will not be moved overseas.

The (Toledo) Blade has done better journalism on this than the national media.

Paine said in reply to save_the_rustbelt...

Rusty

Come on

The story is as big as big as Paul bunion

But it's standing on size 2 fact feet

If mitt is just play politics as usual

I've been asleep my whole life

Nixon would never dare to pull stunts like

The Romney campaign pulls day after day

Come on

The story is as big as big as Paul bunion

But it's standing on size 2 fact feet

If mitt is just play politics as usual

I've been asleep my whole life

Nixon would never dare to pull stunts like

The Romney campaign pulls day after day

Nixon hated the press but he feared it

Mitt has contempt for the press and gaffs at it

Mitt has contempt for the press and gaffs at it

Here I mean the press as guardian of a de facto set of game rules on fact telling

The stretch limits and frequency ceilings in other words

The stretch limits and frequency ceilings in other words

Oh go ahead rusty vote mitt

The rust belt is in for a big scrub off

Now starting plant floor wages are half what they once were

The rust belt is in for a big scrub off

Now starting plant floor wages are half what they once were

However the spontaneous rate of re industrialization for some time

will remain below the rate of deindustrialization

Only an overt and massive industrial program funded and directed from Washington can get our production platform back up to 1946 type global status

will remain below the rate of deindustrialization

Only an overt and massive industrial program funded and directed from Washington can get our production platform back up to 1946 type global status

Comment below or sign

Free rider Charybdis free loader Scylla

taking your look from a white male low ed voter perspective

the dembots since 1968

have gotten their brand on the wrong side of both these monsters

the dembots since 1968

have gotten their brand on the wrong side of both these monsters

Tuesday, October 30, 2012

new most repulsive humanoid

timmy tubfest

" I rarely watch 8 hours of television per week, much less per day. "

"I had a conversation the other day in which someone was incredulous

that I have never seen an episode of Seinfeld, or Friends,

or actually any sitcom in the last decade or so."

" I told them that I used to watch M*A*S*H now and then

, and they looked at me with pity."

pity ?

pity!

"get out the flame thrower" i say

roast the prig pig

"the Federal Government should undertake no governmental, social or economic action, except where local government, or the people, cannot undertake it for themselves ... "

thanx for the tip herbie

pretty big gaps there to sail the top down totalization fleet thru

can not standing alone

provide adequate metrics of either equity or efficiency

no comparative dynamics

a set of evaluative metric dimensions scream at us to be heard

b4 we assign tasks to levels and sectors

building the best set of institutions gets very little light from this Hooverian maxim

little guy big bogosity bobby reich : "America faces a huge budget deficit"

can he really NOT see the facts here ?

is he just hungry for more revenue ?

has he never worked thru the numbers on debt accumulation rates

debt service rates real gdp growth rates and inflation rates ?

is that possible ?

Monday, October 29, 2012

socialization of household usury

that is the great new macro tool

activated conciously during the post war era

even in the pre great moderation phases

basically heat up the residential mortgage market ...chill the residential mortgage market

oh ya and car loan markets

then came credit cards student loans

a vast symphony of household debt instruments

activated conciously during the post war era

even in the pre great moderation phases

basically heat up the residential mortgage market ...chill the residential mortgage market

oh ya and car loan markets

then came credit cards student loans

a vast symphony of household debt instruments

Saturday, October 27, 2012

Wednesday, October 24, 2012

zero real return "citizen " bonds ( ZRRs )

this amounts to stable purchasing power

and beside that social good

it means no ability to use the product price level path to "trim"

latent purchasing power contained in the bond stock /debt stock/obligation grid

in the event of outflow exceeding inflow to this stock of zero real bonds

where old issue pay offs exceed new issue buy ups

and with final output production running at capacity

and inadequate buffer stocks of final products

we get a broad product price event

or shortages

how might this be pre empted

by forward looking price increase policy

if this stock is real PP protected

then there is no way to trim this demand

would one increase taxes on work income

how far in advance ?

as far in advance as possible ?

to reduce the inflow to the stock of ZRRs

now consider

a "savings system "

where bonds are issued with real coupon returns equal to the change in per job hour real output ?

and beside that social good

it means no ability to use the product price level path to "trim"

latent purchasing power contained in the bond stock /debt stock/obligation grid

in the event of outflow exceeding inflow to this stock of zero real bonds

where old issue pay offs exceed new issue buy ups

and with final output production running at capacity

and inadequate buffer stocks of final products

we get a broad product price event

or shortages

how might this be pre empted

by forward looking price increase policy

if this stock is real PP protected

then there is no way to trim this demand

would one increase taxes on work income

how far in advance ?

as far in advance as possible ?

to reduce the inflow to the stock of ZRRs

now consider

a "savings system "

where bonds are issued with real coupon returns equal to the change in per job hour real output ?

Tuesday, October 23, 2012

excessive levels of foreign exchange reserves :is this screen sound inhunt to find the forex fiddlers

nope

this is perhaps sufficient evidence but not necessary evidence

trad might even be in deficit

we need to do a fairly complex calculation to scoop up all the forex arbitrage profits

we gotta start with real exchange ratios between products and between wages and other resources at ppp

build a ppp consistent synthetic forex rate etc etc blah blah blah

gagnon omics part II he is more then just a titanic quantitative easer

.... In order to get manipulators to agree to this change in international rules, the main targets of currency manipulation—the United States and the euro area—may have to play tough. "

here's gaggy's solution:

".. tax or otherwise restrict purchases of US and euro area financial assets by currency manipulators."

View full document [pdf]

busting a klein bottle

" 1) What you’re saying when you say you want to put an end to global currency manipulation is that you want a weaker dollar. That’s what currency manipulation is: An effort by other countries to artificially strengthen the dollar in order to make their currency — and thus their exports — comparatively cheaper. But if we want to weaken our dollar, we could just, you know, weaken the dollar."

"2) China is not the world’s worst currency manipulator, or even particularly close to it. Singapore is worse than China. Taiwan is worse than China. These days, Switzerland and Japan are arguably worse than China. And there are other countries, like Israel, who aren’t worse than China, but who are still pretty bad. :

Now, most of these countries are also much smaller than China, so we care about them a bit less. But still, it’s hard to take aim at China when so many other countries are getting worse. To the Chinese, it looks like you’re singling them out."

"3) China is getting much better. They’ve allowed their currency to rise substantially in recent years. Gagnon told me that China’s ”current account peaked at 10.7 percent of GDP in 2007. This year, it looks like it’ll only be 2 percent.” It seems a bit weird to intensify the pressure on China, and to try and publicly humiliate them, at the exact moment when they’re doing what we’ve been asking them to do.there was a very good case for the [U.S.] to take action against China five years ago, but not now.”"

"4) Calling someone a “currency manipulator” doesn’t trigger some magical process that leads to them no longer manipulating their currency. On its own, its nothing but an international insult. But if you follow through, then it’s a first step towards slapping tariffs on Chinese goods. But then China can begin slapping retaliatory tariffs on our goods. Does anyone think that a trade war with China would be a good thing right now? If so, why?"

"5) Many experts think calling China a “currency manipulator” will backfire. China, at times, seems to run a pride-based foreign policy. If the rest of the world demands they do something, they simply refuse to do it. After all, it doesn’t look good to ordinary Chinese if China is permitting America to set its monetary policy. Thus, if you want to call China a “currency manipulator,” you need an explanation for why that’s a better strategy than the one we’re following, which has actually led to China permitting its currency to appreciate. “Getting tough” is a posture, not a policy argument.

For the record, there are experts, like Gagnon, who believe that the United States needs to think about how to get tougher on currency manipulation overall. He’s got some ideas on how to do that here. But the case to just get tough on China, and to do it by trying to humiliate them on the world stage, is much weaker today than it was five or eight years ago."

"2) China is not the world’s worst currency manipulator, or even particularly close to it. Singapore is worse than China. Taiwan is worse than China. These days, Switzerland and Japan are arguably worse than China. And there are other countries, like Israel, who aren’t worse than China, but who are still pretty bad. :

Now, most of these countries are also much smaller than China, so we care about them a bit less. But still, it’s hard to take aim at China when so many other countries are getting worse. To the Chinese, it looks like you’re singling them out."

"3) China is getting much better. They’ve allowed their currency to rise substantially in recent years. Gagnon told me that China’s ”current account peaked at 10.7 percent of GDP in 2007. This year, it looks like it’ll only be 2 percent.” It seems a bit weird to intensify the pressure on China, and to try and publicly humiliate them, at the exact moment when they’re doing what we’ve been asking them to do.there was a very good case for the [U.S.] to take action against China five years ago, but not now.”"

"4) Calling someone a “currency manipulator” doesn’t trigger some magical process that leads to them no longer manipulating their currency. On its own, its nothing but an international insult. But if you follow through, then it’s a first step towards slapping tariffs on Chinese goods. But then China can begin slapping retaliatory tariffs on our goods. Does anyone think that a trade war with China would be a good thing right now? If so, why?"

"5) Many experts think calling China a “currency manipulator” will backfire. China, at times, seems to run a pride-based foreign policy. If the rest of the world demands they do something, they simply refuse to do it. After all, it doesn’t look good to ordinary Chinese if China is permitting America to set its monetary policy. Thus, if you want to call China a “currency manipulator,” you need an explanation for why that’s a better strategy than the one we’re following, which has actually led to China permitting its currency to appreciate. “Getting tough” is a posture, not a policy argument.

For the record, there are experts, like Gagnon, who believe that the United States needs to think about how to get tougher on currency manipulation overall. He’s got some ideas on how to do that here. But the case to just get tough on China, and to do it by trying to humiliate them on the world stage, is much weaker today than it was five or eight years ago."

Monday, October 22, 2012

slow down ahead for han express?

"Using international data starting in 1957, we construct a sample of cases where fast-growing economies slow down."

" The evidence suggests that rapidly growing economies slow down significantly, in the sense that the growth rate downshifts by at least 2 percentage points, when their per capita incomes reach around $17,000 US in year-2005 constant international prices"

", a level that China should achieve by or soon after 2015."

" Among our more provocative findings is that growth slowdowns are more likely in countries that maintain undervalued real exchange rates"

all quotes from barry eichy et al

have they rectified the Han fiddle yet ?

At the same time. China’s surplus has come way down:

that plunging surplus

an indication we might sound the " all clear" ?

an indication we might sound the " all clear" ?

of course not !!!!

christ the fiddle sticks thru balanced trade if balance is contrived by

"other means" then pure forex adjustments

christ the fiddle sticks thru balanced trade if balance is contrived by

"other means" then pure forex adjustments

keynesian klarabell krugman goes deep and finds only " a samuelsonian social contrivance "

" the notion that there must be a “fundamental” source for money’s value, although it’s a right-wing trope, bears a strong family resemblance to the Marxist labor theory of value."

" In each case what people are missing is that value is an emergent property, not an essence: money, and actually everything, has a market value based on the role it plays in our economy — full stop."

"value is an emergent property, not an essence"

we all know essences never emerge

think plato's cave

essences don't exist

their fans simply insist

"the Marxist labor theory of value"

" he's talking about the marxist labor theory of value ...marxist ! you noodle head.... marxist !"

ricardo sighs with relief

------------------------------------------

"actually everything, has a market value

based on the role it plays in our economy"

markets create by emergence the value of everything

and so are we to suppose

the price of nothing

its a paradox

labor plays its role less well these days

or does it just have a smaller part ?

of course there are no small roles only small....essences

" In each case what people are missing is that value is an emergent property, not an essence: money, and actually everything, has a market value based on the role it plays in our economy — full stop."

"value is an emergent property, not an essence"

we all know essences never emerge

think plato's cave

essences don't exist

their fans simply insist

"the Marxist labor theory of value"

" he's talking about the marxist labor theory of value ...marxist ! you noodle head.... marxist !"

ricardo sighs with relief

------------------------------------------

"actually everything, has a market value

based on the role it plays in our economy"

markets create by emergence the value of everything

and so are we to suppose

the price of nothing

its a paradox

labor plays its role less well these days

or does it just have a smaller part ?

of course there are no small roles only small....essences

IT COMES DOWN TO WHO BORROWS

the present effective demand dirth can only be filled up with borrowed funds

uncle borrows and pays out is always beter then we the weebles getting special re introductory usury terms and amounts eh ?

now of course we can't even trigger a usury fueled boom here anyway

so .....

uncle borrows and pays out is always beter then we the weebles getting special re introductory usury terms and amounts eh ?

now of course we can't even trigger a usury fueled boom here anyway

so .....

lord K " “… no country can . . . safely allow the flight of funds for political reasons or to evade domestic taxation or in anticipation of the owner turning refugee. Equally, there is no country that can safely receive fugitive funds, which constitute an unwanted import of capital, yet cannot safely be used for fixed investment.”

paula versus dean

debate topic

what if we had just let laputa sink to the bottom of the atlantic ?

paula

"heavens what a bigger mess we'd be in today"

dean

" we'd be right about where we are "

-------------------------------------------

the implied dean line:

separate the lot bubble pop

from its hi fi laputa knock on effects and...?

somehow imagine we don't get the knock on hi fi laputa market effects

remove the spike

we'd still have the lot plop though maybe its a slow slow many many quarter plop

------------------------------------------------------------------------

notes to myself:

---an expectational quantum shift convulsion ??---

---the repro market convulsion happens of course i guess ---

at any rate look at it in reverse:

without the underlying fast contraction of lot values

the fall 08 crisis might have proceeeded like the dot com pop after math

or the after math of the earlier savings and loan blow out

ie

without the huge bash to medium term householder spending

that the house lot hyper quick by lot dynamic standards

' pop and plop' collateral crash registered

in the after math of the lot melt down

underwater householders spending fueled by go go usury policy

could not resume

and since a first world north hemi wage boom was out of the question....

what if we had just let laputa sink to the bottom of the atlantic ?

paula

"heavens what a bigger mess we'd be in today"

dean

" we'd be right about where we are "

-------------------------------------------

the implied dean line:

separate the lot bubble pop

from its hi fi laputa knock on effects and...?

somehow imagine we don't get the knock on hi fi laputa market effects

remove the spike

we'd still have the lot plop though maybe its a slow slow many many quarter plop

------------------------------------------------------------------------

notes to myself:

---an expectational quantum shift convulsion ??---

---the repro market convulsion happens of course i guess ---

at any rate look at it in reverse:

without the underlying fast contraction of lot values

the fall 08 crisis might have proceeeded like the dot com pop after math

or the after math of the earlier savings and loan blow out

ie

without the huge bash to medium term householder spending

that the house lot hyper quick by lot dynamic standards

' pop and plop' collateral crash registered

in the after math of the lot melt down

underwater householders spending fueled by go go usury policy

could not resume

and since a first world north hemi wage boom was out of the question....

securitization advanced during the great moderation ...and so did" derivatization"

"..from 1990-2005 the estimated sum of

equity-market capitalization,

outstanding total bond issues (sovereign and corporate) and global bank assets

rose from 81% to 137% ...."of Global GP (gross product),

the last bit

bank assets is of course traditional monoploy stage financialization

a guilded age dinosaur ..still thriving ..till it crashed..

on its crazy eddie off regulation edges

derivatives ?

" ..over-the-counter derivatives markets tripled" between 2000 and 2005

to $285 trillion.."

"..six times .." Global GP

outstanding total bond issues (sovereign and corporate) and global bank assets

rose from 81% to 137% ...."of Global GP (gross product),

the last bit

bank assets is of course traditional monoploy stage financialization

a guilded age dinosaur ..still thriving ..till it crashed..

on its crazy eddie off regulation edges

derivatives ?

" ..over-the-counter derivatives markets tripled" between 2000 and 2005

to $285 trillion.."

"..six times .." Global GP

Saturday, October 20, 2012

Plansmart institute to open in January

eve abel and my older brother js are at long last giving us

a tentaive launch date

first erection

the mark up warrant mechanism

a tentaive launch date

first erection

the mark up warrant mechanism

Wednesday, October 17, 2012

euro zone secessionism

of course it makes sense

when the functions of the state worth keeping

are all at the level of the euro corral

not the historic state level

nationalism is fragmenting these historic accidents

into more solid basic units

divide today to re unify at a higher level tomorrow

when the functions of the state worth keeping

are all at the level of the euro corral

not the historic state level

nationalism is fragmenting these historic accidents

into more solid basic units

divide today to re unify at a higher level tomorrow

Monday, October 15, 2012

pk nicky knot hola and the debt burden waddlings of n successive generations

" a debt inherited from the past is, in effect, simply a rule requiring that one group of people — the people who didn’t inherit bonds from their parents — make a transfer to another group, the people who did" pk

pk avoids the main point of rowe

bonds bought not inherited

what rowe misses

that buying "generation"

sells the bonds to a third generation

and on and on it goes

---------------------------------------------

"It’s quite possible that debt can raise the consumption of one generation and reduce the consumption of the next generation during the period when members of both generations are still alive" pk

of course

but the real transfer such as it is

whenever it occurs

and between whom so ever

is an incomplete accounting

of a system moving forever through time

we buy bonds we sell bonds

its a relay thru time

only at an end of time

can the accounting be complete

------------------------------------------

what about the rate of growth of debt by rate of interest

what if its continually faster than the growth rate of the economy"

in a model

the rate ratio assumption

g/r

where g is gdp growth rate

and r the average rate of payment

on existing sovereign debt

can create scare stories

because one can assume any pair of rates one wants to assume

but if we look even a little at social reality

out there

ie the historical record

Clio shows us

the growth rate exceeds the debt service rate

over long hauls

and of course the ratio is always under the potential control

of the central bank

in a pure credit money system like ours

of course

but the real transfer such as it is

whenever it occurs

and between whom so ever

is an incomplete accounting

of a system moving forever through time

we buy bonds we sell bonds

its a relay thru time

only at an end of time

can the accounting be complete

------------------------------------------

what about the rate of growth of debt by rate of interest

what if its continually faster than the growth rate of the economy"

in a model

the rate ratio assumption

g/r

where g is gdp growth rate

and r the average rate of payment

on existing sovereign debt

can create scare stories

because one can assume any pair of rates one wants to assume

but if we look even a little at social reality

out there

ie the historical record

Clio shows us

the growth rate exceeds the debt service rate

over long hauls

and of course the ratio is always under the potential control

of the central bank

in a pure credit money system like ours

Friday, October 12, 2012

polarizing wealth can have no merit

"the model assumes that all households are identical with respect to patience (consumption decisions) and skill (earnings ability). Household outcomes differ solely because they have idiosyncratic investment opportunities—that is, they can’t invest in the market, only in things like privately-held businesses or unique pieces of real estate. Yet when you simulate the model, you see an increasing share of wealth finding its way into fewer and fewer hands:"

the first graph is non-routine cognitive

the second is non-routine manual

the third is routine

the second is non-routine manual

the third is routine

"In the last 30 years the US labor market has been characterized by job polarization and jobless recoveries. In this paper we demonstrate how these are related. We first show that the loss of middle-skill, routine jobs is concentrated in economic downturns. In this sense, the job polarization trend is a business cycle phenomenon. Second, we show that job polarization accounts for jobless recoveries. This argument is based on the fact that almost all of the contraction in aggregate employment during recessions can be attributed to job losses in middle-skill, routine occupations (that account for a large fraction of total employment), and that jobless recoveries are observed only in these disappearing routine jobs since job polarization began. We then propose a simple search-and-matching model of the labor market with occupational choice to rationalize these facts. We show how a trend in routine-biased technological change can lead to job polarization that is concentrated in downturns, and recoveries from these recessions that are jobless".

Tuesday, October 9, 2012

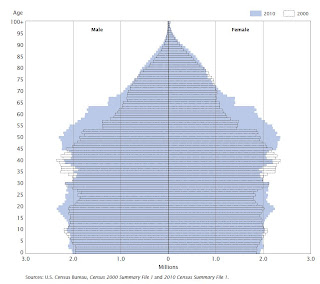

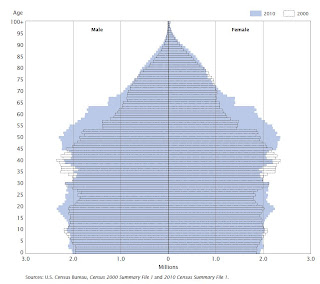

a view into forecasting participation dynamics

" ... expecting a couple of recent trends to continue: lower participation rates for people in the 16 to 24 year age group and an increase in the participation for older age groups".

... expecting a couple of recent trends to continue: lower participation rates for people in the 16 to 24 year age group and an increase in the participation for older age groups".

"...a large cohort is moving

from the 55 to 59 age category

into the 60 to 64 age group....

..... Even though the participation rate

is rising for the age group, it is lower than for the 45-to-55 age groups ...pushing down over all participation..."

"There are counter acting changes...

A fairly large group just moved into the 20-to-24 age group, ie moving into higher participation age groups "

"...for men in the 16-to-19 the P rate declined sharply from 2000 through 2007 "

"...for men in the 16-to-19 the P rate declined sharply from 2000 through 2007 "

the sweet spot :

after late school before early retirement

ie mid streamers men 35 -44

" A long term down trend

from about 97% participation in 1968 to about 91% participation now

...short term trend - from 1995 through 2007

... about a 1% decline in the participation rate due to the recession (from 92% to 91%)....

long term trend

participation rate is about what we'd expect."

... expecting a couple of recent trends to continue: lower participation rates for people in the 16 to 24 year age group and an increase in the participation for older age groups".

... expecting a couple of recent trends to continue: lower participation rates for people in the 16 to 24 year age group and an increase in the participation for older age groups"."...a large cohort is moving

from the 55 to 59 age category

into the 60 to 64 age group....

..... Even though the participation rate

is rising for the age group, it is lower than for the 45-to-55 age groups ...pushing down over all participation..."

"There are counter acting changes...

A fairly large group just moved into the 20-to-24 age group, ie moving into higher participation age groups "

"...for men in the 16-to-19 the P rate declined sharply from 2000 through 2007 "

"...for men in the 16-to-19 the P rate declined sharply from 2000 through 2007 "the sweet spot :

after late school before early retirement

ie mid streamers men 35 -44

" A long term down trend

from about 97% participation in 1968 to about 91% participation now

...short term trend - from 1995 through 2007

... about a 1% decline in the participation rate due to the recession (from 92% to 91%)....

long term trend

participation rate is about what we'd expect."

Saturday, October 6, 2012

wage boom product inflation vs monopoly repricing and rent wind fall bubble ups from credit based spec-ing

the gross debt ratio to gross product is no good

look at household debt to household earned income

look at household debt to household earned income

we are all taxpayers we are all bond holders:

what's wrong with that statement ?

yes you need to model the distribution of both

taxes and bond holdings

over households

to get an idea of winners and losers that a certain policy path might generate

for instance:

we can have low inflation with un-pinned lending rates

and thus higher debt service leading to higher taxes

or

we might have lower real returns and lower taxes

thru high inflation with pinned lending rates

usually fellahs out to putting you inside a desirable thought box

leave out some vital capacity of a central bank in a pure credit money system

but another nice trick is to lump us all together and then look at only one set of consequences

or separate out the widows and orphans

or the sharks of lower manhattan

or

ya to get your mind's arms all the way around this stuff requires a model

but of course its models that contain the magic tricks too

yes you need to model the distribution of both

taxes and bond holdings

over households

to get an idea of winners and losers that a certain policy path might generate

for instance:

we can have low inflation with un-pinned lending rates

and thus higher debt service leading to higher taxes

or

we might have lower real returns and lower taxes

thru high inflation with pinned lending rates

usually fellahs out to putting you inside a desirable thought box

leave out some vital capacity of a central bank in a pure credit money system

but another nice trick is to lump us all together and then look at only one set of consequences

or separate out the widows and orphans

or the sharks of lower manhattan

or

ya to get your mind's arms all the way around this stuff requires a model

but of course its models that contain the magic tricks too

pure unitary credit and grant system

the anachronism of an existing stock of finacial capacity

and the resultant

tacit fixed limits of the value of productive factors in simultaneous operation

the vail of independent funding fixity over the perfect elastcity

of a pure credit ration system leads to meaningless constraints

on firm formation expansion / contraction

pricing and output decision autonomy

the efficacy of red ink barriers

and the organization of internal control

and the resultant

tacit fixed limits of the value of productive factors in simultaneous operation

the vail of independent funding fixity over the perfect elastcity

of a pure credit ration system leads to meaningless constraints

on firm formation expansion / contraction

pricing and output decision autonomy

the efficacy of red ink barriers

and the organization of internal control

Subscribe to:

Comments (Atom)

paine